Investors: DEBT

Debt Profile

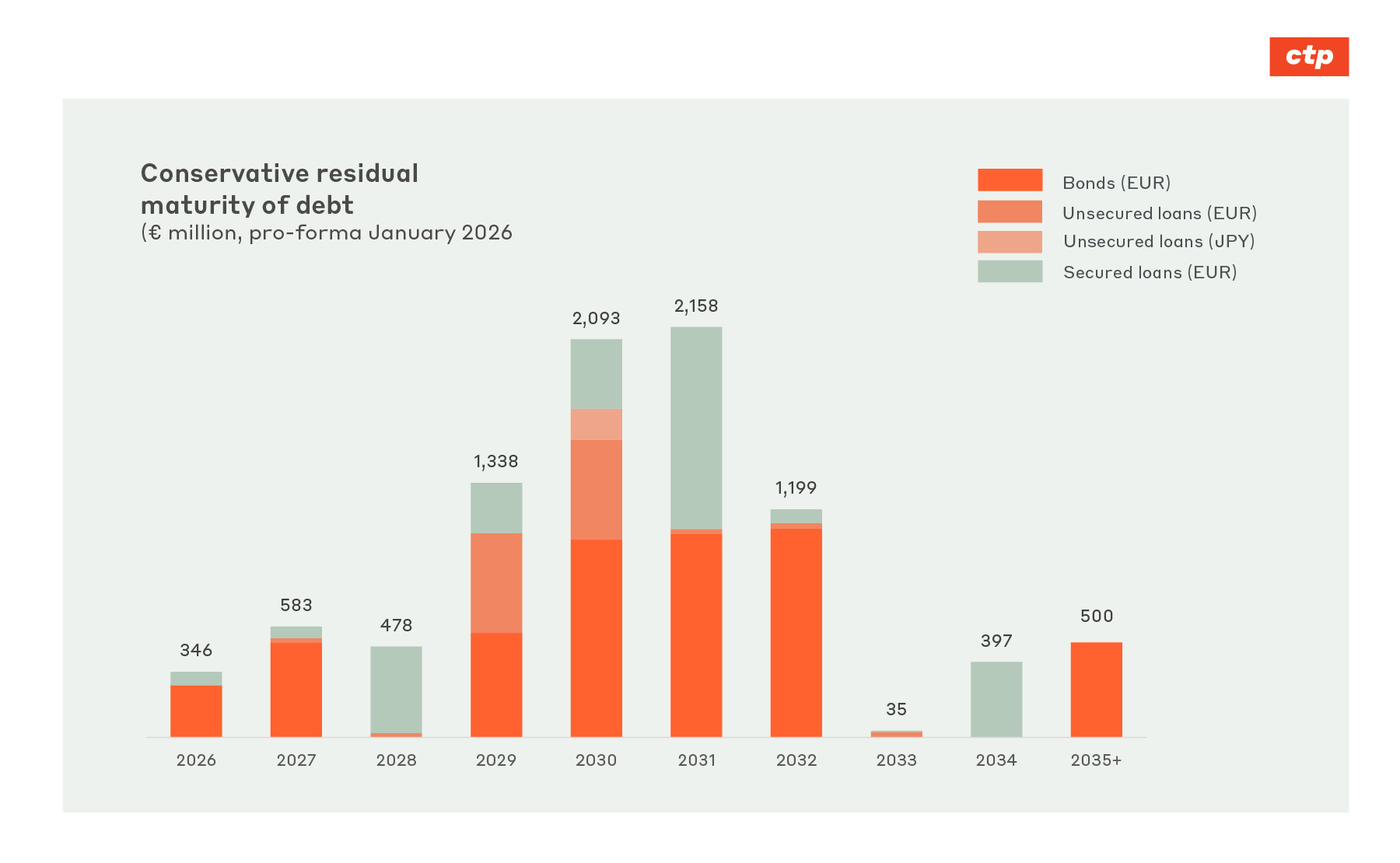

CTP maintains a conservative capital structure and has a diversified funding strategy, including bank loans and capital markets funding. This allows for flexibility in managing the debt portfolio and ensures long-term financial stability.

Bonds

| ISIN | Original Amount | O/S Amount | Issue Date | Maturity | Coupon | ||

|---|---|---|---|---|---|---|---|

| DE000A3E5L07 | 20,000,000 | 20,000,000 | 09.06.2021 | 09.06.2031 | 3.300% | ||

| XS2303052695 | 500,000,000 | 500,000,000 | 18.02.2021 | 18.02.2027 | 0.750% | ||

| XS2356030556 | 500,000,000 | 500,000,000 | 21.06.2021 | 21.06.2029 | 1.250% | ||

| XS2390530330 | 500,000,000 | 274,997,000 | 27.09.2021 | 27.09.2026 | 0.625% | ||

| XS2390546849 | 500,000,000 | 500,000,000 | 27.09.2021 | 27.09.2031 | 1.500% | ||

| XS2390546849 | 49,500,000 | 49,500,000 | 01.07.2022 | 27.09.2031 | 1.500% | ||

| XS2759989234 | 824,780,000 | 539,760,000 | 05.02.2024 | 05.02.2030 | 4.750% | ||

| XS2919892179 | 500,000,000 | 500,000,000 | 21.11.2024 | 21.11.2032 | 3.875% | ||

| XS2948774109 | 50,000,000 | 50,000,000 | 03.12.2024 | 03.12.2029 | 3.427% | ||

| XS3017990048 | 500,000,000 | 500,000,000 | 10.03.2025 | 10.03.2031 | 3.625% | ||

| XS3017991368 | 500,000,000 | 500,000,000 | 10.03.2025 | 10.03.2035 | 4.250% | ||

| XS3202199066 | 600,000,000 | 600,000,000 | 13.10.2025 | 13.04.2032 | 3.625% | ||

| XS3261863412 | 500,000,000 | 500,000,000 | 19.01.2026 | 19.07.2030 | 3.375% | ||

| Total | 5,034,257,000 |

Investor Contact