Wyniki CTP NV poł. 1-2024

CTP raportuje, że skorygowany dla danej spółki eps EPRA wyniósł 0,40 €, co oznacza wzrost o 11,2% rok do roku w wyniku silnego wzrostu czynszów w porównaniu do analogicznego okresu o 4,8%; EPRA NTA za akcję do 17,05 €

AMSTERDAM, 8 sierpnia 2024 r – CTP NV (CTPNV.AS), („CTP”, „Grupa” lub „Spółka”) odnotowana w I półroczu 2024 r. Przychód z wynajmu w wysokości 320,9 mln euro, co oznacza wzrost o 14,41TP3 tys. rok do roku oraz wzrost czynszów w porównaniu do analogicznego okresu roku ubiegłego na poziomie 4,8%, głównie w wyniku indeksacji i rewersji w związku z renegocjacjami i wygasającymi umowami najmu. Na dzień 30 czerwca 2024 r. roczne przychody z najmu wyniosły 679,0 mln, a obłożenie w pierwszym półroczu wyniosło 93%.

W pierwszym półroczu CTP dostarczyło 328 000 mkw. przy wskaźniku YoC wynoszącym 10,7% i wynajęto 92% w momencie ukończenia, zwiększając portfolio Grupy do 12,4 mln mkw. GLA, podczas gdy wartość aktywów brutto („GAV”) wzrosła o 8,5% do 14,8 EUR miliard. Przeszacowanie porównywalne wyniosło 3,0%, na co złożył się wzrost ERV o 2,9%, przy stabilnych rentownościach. EPRA NTA na akcję wzrosła o 7,1% w pierwszej połowie roku do 17,05 €.

Skorygowane zyski EPRA specyficzne dla spółki wzrosły o 11,71 TP3 tys. rok do roku, do 87,4 mln euro. Skorygowany EPS EPRA dla spółki CTP wyniósł 0,20 €, co oznacza wzrost o 10,7%. Grupa potwierdza swoje skorygowane wytyczne EPRA EPSA na rok 2024 w wysokości 0,80–0,82 EUR dla danej spółki.

Na dzień 30 czerwca 2024 r. w budowie znajdowało się 2,0 mln mkw. projektów, z czego znaczna część zostanie oddana do użytku w 2024 r., a potencjalne przychody z czynszów przy pełnym wynajęciu wyniosą 148 mln euro i oczekiwana rentowność kosztów na poziomie 10,3%.

Bank gruntów Grupy o powierzchni 25,5 mln m2, z czego 20,3 mln m2 stanowi własność spółki i jest bilansowe, oferuje CTP znaczny, zabezpieczony przyszły potencjał wzrostu. Dzięki wiodącemu w branży wskaźnikowi YoC, CTP ma potencjał przeszacowania na poziomie 350 euro za mkw. powierzchni GLA. W połączeniu z osiągnięciami Grupy w zakresie dostarczania ponad 101 TP3T nowego GLA rocznie, CTP spodziewa się, że w nadchodzących latach będzie w stanie w dalszym ciągu generować dwucyfrowy wzrost NTA.

Oczekujemy dalszego wzrostu stawek czynszów na rynku w nadchodzących latach, podczas gdy rentowności osiągnęły najwyższy poziom, co doprowadziło do punktu zwrotnego pod względem wartości nieruchomości, przy czym wycena portfela stałego w porównaniu z analogiczną okresem wzrosła w pierwszej połowie o 3,0%.

Popyt na nieruchomości przemysłowe i logistyczne w regionie CEE napędzany jest strukturalnymi czynnikami popytowymi, takimi jak profesjonalizacja łańcuchów dostaw przez 3PL, e-commerce oraz Nearshoring i Friends-Shoring najemców, ponieważ region CEE oferuje najlepszą lokalizację kosztową w Europie . Obecnie prawie 10% z naszego portfolio wynajęliśmy azjatyckim najemcom, którzy produkują w Europie dla Europy.

Od czasu naszego IPO w marcu 2021 r. zwiększyliśmy ponad dwukrotnie nasz GLA, bank ziemi i dochód z wynajmu. To dopiero początek, ponieważ kolejna faza wzrostu jest już zabezpieczona dzięki 2 milionom mkw. GLA w budowie i ponad 25 milionom mkw. banku ziemi, co pozwoli nam również w nadchodzących latach generować dwucyfrowy wzrost NTA”.

Najważniejsze informacje

| W mln € | I półrocze 2024 | H1-2023 | Zmiana % | II kwartał 2024 r | II kwartał 2023 r | Zmiana % |

| Dochód z wynajmu brutto | 320.9 | 280.4 | +14.4% | 163.3 | 144.4 | +13.1% |

| Dochód netto z wynajmu | 313.8 | 268.3 | +17.0% | 160.2 | 137.6 | +16.4% |

| Wynik netto z wyceny nieruchomości inwestycyjnych | 436.7 | 417.2 | +4.7% | 270.0 | 208.9 | +29.2% |

| Zysk za okres | 533.7 | 469.6 | +13.6% | 306.8 | 244.2 | +25.7% |

| Skorygowany zysk EPRA dla poszczególnych spółek | 177.6 | 158.1 | +12.4% | 90.2 | 79.8 | +13.0% |

| W € | I półrocze 2024 | H1-2023 | Zmiana % | II kwartał 2024 r | II kwartał 2023 r | Zmiana % |

| Skorygowany wskaźnik EPRA EPS dla poszczególnych spółek | 0.40 | 0.36 | +11.2% | 0.20 | 0.18 | +11.7% |

| W mln € | 30 czerwca 2024 r | 31 grudnia 2023 r | Zmiana % | |||

| Nieruchomości inwestycyjne ("IP") | 13,012.7 | 12,039.2 | +8.1% | |||

| Nieruchomość inwestycyjna w trakcie realizacji ("IPuD") | 1,530.9 | 1,359.6 | +12.6% | |||

| 30 czerwca 2024 r | 31 grudnia 2023 r | Zmiana % | ||||

| EPRA NTA na akcję | €17.05 | €15.92 | +7.1% | |||

| Oczekiwany YoC projektów w budowie | 10.3% | 10.3% | ||||

| LTV | 46.2% | 46.0% |

Utrzymujący się duży popyt ze strony najemców napędza wzrost czynszów

W I półroczu 2024 r. spółka CTP podpisała umowy najmu na 918 000 mkw., co oznacza wzrost o 8% w porównaniu do I półrocza 2023 r., przy zakontraktowanych rocznych przychodach z czynszów na poziomie 61,5 mln euro i średnim miesięcznym czynszu za mkw. na poziomie 5,59 euro (I półrocze 2023 r.: 5,47 euro) . Po uwzględnieniu różnicy w strukturze krajów czynsze wzrosły średnio o 8%.

| Podpisane umowy najmu wg mkw. | Q1 | Q2 | NARASTAJĄCO | Q3 | Pytanie 4 | FY |

| 2022 | 441,000 | 452,000 | 893,000 | 505,000 | 485,000 | 1,883,000 |

| 2023 | 297,000 | 552,000 | 849,000 | 585,000 | 542,000 | 1,976,000 |

| 2024 | 336,000 | 582,000 | 918,000 |

| Średni miesięczny czynsz podpisanych umów najmu na m2 (€) | Q1 | Q2 | NARASTAJĄCO | Q3 | Pytanie 4 | FY |

| 2022 | 4.87 | 4.89 | 4.88 | 4.75 | 4.80 | 4.82 |

| 2023 | 5.31 | 5.56 | 5.47 | 5.77 | 5.81 | 5.69 |

| 2024 | 5.65 | 5.55 | 5.59 |

Około dwie trzecie tych umów najmu zawarto z istniejącymi najemcami, zgodnie z modelem biznesowym CTP polegającym na rozwoju z istniejącymi najemcami w istniejących parkach.

Generowanie przepływów pieniężnych poprzez stały portfel i przejęcia

Średni udział CTP w rynku w Czechach, Rumunii, na Węgrzech i Słowacji wynosi 27,5% na dzień 30 września 2023 r. i pozostaje największym właścicielem i deweloperem nieruchomości przemysłowych i logistycznych na tych rynkach. Grupa jest również liderem rynku w Serbii i Bułgarii.

Z ponad 1000 klientów, CTP posiada szeroką i zdywersyfikowaną międzynarodową bazę najemców, składającą się z największych firm o silnych ratingach kredytowych. Najemcy CTP reprezentują szeroki zakres branż, w tym produkcję, zaawansowane technologie/IT, motoryzację, e-commerce, handel detaliczny, hurtowy i logistykę zewnętrzną. Baza najemców jest wysoce zdywersyfikowana, a żaden z nich nie odpowiada za więcej niż 2,5% rocznego czynszu, co zapewnia stabilny strumień przychodów. 50 największych najemców CTP odpowiada jedynie za 33,3% rocznego czynszu, a większość z nich działa w wielu parkach CTP.

Stan zajętości Spółki wyniósł 93% (I półrocze 2023: 93%). Wskaźnik utrzymania klientów Grupy utrzymuje się na wysokim poziomie 95% (rok budżetowy 2023: 90%) i pokazuje zdolność CTP do wykorzystywania długotrwałych relacji z klientami. Portfel WAULT wyniósł 6,5 roku (1 półrocze 2023: 6,5 roku), co jest zgodne z celem Spółki wynoszącym >6 lat.

Poziom ściągalności czynszów w I półroczu 2024 roku wyniósł 99,9% (rok obrotowy 2023: 99,9%), przy braku pogorszenia profilu płatności najemców.

Przychody z najmu wyniosły 320,9 mln euro, co oznacza wzrost o 14,41 TP3 tys. rok do roku w ujęciu bezwzględnym. W ujęciu analogicznym przychody z najmu wzrosły o 4,8%, głównie w wyniku indeksacji i rewersji w przypadku renegocjacji i wygasających umów najmu.

Grupa wdrożyła środki mające na celu ograniczenie wycieku opłat za usługi, co spowodowało poprawę wskaźnika dochodu netto z wynajmu do dochodu z wynajmu z 95,7% w I półroczu 2023 r. do 97,8% w I półroczu 2024 r. W rezultacie dochód netto z wynajmu wzrósł o 17,0% r/r.

Coraz większa część przychodów z najmu generowanych przez portfel inwestycyjny CTP korzysta z ochrony przed inflacją. Od końca 2019 r. wszystkie nowe umowy najmu Grupy zawierają klauzulę podwójnej indeksacji, która oblicza roczny wzrost czynszu jako wyższą z następujących wartości:

- stały wzrost o 1,5%-2,5% rocznie; lub

- wskaźnik cen towarów i usług konsumpcyjnych[1].

Na dzień 30 czerwca 2024 roku 69% przychodów generowanych przez portfel Grupy zawiera klauzulę podwójnej indeksacji i Grupa spodziewa się dalszego wzrostu tej wartości.

Potencjał rewersyjny wzrósł do 15,3%. Nowe umowy najmu są podpisywane w sposób ciągły powyżej umów ERV, co ilustruje utrzymujący się silny wzrost stawek czynszów na rynku i wspiera wyceny.

Roczne przychody z najmu na dzień 30 czerwca 2024 r. wyniosły 679,0 mln euro, co oznacza wzrost o 20,11 TP3 tys. rok do roku, co świadczy o silnym wzroście przepływów pieniężnych z portfela inwestycyjnego CTP.

W pierwszej połowie roku CTP nabyła w Rumunii portfel generujący dochód o powierzchni 270 000 mkw., w tym bank gruntów o powierzchni 299 000 mkw., za cenę zakupu wynoszącą 168,6 EUR[2] milion. Przy rentowności rewersyjnej wynoszącej ponad 9%, przejęcie rośnie od pierwszego dnia.

Zmiany w I kwartale 2024 r. dostarczone z 10,7% YoC i 95% z dostawą

CTP kontynuowała zdyscyplinowane inwestycje w swój wysoce rentowny rurociąg.

W I kwartale 2024 r. Grupa oddała do użytku 169 000 mkw. GLA (I kwartał 2023 r.: 223 000 mkw.), nieco mniej niż w roku ubiegłym, kiedy do sieci trafiło kilka projektów, które zostały przełożone na rok 2022 ze względu na wyższe koszty budowy. Inwestycje zostały oddane przy 10,7% na poziomie 10,7%, 95% najmu i będą generować zakontraktowany roczny dochód z wynajmu w wysokości 9,8 mln euro, a kolejne 0,6 mln euro pojawi się po osiągnięciu pełnego obłożenia.

Do najważniejszych dostaw zrealizowanych w I półroczu 2024 r. zaliczały się: 39 000 m2 w CTPark Zabrze (Polska), 37 000 m2 w CTPark Budapest Ecser (Węgry), 34 000 m2 w CTPark Novi Sad East (Serbia), 30 000 m2 w CTPark Weiden (Niemcy), mkw. w CTPark Bucharest West (Rumunia), 23 000 mkw. w CTPark Katowice (Polska) i 23 000 mkw. w CTPark Arad West (Rumunia).

O ile średnie koszty budowy w 2022 r. wyniosły około 550 euro za mkw., o tyle w 2023 r. i I kwartale 2024 r. wyniosły 500 euro za mkw. CTP spodziewa się, że utrzymają się one na tym poziomie do 2024 r. Dzięki temu Grupa będzie mogła w dalszym ciągu zapewniać wiodącą w branży wartość wskaźnika YoC powyżej 10%, co jest również wspierane przez unikalny model parku CTP oraz własną wiedzę specjalistyczną w zakresie budownictwa i zaopatrzenia.

Na koniec trzeciego kwartału 2023 r. Grupa posiadała 1,9 mln mkw. budynków w budowie z potencjalnym przychodem z najmu w wysokości 139 mln euro i oczekiwanym wskaźnikiem YoC na poziomie 10,6%. CTP ma wieloletnie doświadczenie w zapewnianiu zrównoważonego wzrostu dzięki rozwojowi prowadzonemu przez najemców w istniejących parkach. 68% projektów Grupy w budowie znajduje się w istniejących parkach, a 25% w nowych parkach - głównie w Polsce - które mają potencjał do rozbudowy do ponad 100 000 mkw. powierzchni GLA. Planowane dostawy w 2023 r. to 77% pre-let, a CTP spodziewa się osiągnąć 80%-90% pre-let w momencie dostawy, zgodnie z historycznymi wynikami. Ponieważ CTP działa na większości rynków jako generalny wykonawca, ma pełną kontrolę nad procesem i harmonogramem dostaw, co pozwala Spółce przyspieszyć lub spowolnić w zależności od zapotrzebowania najemców, jednocześnie oferując im elastyczność w zakresie wymagań budowlanych.

W 2024 roku Grupa planuje dostarczyć od 1 do 1,5 mln mkw., w zależności od zapotrzebowania najemców. Podpisane obecnie umowy najmu na przyszłe projekty, których budowa jeszcze się nie rozpoczęła, stanowią kolejną ilustrację utrzymującego się popytu ze strony najemców.

Bank gruntów CTP na dzień 31 marca 2024 r. wynosił 23,1 mln mkw. (31 grudnia 2023 r.: 23,4 mln mkw.), co pozwala Spółce osiągnąć cel wynoszący 20 mln mkw. GLA do końca dekady. Grupa koncentruje się na mobilizacji istniejącego banku ziemi w celu maksymalizacji zwrotu, przy jednoczesnym zachowaniu zdyscyplinowanej alokacji kapitału w zakresie uzupełniania banku ziemi. Część 58% banku gruntów zlokalizowana jest na terenie istniejących parków CTP, natomiast część 33% znajduje się na terenie nowych parków lub sąsiaduje z nimi, które mają potencjał wzrostu do ponad 100 000 m2. 24% banku gruntów zostało zabezpieczone opcjami, natomiast pozostałe 76% stanowiło własność i zostało odpowiednio odzwierciedlone w bilansie.

Zakładając współczynnik zabudowy wynoszący 2 mkw. gruntu na 1 mkw. GLA, CTP może wybudować ponad 12 mln mkw. GLA na zabezpieczonym banku gruntów. Wartość gruntów CTP w bilansie wynosi około 50 euro za mkw., a koszty budowy wynoszą średnio około 500 euro za mkw., co daje całkowite koszty inwestycji wynoszące około 600 euro za mkw. Stały portfel Grupy wyceniany jest na około 950 euro za mkw., co implikuje potencjał przeszacowania na poziomie 350 euro za mkw. wybudowanej powierzchni najmu GLA.

Monetyzacja biznesu energetycznego

CTP kontynuuje swój plan rozwoju w zakresie wdrażania systemów fotowoltaicznych. Przy średnim koszcie wynoszącym ~750 000 EUR na MWp, Grupa planuje osiągnąć w przypadku tych inwestycji wskaźnik YoC na poziomie 151 TP3T.

W I półroczu 2024 roku Grupa zainstalowała na dachu dodatkowe 15 MWp, które obecnie są przyłączane do sieci. Całkowita moc zainstalowana wynosi obecnie 115 MWp.

W I półroczu 2024 r. przychody z energii odnawialnej wyniosły 3,4 mln euro, co oznacza wzrost o 25% rok do roku.

Ambicje CTP w zakresie zrównoważonego rozwoju idą w parze z coraz większą liczbą najemców oczekujących systemów fotowoltaicznych, ponieważ zapewniają im one i) większe bezpieczeństwo energetyczne, ii) niższe koszty użytkowania, iii) zgodność z zaostrzonymi przepisami, iv) zgodność z wymaganiami klientów oraz v) możliwość realizacji własnych ambicji ESG.

Wyniki wyceny uzależnione od stanu portfela w przygotowaniu i pozytywnej rewaluacji

Wartość nieruchomości inwestycyjnych („IP”) wzrosła z 12,0 mld euro na dzień 31 grudnia 2023 r. do 13,0 mld euro na dzień 30 czerwca 2024 r., co wynikało głównie z przeniesienia ukończonych projektów z Nieruchomości inwestycyjnych w fazie rozwoju („IPuD”) do IP oraz przejęć akrecyjnych.

IPuD wzrósł o 12,6% do 1,5 miliarda euro na dzień 30 czerwca 2024 r. w związku z postępem prac rozwojowych, przy czym większość projektów ma zostać ukończona w drugiej połowie roku.

GAV wzrósł do 14,8 mld euro na dzień 30 czerwca 2024 r., co oznacza wzrost o 8,5% w porównaniu do stanu na dzień 31 grudnia 2023 r.

Aktualizacja wyceny w I półroczu 2024 r. wyniosła 436,7 mln euro, na co złożyła się dodatnia wycena projektów IPuD (+175,2 mln euro), banku gruntów (+32,3 mln euro) i aktywów trwałych (+229,2 mln euro).

Porównując, portfel CTP odnotował wzrost o 3,0% w I półroczu 2024 r., napędzany wzrostem ERV o 2,9%.

Portfel Grupy charakteryzuje się konserwatywną wyceną rentowności, przy rewersyjnym wzroście rentowności w ciągu ostatnich 2 lat o 80 punktów bazowych, co doprowadziło do poziomu 7,2%. CTP spodziewa się, że najwyższe zyski osiągną w sektorze Przemysłu i Logistyki w regionie Europy Środkowo-Wschodniej. Wraz z większymi zmianami plonów na rynkach Europy Zachodniej, różnica w zyskach pomiędzy logistyką w Europie Środkowo-Wschodniej i Europie Zachodniej powraca do długoterminowej średniej. CTP spodziewa się, że różnica w rentownościach będzie się dalej zmniejszać w miarę upływu czasu, napędzana wyższymi oczekiwaniami dotyczącymi wzrostu w regionie Europy Środkowo-Wschodniej.

CTP spodziewa się dalszego pozytywnego wzrostu ERV dzięki utrzymującemu się popytowi ze strony najemców, na który pozytywny wpływ mają sekularne czynniki wzrostu w regionie Europy Środkowo-Wschodniej. Zwłaszcza, że poziom czynszów w Europie Środkowo-Wschodniej pozostaje przystępny, ponieważ pomimo obserwowanego silnego wzrostu, rozpoczął się on od znacznie niższych poziomów bezwzględnych niż w krajach Europy Zachodniej. W ujęciu realnym czynsze na wielu rynkach Europy Środkowo-Wschodniej są nadal niższe niż w 2010 roku.

EPRA NTA na akcję wzrosła z 15,92 EUR na dzień 31 grudnia 2023 r. do 17,05 EUR na dzień 30 czerwca 2024 r., co stanowi wzrost o 7,1%. Wzrost wynika głównie z aktualizacji wyceny (+0,96 EUR), skorygowanego specyficznego dla Spółki EPSA EPS (+0,40 EUR), częściowo skompensowanego przez wypłaconą dywidendę (-0,28 EUR).

Solidny bilans i silna pozycja płynnościowa

Zgodnie ze swoim proaktywnym i ostrożnym podejściem, Grupa korzysta z solidnej pozycji płynnościowej, aby sfinansować swoje ambicje wzrostu, przy stałym koszcie zadłużenia i konserwatywnym profilu spłaty.

W pierwszej połowie 2024 r. Grupa zebrała 1,7 miliarda euro:

- 6-letni kredyt zabezpieczony w wysokości 100 mln euro z konsorcjum banku włoskiego i czeskiego przy stałym całkowitym koszcie wynoszącym 4,9%;

- Sześcioletnia zielona obligacja o wartości 750 mln euro przy MS +220 pb i kuponie 4,75%; I

- Siedmioletni kredyt zabezpieczony w wysokości 90 mln euro w austriackim banku ze stałym całkowitym kosztem wynoszącym 4,9%;

- Siedmioletni kredyt zabezpieczony o wartości 168 mln euro z konsorcjum banków słowackich i austriackich przy stałym całkowitym koszcie wynoszącym 5,1%;

- 75 mln euro z sześcioletnich zielonych obligacji wyemitowanych w lutym 2024 r. po MS +171 punktów bazowych; I

- Pięcioletni niezabezpieczony kredyt w wysokości 500 milionów euro z konsorcjum międzynarodowych banków przy stałym całkowitym koszcie wynoszącym 4,7%.

CTP sfinalizowała również dwa wezwania na obligacje, odkupując obligacje krótkoterminowe o wartości 750 mln euro, realizując zysk kapitałowy w wysokości 31,9 mln euro, skracając okresy zapadalności długu w latach 2025 i 2026 oraz aktywnie wydłużając jego profil zapadalności.

W miarę racjonalizacji cen na rynku obligacji warunki są obecnie bardziej konkurencyjne niż ceny na rynku kredytów bankowych.

Pozycja płynnościowa Grupy wyniosła 1,7 miliarda euro, na co składało się 1,1 miliarda euro środków pieniężnych i ich ekwiwalentów oraz niewykorzystany kapitał RCF w wysokości 550 milionów euro.

Średni koszt zadłużenia CTP wyniósł 2,38% (31 grudnia 2023 r.: 1,95%), przy czym 99,7% zadłużenia było stałe lub zabezpieczone do terminu zapadalności. Grupa nie kapitalizuje odsetek od inwestycji, w związku z czym wszystkie koszty odsetkowe rozliczane są w rachunku zysków i strat. Średni okres zapadalności długu wyniósł 5,2 roku (31 grudnia 2023 r.: 5,3 roku).

Pierwszy istotny zbliżający się termin zapadalności Grupy wynosi 272 miliony euro[3] obligacja wymagalna w czerwcu 2025 roku, która zostanie spłacona z dostępnych rezerw gotówkowych.

LTV CTP wyniosło 46,2% na dzień 30 czerwca 2024 r. w związku z przejęciem rumuńskiego portfela (+60 pb), w dużej mierze skompensowanym dodatnimi przeszacowaniami zarówno portfela stałego, jak i planowanych inwestycji. CTP spodziewa się, że LTV będzie trend spadkowy, w związku z pełnym zaksięgowaniem aktualizacji wyceny inwestycji Grupy.

LTV jest nieco powyżej docelowej wartości LTV Spółki wynoszącej 40%-45%, co Grupa uważa za odpowiedni poziom, biorąc pod uwagę wyższą rentowność portfela brutto, która wynosi 6,7%. Aktywa o wyższej stopie zwrotu prowadzą do zdrowego poziomu dźwigni przepływów pieniężnych, co znajduje również odzwierciedlenie w znormalizowanym wskaźniku zadłużenia netto do EBITDA wynoszącym 9,1x (31 grudnia 2023 r.: 9,2x), który Grupa zamierza utrzymać poniżej 10x.

Na dzień 30 czerwca 2024 r. Grupa miała 60% niezabezpieczonego długu i 40% zabezpieczonego długu, przy czym istniała znaczna rezerwa w ramach Testu Zabezpieczonego Długu i Testu Aktywów Nieobciążonych.

| 30 czerwca 2024 r | Przymierze | |

| Test długu zabezpieczonego | 19.1% | 40% |

| Test aktywów wolnych od obciążeń | 183.5% | 125% |

| Wskaźnik pokrycia odsetek | 3,1x | 1.5x |

W lipcu agencja Moody's potwierdziła rating kredytowy CTP Baa3 z perspektywą stabilną.

Potwierdzono wskazówki

Dynamika najmu pozostaje wysoka, przy silnym popycie ze strony najemców i malejącej nowej podaży, co prowadzi do dalszego wzrostu stawek czynszów.

CTP ma dobrą pozycję, aby czerpać korzyści z tych trendów. Rurociągi Grupy są wysoce rentowne i prowadzone są przez najemców. Wskaźnik YoC rurociągu CTP wzrósł do 10,3% dzięki spadającym kosztom budowy i wzrostowi czynszów. Rozpoczął się i finansowany jest kolejny etap rozwoju – na dzień 30 czerwca 2024 r. w budowie będzie 2,0 mln mkw., a docelowo w 2024 r. będzie można dostarczyć od 1 do 1,5 mln mkw.

Solidna struktura kapitałowa CTP, zdyscyplinowana polityka finansowa, silny dostęp do rynku kredytowego, wiodący w branży bank gruntów, własna wiedza specjalistyczna w zakresie budownictwa i głębokie relacje z najemcami pozwalają CTP realizować swoje cele. CTP spodziewa się osiągnąć 1,0 miliarda euro przychodów z najmu w 2027 r., dzięki ukończeniom inwestycji, indeksacji i rewersji, i jest na dobrej drodze, aby przed końcem dekady osiągnąć 20 milionów mkw. GLA i 1,2 miliarda euro przychodów z czynszów.

Grupa potwierdza swoje skorygowane wytyczne EPRA EPSA na rok 2024 w wysokości 0,80–0,82 EUR dla danej spółki.

Dywidenda

CTP ogłasza śródroczną dywidendę w wysokości 0,25 euro na akcję zwykłą, co stanowi wzrost o 14% w porównaniu z pierwszym półroczem 2022 r. i co stanowi wypłatę 70% skorygowanego EPRA EPS specyficznego dla Spółki, zgodnie ze wskaźnikiem wypłaty dywidendy Grupy 70% - 80%. Domyślnie jest to dywidenda scrip, ale akcjonariusze mogą zdecydować się na wypłatę dywidendy w gotówce.

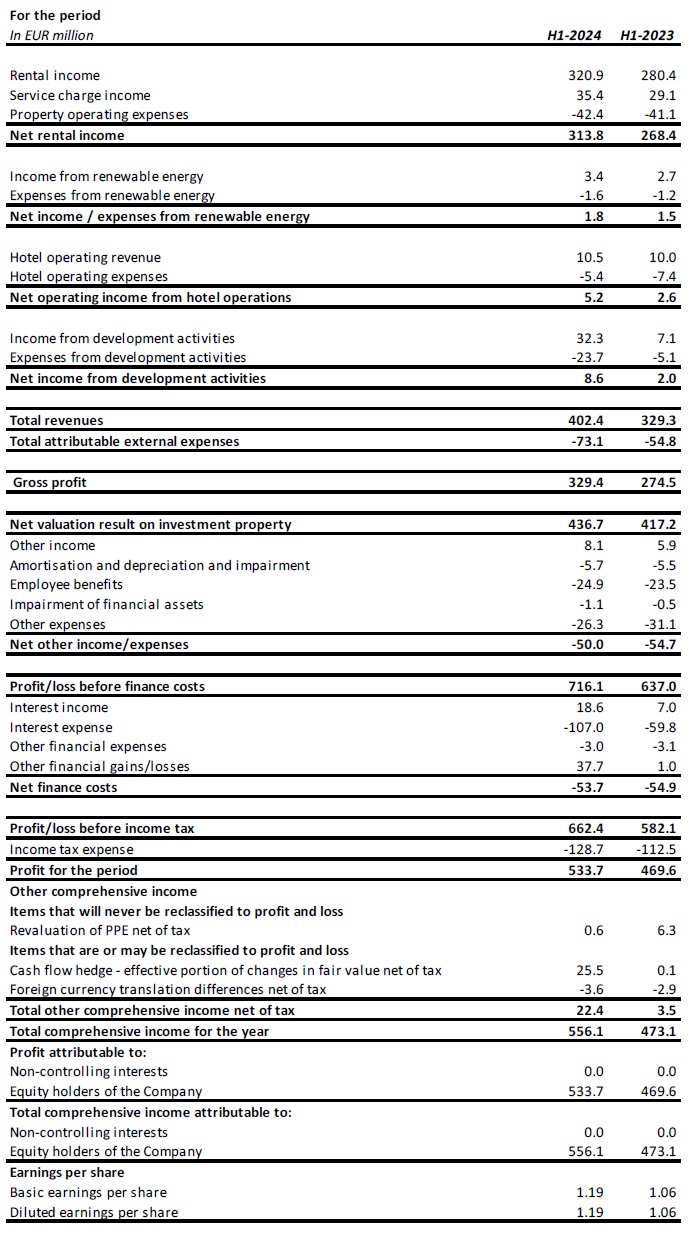

Skonsolidowany rachunek zysków i strat oraz innych całkowitych dochodów

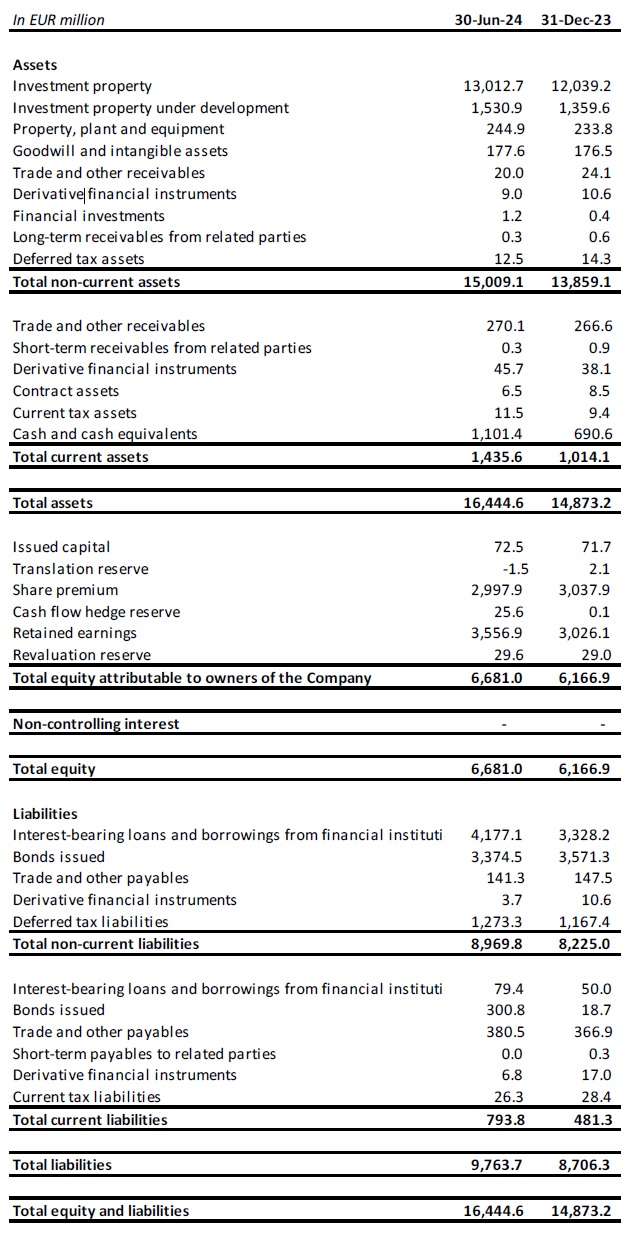

Skonsolidowane sprawozdanie z sytuacji finansowej

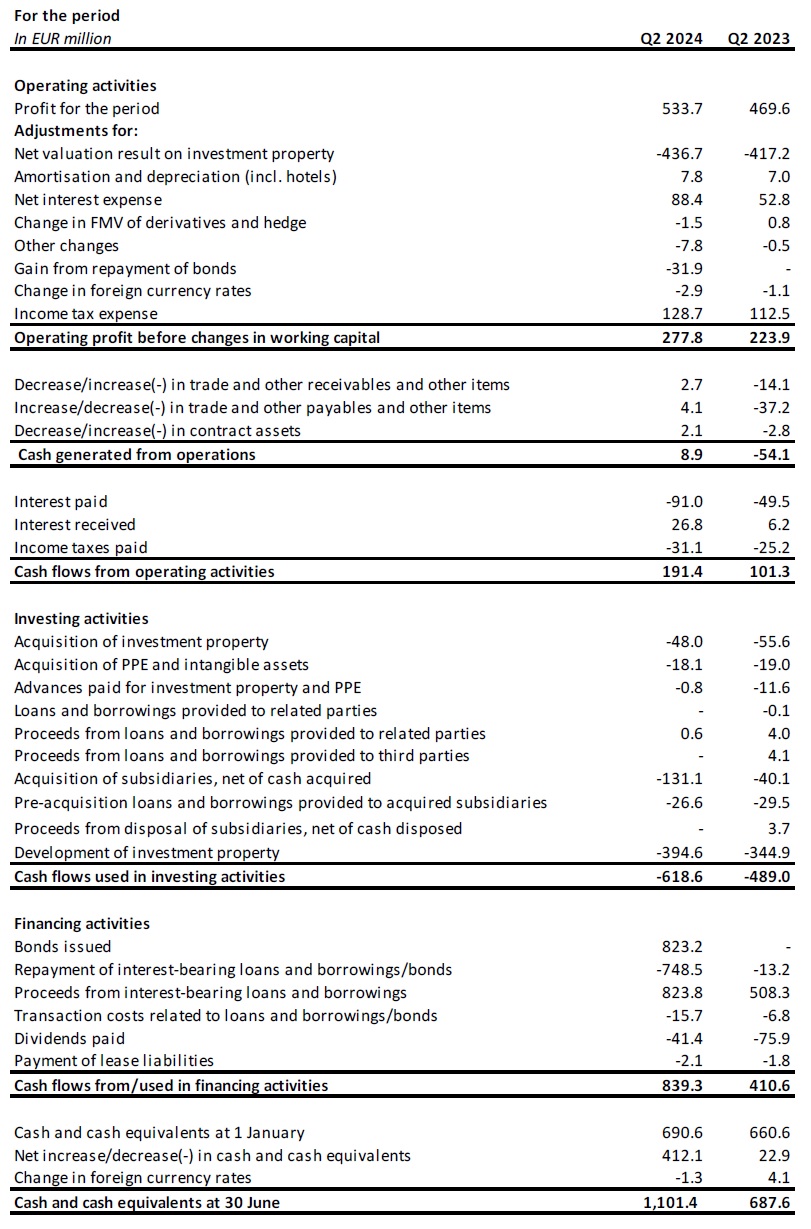

Skonsolidowane sprawozdanie z przepływów pieniężnych

WEBCAST I TELEKONFERENCJA DLA ANALITYKÓW I INWESTORÓW

Dziś o godzinie 9 rano (GMT) i 10 rano (CET) Spółka przeprowadzi prezentację wideo i sesję pytań i odpowiedzi dla analityków i inwestorów, za pośrednictwem transmisji internetowej na żywo i połączenia konferencyjnego audio.

Aby obejrzeć transmisję na żywo, należy zarejestrować się na stronie:

https://www.investis-live.com/ctp/667983951c01ae0c0047f54e/neij

Aby dołączyć do prezentacji telefonicznie, należy wybrać jeden z poniższych numerów i wprowadzić kod dostępu uczestnika 146081.

Niemcy +49 32 22109 8334

Francja +33 9 70 73 39 58

Holandia +31 85 888 7233

Wielka Brytania +44 20 3936 2999

Stany Zjednoczone +1 646 787 9445

Naciśnij *1, aby zadać pytanie, *2, aby wycofać pytanie lub *0, aby uzyskać pomoc operatora.

Nagranie będzie dostępne na stronie internetowej CTP w ciągu 24 godzin od prezentacji: https://www.ctp.eu/investors/financial-reports/

KALENDARZ FINANSOWY CTP

| Działanie | Data |

| Bez dywidendy – dywidenda zaliczna za 2024 rok | 2 września 2024 |

| Dzień dywidendy – zaliczka na dywidendę za 2024 rok | 3 września 2024 r |

| Rozpocznij okres wyborczy w formie akcji lub gotówki – dywidenda zaliczkowa za 2024 rok | 4 września 2024 r |

| Dzień Rynków Kapitałowych (Bukareszt, Rumunia) | 25/26 września 2024 r |

| Zakończenie okresu wyborczego – zaliczka na dywidendę za 2024 rok | 27 września 2024 (włącznie) |

| Termin wypłaty – dywidenda zaliczkowa za rok 2024 | 3 października 2024 r |

| Wyniki za III kw. 2024 r. | 6 listopada 2024 r |

| Wyniki za rok 2024 | 27 lutego 2025 r |

DANE KONTAKTOWE DLA ANALITYKÓW I INWESTORÓW:

Maarten Otte, dyrektor ds. relacji inwestorskich

Telefon komórkowy: +420 730 197 500

E-mail: [email protected]

DANE KONTAKTOWE DLA MEDIÓW:

Patryk Statkiewicz, Group Head of Marketing & PR

Telefon komórkowy: +31 (0) 629 596 119

E-mail: [email protected]

O CTP

CTP jest największym w Europie notowanym na giełdzie właścicielem, deweloperem i zarządcą nieruchomości logistycznych i przemysłowych pod względem powierzchni najmu brutto, posiadającym 11,2 miliona mkw. powierzchni GLA w 10 krajach na dzień 30 września 2023 roku. CTP certyfikuje wszystkie nowe budynki zgodnie z BREEAM na poziomie bardzo dobrym lub lepszym i uzyskała ocenę ESG "Negligible-Risk" od Sustainalytics, podkreślając swoje zaangażowanie w zrównoważony rozwój. Więcej informacji można znaleźć na stronie korporacyjnej CTP: www.ctp.eu

Zastrzeżenie

Niniejszy komunikat zawiera pewne stwierdzenia dotyczące przyszłości w odniesieniu do sytuacji finansowej, wyników działalności i działalności CTP. Te stwierdzenia dotyczące przyszłości można zidentyfikować poprzez użycie terminologii dotyczącej przyszłości, w tym terminów "uważa", "szacuje", "planuje", "projektuje", "przewiduje", "oczekuje", "zamierza", "cele", "może", "dąży", "prawdopodobnie", "byłby", "mógłby", "może mieć", "będzie" lub "powinien" lub, w każdym przypadku, ich negatywnych lub innych odmian lub porównywalnej terminologii. Stwierdzenia dotyczące przyszłości mogą i często różnią się istotnie od rzeczywistych wyników. W związku z tym nie należy przywiązywać nadmiernej wagi do jakichkolwiek stwierdzeń dotyczących przyszłości. Niniejsza informacja prasowa zawiera informacje poufne w rozumieniu art. 7 ust. 1 rozporządzenia (UE) nr 596/2014 z dnia 16 kwietnia 2014 r. (rozporządzenie w sprawie nadużyć na rynku).

[1] W przypadku połączenia lokalnego wskaźnika CPI oraz wskaźnika CPI w UE-27/strefie euro, tylko ograniczona liczba ograniczeń.

[2] Na podstawie wypływów pieniężnych netto (74,8 mln euro) + nabytych zobowiązań (93,8 mln euro)

[3] Pozostała kwota po rozliczeniu wezwania w dniu 28 czerwca 2024 r.

Zapisz się do naszego newslettera

Otrzymuj najświeższe informacje od lidera rynku nieruchomości przemysłowych prosto do swojej skrzynki odbiorczej.