Wyniki CTP N.V. za 3Q-2025 r.

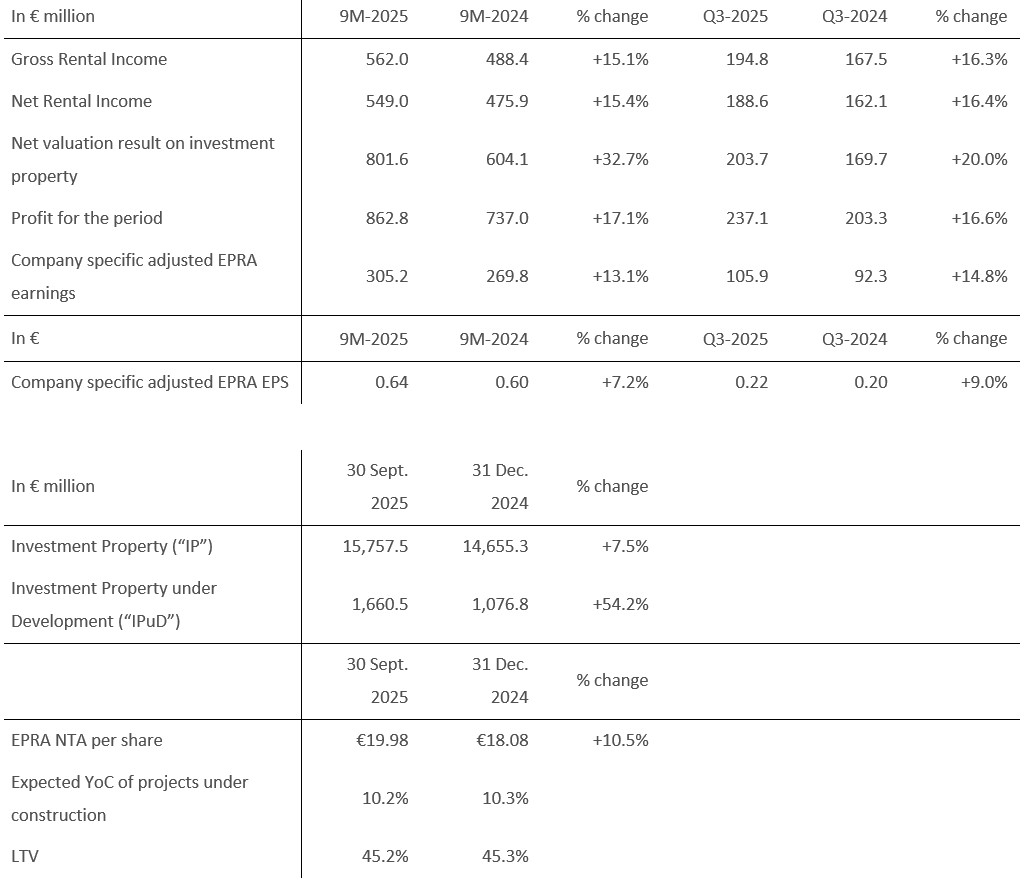

DOCHÓD NETTO Z NAJMU WZRÓSŁ O 15,41 TP7 R/R, WZROST CZYNSZÓW W UJĘCIU PORÓWNYWALNYM O 4,51 TP7 R/R, A WSKAŹNIK ZYSKU NA AKCJĘ WZRÓSŁ O 14,01 TP7 R/R DO 19,98 EURO.

AMSTERDAM, 6 listopada 2025 r. - CTP N.V. (CTPNV.AS), (“CTP”, “Grupa” lub “Spółka”), w pierwszych dziewięciu miesiącach roku zwiększyła przychody brutto z najmu o 15,1% rok do roku do 562 mln euro i odnotowała wzrost czynszów o 4,5% rok do roku, głównie dzięki indeksacji i rewersji renegocjacji i wygasających umów najmu. Na dzień 30 września 2025 r. roczny dochód z najmu wzrósł do 778 mln euro, podczas gdy obłożenie utrzymało się na poziomie 93%, a wskaźnik ściągalności czynszu wyniósł 99,8%.

W okresie 9 miesięcy - 2025 r. CTP oddało do użytku 553 000 mkw. powierzchni przy stopie zwrotu z kosztów (“YoC”) na poziomie 10,3%, które w momencie ukończenia zostały wynajęte w 100%, co zwiększyło portfolio Grupy do 13,8 mln mkw. powierzchni GLA. Wartość aktywów brutto (“GAV”) wzrosła o 10,6% do 17,7 mld euro i 16,0% rok do roku. EPRA NTA na akcję wzrosła o 10,5% w 9M-2025 do 19,98 euro i 14,0% rok do roku.

Skorygowany zysk EPRA dla spółki wzrósł o 13,1% rok do roku do 305,2 mln euro. Skorygowany zysk na akcję EPRA EPS wyniósł 0,64 euro, co oznacza wzrost o 7,2%. Dzięki dostawom i przychodom netto z działalności deweloperskiej w drugiej połowie roku, Grupa pozostaje na dobrej drodze do osiągnięcia prognozy 0,86-0,88 euro na 2025 r., co stanowi wzrost o 8%-10% w porównaniu z 2024 r.

Na dzień 30 września 2025 r. łączna powierzchnia projektów w budowie wynosiła 2,0 mln mkw. przy oczekiwanym wskaźniku YoC na poziomie 10,2% i potencjalnym dochodzie z najmu w wysokości 165 mln euro po pełnym wynajęciu. Znaczna część tych projektów zostanie oddana do użytku w 2025 r., a CTP nadal oczekuje, że w tym roku dostarczy od 1,3 mln mkw. do 1,6 mln mkw. powierzchni.

Bank ziemi Grupy wynosił 25,7 mln m2, z czego 22,0 mln m2 jest własnością i znajduje się w bilansie. Ten bank ziemi zapewnia CTP znaczny potencjał wzrostu w przyszłości, z 90% zlokalizowanymi wokół istniejących parków biznesowych (57% w istniejących parkach, 33% w nowych parkach z potencjałem ponad 100 000 mkw. powierzchni GLA). W połączeniu z wiodącym w branży wskaźnikiem YoC, CTP spodziewa się dalszego dwucyfrowego wzrostu NTA w nadchodzących latach.

Siła platformy CTP została podkreślona we wrześniu przez podniesienie ratingu kredytowego przez S&P z BBB- do BBB z perspektywą stabilną. Podwyższenie ratingu nastąpiło po tym, jak w drugim kwartale 2025 r. agencja Moody's podniosła perspektywę CTP ze stabilnej na pozytywną.

Dysponujemy bankiem gruntów o powierzchni 25,7 mln mkw. z wbudowanym potencjalnym zyskiem z działalności deweloperskiej w wysokości ponad 5 mld euro, co zapewnia znaczne możliwości dalszego tworzenia wartości. Nasz unikalny zintegrowany model jako operatora, dewelopera i platformy wzrostu daje nam zdolność i elastyczność do wykorzystywania możliwości, zarówno na naszych obecnych rynkach, jak i potencjalnych nowych rynkach.

Trendy strukturalne, takie jak nearshoring, przyspieszają, co ilustruje ciągły wzrost liczby azjatyckich najemców produkcyjnych w naszym portfelu. W regionie Europy Środkowo-Wschodniej nadal obserwujemy silny wzrost konsumpcji krajowej, podczas gdy w Niemczech korzystamy z modernizacji gospodarki. Dzięki naszej skali, jakości portfela i planowanym inwestycjom, CTP jest dobrze przygotowana do czerpania korzyści z tych trendów i osiągnięcia naszego ambitnego celu, jakim jest 30 milionów mkw. powierzchni GLA w 2030 roku”.”

Najważniejsze informacje

Utrzymujący się duży popyt ze strony najemców napędza wzrost czynszów

W 9M-2025 CTP podpisała umowy najmu na 1 577 000 m2, co stanowi wzrost o 6% w porównaniu z tym samym okresem w 2024 r., przy średnim miesięcznym czynszu za m2 wynoszącym 5,86 euro (9M-2024: 5,63 euro). Uwzględniając różnice między krajami, czynsze wzrosły średnio o 6%.

| Podpisane umowy najmu wg mkw. | Q1 | Q2 | Q3 | NARASTAJĄCO | Pytanie 4 | FY |

| 2023 | 297,000 | 552,000 | 585,000 | 1,435,000 | 542,000 | 1,976,000 |

| 2024 | 336,000 | 582,000 | 577,000 | 1,495,000 | 618,000 | 2,113,000 |

| 2025 | 416,000 | 599,000 | 562,000 | 1,577,000 |

| Średni miesięczny czynsz podpisanych umów najmu na m2 (€) | Q1 | Q2 | Q3 | NARASTAJĄCO | Pytanie 4 | FY |

| 2023 | 5.31 | 5.56 | 5.77 | 5.60 | 5.81 | 5.69 |

| 2024 | 5.65 | 5.55 | 5.69 | 5.63 | 5.79 | 5.68 |

| 2025 | 6.17 | 5.91 | 5.64 | 5.86 |

W sumie 73% podpisanych umów najmu dotyczyło istniejących najemców, zgodnie z modelem biznesowym CTP polegającym na rozwoju z istniejącymi najemcami w istniejących parkach.

Generowanie przepływów pieniężnych poprzez stały portfel i przejęcia

Średni udział CTP w rynku w Czechach, Rumunii, na Węgrzech i Słowacji wyniósł 28,3% na dzień 30 września 2025 r. i pozostaje największym właścicielem i deweloperem nieruchomości przemysłowych i logistycznych na tych rynkach. Grupa jest również liderem rynku w Serbii i Bułgarii.

Z ponad 1500 klientami, CTP posiada szeroką i zróżnicowaną międzynarodową bazę najemców, składającą się z największych firm o wysokim ratingu kredytowym. Najemcy CTP reprezentują szeroki zakres branż, w tym produkcję, high-tech/IT, motoryzację, e-commerce, handel detaliczny, hurtowy i 3PL. Baza najemców jest wysoce zdywersyfikowana, a żaden z nich nie odpowiada za więcej niż 2,5% rocznego czynszu Spółki, co zapewnia stabilny strumień przychodów. Tylko 50 największych najemców CTP odpowiada za 32,7% rocznego czynszu, a zdecydowana większość klientów wynajmuje powierzchnię w wielu parkach CTP.

Spółka utrzymuje obłożenie na poziomie 93% (rok finansowy 2024: 93%). Wskaźnik utrzymania klientów Grupy utrzymuje się na wysokim poziomie 82% (rok finansowy 2024: 87%) i świadczy o zdolności CTP do wykorzystywania długotrwałych relacji z klientami. Wskaźnik WAULT portfela wyniósł 6,1 roku (w roku obrotowym 2024: 6,4 roku), zgodnie z celem Spółki wynoszącym >6 lat.

Poziom ściągalności czynszów wyniósł 99,8% w 9M-2025 (FY-2024: 99,8%), bez pogorszenia profilu płatności najemców.

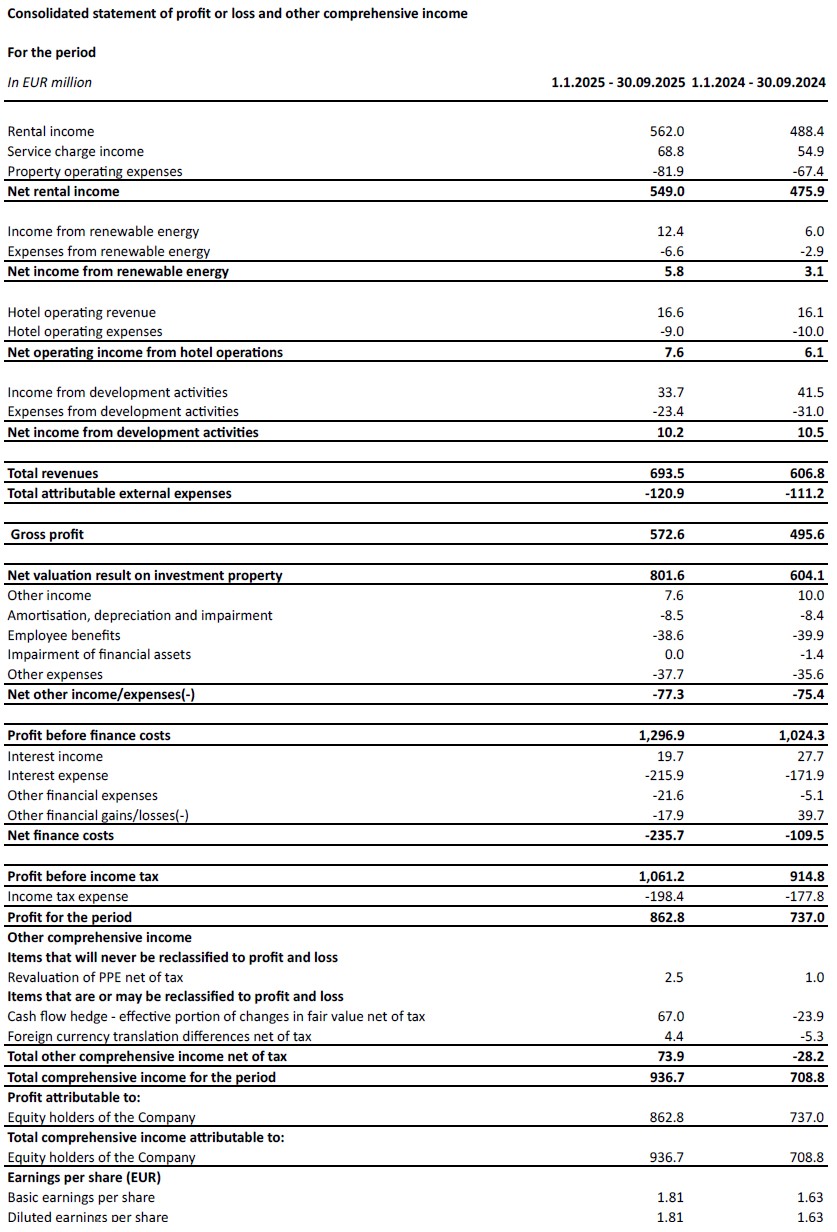

Przychody z czynszów w 9M-2025 wyniosły 562 mln EUR, co oznacza wzrost o 15,1% rok do roku w ujęciu bezwzględnym, głównie dzięki dostawom i wzrostowi w ujęciu porównywalnym. W ujęciu porównywalnym przychody z najmu wzrosły o 4,5%, dzięki indeksacji i rewersji renegocjacji i wygasających umów najmu.

Grupa wdrożyła środki mające na celu ograniczenie wycieków opłat eksploatacyjnych, co zaowocowało poprawą wskaźnika przychodów netto z najmu do przychodów z najmu z 97,4% w 9M-2024 do 97,7% w 9M-2025. W rezultacie przychody netto z najmu wzrosły o 15,4% rok do roku.

Coraz większa część przychodów z najmu generowanych przez portfel inwestycyjny CTP korzysta z ochrony przed inflacją. Od końca 2019 r. nowe umowy najmu Grupy zawierają klauzulę indeksacji CPI, która oblicza roczny wzrost czynszu jako wyższą z następujących wartości:

- stały wzrost o 1,5%-2,5% rocznie; lub

- wskaźnik cen towarów i usług konsumpcyjnych[1].

Na dzień 30 września 2025 r. 72% dochodu wygenerowanego przez portfel Grupy obejmuje tę klauzulę podwójnej indeksacji, a Grupa spodziewa się dalszego jej wzrostu.

Potencjał rewersyjny wyniósł 13,7%. Nowe umowy najmu były podpisywane stale powyżej szacowanej wartości czynszu (“ERV”), co ilustruje utrzymujący się silny wzrost czynszów rynkowych i wspiera wyceny.

Roczny dochód z najmu wyniósł 778 mln euro na dzień 30 września 2025 r., co stanowi wzrost o 10,8% rok do roku, pokazując silny wzrost przepływów pieniężnych portfela inwestycyjnego CTP.

9M-2025 inwestycje dostarczone z 10,3% YoC i 100% wynajęte w momencie dostawy

CTP kontynuowała zdyscyplinowane inwestycje w swój wysoce rentowny rurociąg.

W okresie 9M-2025 Grupa ukończyła 553 000 mkw. powierzchni GLA (9M-2024: 545 000 mkw.). Inwestycje zostały oddane do użytku przy wskaźniku YoC na poziomie 10,3%, 100% wynajęte i wygenerują zakontraktowany roczny dochód z najmu w wysokości 35,5 mln euro. Jak zwykle, dostawy w 2025 r. przypadają na czwarty kwartał.

Podczas gdy średnie koszty budowy w 2022 r. wyniosły około 550 euro za mkw., w 2023 i 2024 r. osiągnęły poziom 500 euro za mkw. i pozostały stabilne w 9M-2025. Umożliwia to Grupie dalsze dostarczanie wiodącego w branży wskaźnika YoC powyżej 10%, który jest również wspierany przez unikalny model parku CTP oraz własne doświadczenie w zakresie budowy i zaopatrzenia.

Na dzień 30 września 2025 r. Grupa posiadała 2,0 mln mkw. budynków w budowie z potencjalnym przychodem z najmu w wysokości 165 mln euro i oczekiwanym wskaźnikiem YoC na poziomie 10,2%. CTP ma wieloletnie doświadczenie w zapewnianiu zrównoważonego wzrostu dzięki rozwojowi prowadzonemu przez najemców w istniejących parkach. 78% projektów Grupy w budowie znajduje się w istniejących parkach, a 10% w nowych parkach, które mają potencjał do rozbudowy do ponad 100 000 mkw. powierzchni GLA. Planowane dostawy na 2025 r. wynoszą 63%, co oznacza wzrost z 35% w roku obrotowym 2024. Wskaźnik przednajmu w istniejących parkach wyniósł 58%, podczas gdy w nowych parkach wskaźnik przednajmu wyniósł 76%, co świadczy o niskim ryzyku związanym z rurociągiem. CTP spodziewa się osiągnąć 80%-90% przednajmu w momencie oddania do użytku, zgodnie z historycznymi wynikami. Ponieważ CTP działa jako generalny wykonawca na większości rynków, ma pełną kontrolę nad procesem i harmonogramem dostaw, co pozwala Spółce na przyspieszenie lub spowolnienie w zależności od zapotrzebowania najemców, jednocześnie oferując im elastyczność w zakresie wymagań dotyczących budynku.

W 2025 r. Grupa spodziewa się dostarczyć od 1,3 mln mkw. do 1,6 mln mkw. powierzchni, w zależności od popytu ze strony najemców. Podpisane już umowy najmu na 151 000 mkw. pod przyszłe projekty - których budowa jeszcze się nie rozpoczęła - są kolejnym dowodem na utrzymujący się popyt ze strony najemców.

Bank ziemi CTP wynosił 25,7 mln mkw. na dzień 30 września 2025 r. (31 grudnia 2024 r.: 26,4 mln mkw.), co w dużej mierze przyczyni się do osiągnięcia ambicji 30 mln mkw. GLA do roku 2030. Grupa koncentruje się na mobilizacji istniejącego banku ziemi, jednocześnie utrzymując zdyscyplinowaną alokację kapitału w celu jego uzupełnienia. 57% banku ziemi znajduje się w istniejących parkach CTP, podczas gdy 33% znajduje się w nowych parkach lub sąsiaduje z nimi, które mają potencjał wzrostu do ponad 100 000 mkw. 15% banku ziemi zostało zabezpieczone opcjami, podczas gdy pozostałe 85% było własnością i odpowiednio odzwierciedlone w bilansie.

Zakładając, że współczynnik zabudowy wynosi 2 m kw. gruntu na 1 m kw. powierzchni GLA, CTP może wybudować około 13 mln m kw. powierzchni GLA na swoich zabezpieczonych gruntach. Grunty CTP są utrzymywane w bilansie w cenie około 60 euro za mkw., a koszty budowy wynoszą średnio około 500 euro za mkw., co daje całkowity koszt inwestycji w wysokości około 620 euro za mkw. Stały portfel Grupy jest wyceniany na około 1 040 euro za mkw., co daje potencjał rewaluacji na poziomie około 400 euro za mkw. wybudowanego obiektu.

Monetyzacja biznesu energetycznego

CTP kontynuuje swój plan rozwoju w zakresie wdrażania systemów fotowoltaicznych. Przy średnim koszcie wynoszącym ~750 000 EUR na MWp, Grupa planuje osiągnąć w przypadku tych inwestycji wskaźnik YoC na poziomie 151 TP3T.

CTP ma zainstalowaną moc fotowoltaiczną 149 MWp, z czego 123,5 MWp jest w pełni operacyjne.

W 9M-2025 przychody z energii odnawialnej wyniosły 12,4 mln euro, co oznacza wzrost o 108% rok do roku, głównie dzięki wzrostowi mocy zainstalowanej w 2024 roku.

Ambicje CTP w zakresie zrównoważonego rozwoju idą w parze z rosnącą liczbą najemców oczekujących zielonej energii z systemów fotowoltaicznych, ponieważ zapewniają im one i) większe bezpieczeństwo energetyczne, ii) niższe koszty użytkowania, iii) zgodność z zaostrzonymi przepisami, iv) zgodność z wymaganiami klientów oraz v) możliwość realizacji własnych ambicji ESG.

Wyniki wyceny napędzane przez pipeline i pozytywną ponowną wycenę portfela stałego

Wycena nieruchomości inwestycyjnych (“IP”) wzrosła z 14,7 mld euro na dzień 31 grudnia 2024 r. do 15,8 mld euro na dzień 30 września 2025 r., co wynikało z przeniesienia ukończonych projektów z nieruchomości inwestycyjnych w trakcie realizacji (“IPuD”) do IP oraz pozytywnej aktualizacji wyceny stałego portfela.

IPuD wzrósł o 54,2% od 31 grudnia 2024 r. do 1,7 mld euro na dzień 30 września 2025 r., co wynika z poniesionych nakładów inwestycyjnych, przeszacowania wynikającego ze zwiększonego przednajmu i postępu budowy oraz rozpoczęcia nowych projektów budowlanych w 9M-2025.

GAV wzrosła do 17,7 mld EUR na dzień 30 września 2025 r., co oznacza wzrost o 10,6% w porównaniu do 31 grudnia 2024 r.

W wynikach za I i III kwartał przeszacowano tylko projekty IPuD. Przeszacowanie w okresie 9M-2025 wyniosło 801,6 mln euro, co wynikało z dodatniej wyceny projektów IPuD (+ 385,2 mln euro), banku gruntów (+ 43,3 mln euro) i aktywów standingowych (+ 373,0 mln euro).

CTP spodziewa się dalszego pozytywnego wzrostu ERV dzięki utrzymującemu się popytowi ze strony najemców, na który pozytywny wpływ mają sekularne czynniki wzrostu w regionie Europy Środkowo-Wschodniej. Poziomy czynszów w Europie Środkowo-Wschodniej pozostają przystępne cenowo, pomimo obserwowanego silnego wzrostu, który rozpoczął się od znacznie niższych poziomów bezwzględnych niż w krajach Europy Zachodniej. W ujęciu realnym czynsze na wielu rynkach Europy Środkowo-Wschodniej (“CEE”) są nadal niższe niż w 2010 roku.

Portfel Grupy charakteryzuje się konserwatywną stopą kapitalizacji na poziomie 7,0%. Oczekuje się, że różnica w rentowności między logistyką w Europie Środkowo-Wschodniej i Europie Zachodniej zmniejszy się z czasem, napędzana wyższymi oczekiwaniami wzrostu dla regionu Europy Środkowo-Wschodniej i rosnącą aktywnością na rynkach inwestycyjnych.

EPRA NTA na akcję wzrosła z 18,08 EUR na dzień 31 grudnia 2024 r. do 19,98 EUR na dzień 30 września 2025 r., co oznacza wzrost o 10,5% w okresie 9 miesięcy-2025 r. i wzrost o 14,0% rok do roku. Wzrost ten wynika głównie z aktualizacji wyceny (+1,67 EUR), skorygowanego wskaźnika EPRA EPS dla poszczególnych spółek (+0,64 EUR) i został skompensowany przez ostateczną dywidendę za 2024 r. wypłaconą w maju (-0,30 EUR) oraz inne pozycje (-0,11 EUR).

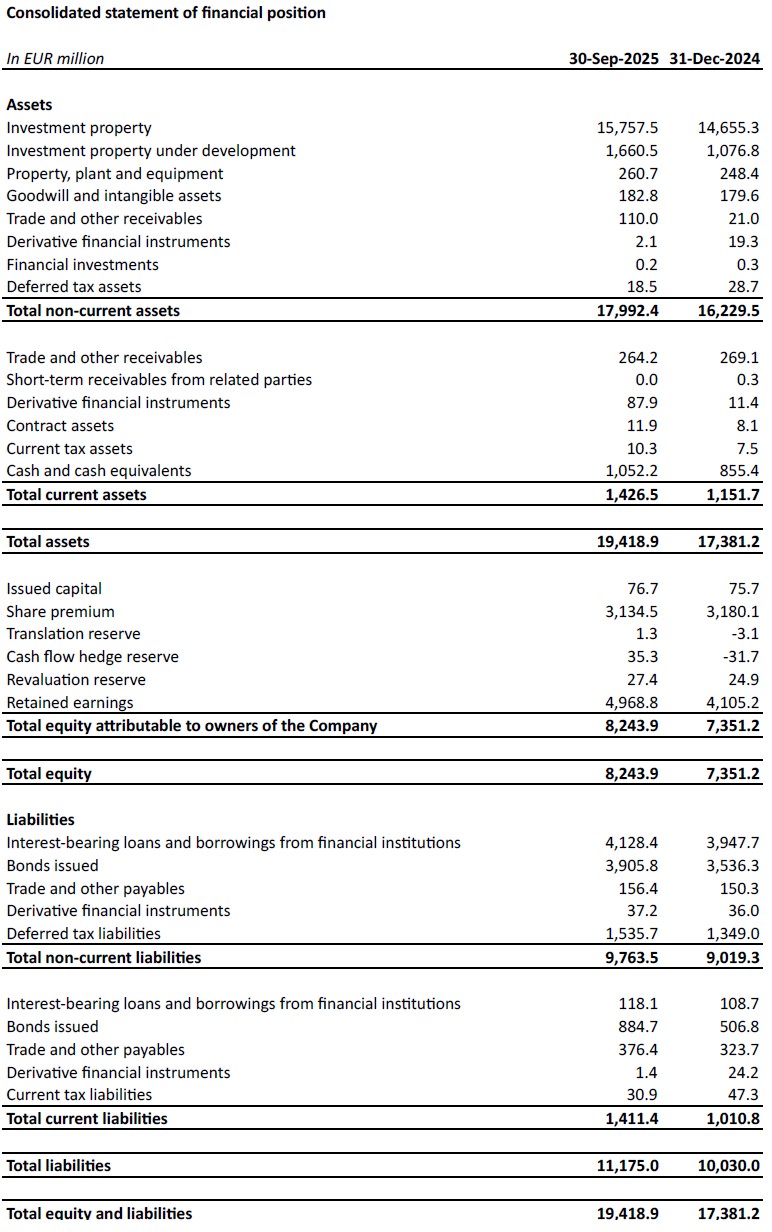

Solidny bilans i silna pozycja płynnościowa

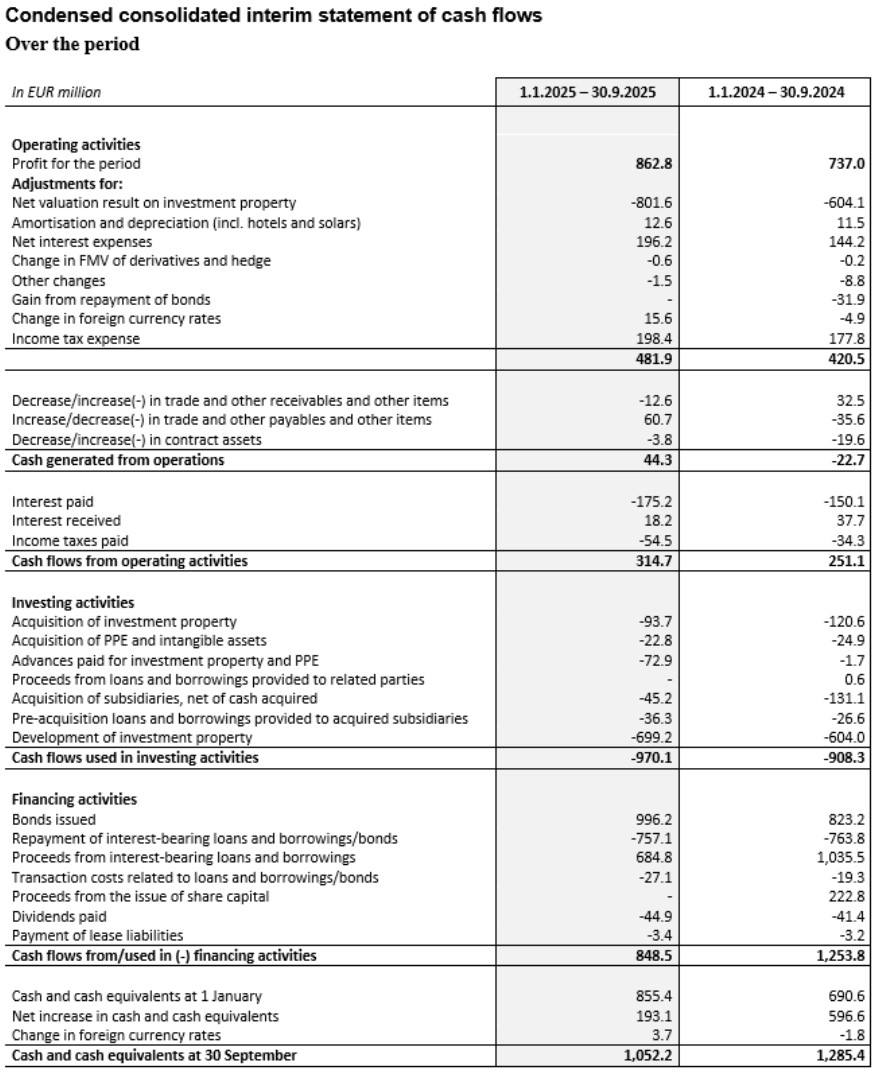

Zgodnie ze swoim proaktywnym i ostrożnym podejściem, Grupa korzysta z solidnej pozycji płynnościowej, aby sfinansować swoje ambicje wzrostu, przy stałym koszcie zadłużenia i konserwatywnym profilu spłaty.

W okresie 9 miesięcy-2025 r. Grupa zabezpieczyła 1,7 mld euro na sfinansowanie swojego organicznego wzrostu:

- Zielona obligacja dwutranszowa o wartości 1,0 mld euro z sześcioletnią transzą o wartości 500 mln euro przy stopie oprocentowania MS +145 punktów bazowych i kuponie 3,625% oraz dziesięcioletnią transzą o wartości 500 mln euro przy stopie oprocentowania MS +188 punktów bazowych i kuponie 4,25%;

- Pięcioletnia niezabezpieczona linia pożyczkowa w wysokości 30 mld JPY (równowartość 185 mln EUR) z konsorcjum banków azjatyckich przy stopie TONAR +130 punktów bazowych i stałym całkowitym koszcie w wysokości 4,1%; oraz

- Pięcioletni, niezabezpieczony kredyt na zrównoważony rozwój w wysokości 500 mln euro udzielony przez konsorcjum 13 banków europejskich i azjatyckich przy stałym koszcie całkowitym wynoszącym 3,7%.

Ponadto w dniu 13 października 2025 r. CTP wyemitowała nową 6,5-letnią zieloną obligację o wartości 600 mln EUR z MS +118 pb i kuponem w wysokości 3,625%.

CTP kontynuowała aktywne zarządzanie portfelem kredytów bankowych w 9M-2025. Wynegocjowano obniżenie marży na kolejne 193 mln euro zabezpieczonych kredytów bankowych, a niezabezpieczony kredyt terminowy w wysokości 441 mln euro podpisany w 2023 r. został przedpłacony i zrefinansowany nowym niezabezpieczonym kredytem w wysokości 500 mln euro. Oba te działania pozwoliły CTP osiągnąć znaczne oszczędności w zakresie stóp procentowych, zmniejszając ogólny koszt zadłużenia w przyszłości.

Płynność Grupy wyniosła 2,4 mld euro, na co składało się 1,1 mld euro w gotówce i jej ekwiwalentach oraz niewykorzystany RCF w wysokości 1,3 mld euro.

Średni koszt zadłużenia CTP wyniósł 3,2% (rok fiskalny 2024: 3,1%), co stanowi niewielki wzrost w porównaniu z końcem 2024 r., ze względu na nowe finansowanie. 99,9% zadłużenia jest oprocentowane na stałe lub zabezpieczone do momentu zapadalności.

Grupa nie kapitalizuje odsetek od projektów deweloperskich, dlatego wszystkie koszty odsetkowe są uwzględniane w rachunku zysków i strat. Średnia zapadalność zadłużenia wyniosła 4,8 roku (FY-2024: 5,0 lat).

Grupa spłaciła obligację o wartości 272 mln euro w czerwcu 2025 r. z dostępnych rezerw gotówkowych. Kolejna obligacja o wartości 185 mln euro z terminem zapadalności w październiku 2025 r. również została spłacona z rezerw gotówkowych.

Wskaźnik LTV CTP wyniósł 45,2% na dzień 30 września 2025 r., na co pozytywny wpływ miała silna aktualizacja wyceny nieruchomości inwestycyjnych w trakcie realizacji.

Aktywa Grupy o wyższej rentowności, dzięki rentowności portfela brutto na poziomie 6,6%, prowadzą do zdrowego poziomu dźwigni przepływów pieniężnych, co znajduje również odzwierciedlenie w znormalizowanym zadłużeniu netto do EBITDA na poziomie 9,2x (w roku obrotowym 2024: 9,1x), który Grupa zamierza utrzymać poniżej 10x.

Zadłużenie Grupy składało się z 68% niezabezpieczonego zadłużenia i 32% zabezpieczonego na dzień 30 września 2025 r., Z wystarczającą ilością miejsca na kowenanty w ramach testu zadłużenia zabezpieczonego i testu aktywów wolnych od obciążeń.

W miarę racjonalizacji cen na rynku obligacji warunki stały się bardziej konkurencyjne niż ceny na rynku kredytów bankowych, co pozwoli Grupie na większe przestawienie się na kredytowanie niezabezpieczone.

| 30 września 2025 r. | Przymierze | |

| Test długu zabezpieczonego | 14.9% | 40% |

| Test aktywów wolnych od obciążeń | 190.6% | 125% |

| Wskaźnik pokrycia odsetek | 2,5x | 1.5x |

W trzecim kwartale 2025 r. agencja S&P podwyższyła rating kredytowy CTP z BBB- do BBB z perspektywą stabilną. W styczniu 2025 r. japońska agencja ratingowa JCR przyznała CTP rating kredytowy A- z perspektywą stabilną. W drugim kwartale 2025 r. agencja Moody's podniosła perspektywę ratingu kredytowego Baa3 ze stabilnej na pozytywną.

Przewodnictwo

Dynamika najmu pozostaje silna, z solidnym popytem ze strony najemców i malejącą nową podażą prowadzącą do ciągłego wzrostu czynszów. CTP jest dobrze przygotowana do czerpania korzyści z tych trendów. Oferta Grupy jest wysoce rentowna i prowadzona przez najemców. Współczynnik YoC dla bieżącego rurociągu CTP pozostaje na wiodącym w branży poziomie 10,2%. Kolejny etap rozwoju jest już wbudowany i sfinansowany, z 2,0 mln mkw. w budowie na dzień 30 września 2025 r., z celem dostarczenia od 1,3 mln mkw. do 1,6 mln mkw. w 2025 r. oraz dodatkowych 1,4 mln mkw. do 1,7 mln mkw. w 2026 r.

Solidna struktura kapitałowa CTP, zdyscyplinowana polityka finansowa, silny dostęp do rynku kredytowego, wiodący w branży bank ziemi, wewnętrzne doświadczenie budowlane i głębokie relacje z najemcami pozwalają CTP realizować swoje cele. CTP spodziewa się osiągnąć dochód z najmu w wysokości 1,0 mld euro w 2027 r., napędzany ukończeniem inwestycji, indeksacją i rewersją. Jest również na dobrej drodze do realizacji ambicji 30 mln mkw. powierzchni GLA do 2030 roku.

Grupa potwierdza swoją prognozę skorygowanego zysku na akcję EPRA EPS na 2025 r. w wysokości 0,86-0,88 euro, która ze względu na planowaną akwizycję w Rumunii, która nie doszła do skutku, jest obecnie oczekiwana w dolnej części przedziału. Wzrost EPRA EPS jest napędzany silnym wzrostem bazowym, przy wzroście czynszów o około 4% w ujęciu porównywalnym, częściowo skompensowanym wyższym średnim kosztem zadłużenia z powodu (ponownego) finansowania w 2024 i 2025 roku. Grupa spodziewa się powrotu do dwucyfrowego wzrostu EPRA EPS w 2026 roku.

Polityka dywidendowa CTP zakłada wypłatę 70% - 80% skorygowanego EPS EPRA specyficznego dla Spółki. Domyślnie wypłacana jest dywidenda w formie skryptu dłużnego, ale akcjonariusze mogą zdecydować się na wypłatę dywidendy w gotówce.

WEBCAST I TELEKONFERENCJA DLA ANALITYKÓW I INWESTORÓW

Dziś o godzinie 9 rano (GMT) i 10 rano (CET) Spółka przeprowadzi prezentację wideo i sesję pytań i odpowiedzi dla analityków i inwestorów, za pośrednictwem transmisji internetowej na żywo i połączenia konferencyjnego audio.

Aby obejrzeć transmisję na żywo, należy zarejestrować się na stronie:

https://www.investis-live.com/ctp/68dce560eefece00147ba94d/vbqpg

Aby dołączyć do prezentacji telefonicznie, należy wybrać jeden z poniższych numerów i wprowadzić kod dostępu uczestnika 128602.

Niemcy +49 32 22109 8334

Francja +33 9 70 73 39 58

Holandia +31 85 888 7233

Wielka Brytania +44 20 3936 2999

Stany Zjednoczone +1 646 664 1960

Naciśnij *1, aby zadać pytanie, *2, aby wycofać pytanie lub *0, aby uzyskać pomoc operatora.

Nagranie będzie dostępne na stronie internetowej CTP w ciągu 24 godzin od prezentacji: https://ctp.eu/investors/financial-results/

KALENDARZ FINANSOWY CTP

| Działanie | Data |

| Wyniki za rok fiskalny 2025 | 26 lutego 2026 |

| Wyniki za okres Q1-2026 | 30 kwietnia 2026 r. |

| Doroczne Walne Zgromadzenie | 20 maja 2026 r. |

| Wyniki za I półrocze 2026 r. | 30 lipca 2026 r. |

| Dni Rynku Kapitałowego | Wrzesień 2026 r. |

| Wyniki za 3Q-2026 | 29 października 2026 r. |

DANE KONTAKTOWE DLA ANALITYKÓW I INWESTORÓW W SPRAWIE ZAPYTAŃ:

Maarten Otte, Dyrektor ds. Relacji Inwestorskich i Rynków Kapitałowych

Telefon komórkowy: +420 730 197 500

Adres e-mail: maarten.otte@ctp.eu

Pavel Švihálek, menedżer ds. finansowania i IR

Telefon komórkowy: +420 724 928 828

E-mail: pavel.svihalek@ctp.eu

DANE KONTAKTOWE DLA MEDIÓW:

E-mail: ctp@secnewgate.co.uk

O CTP

CTP jest największym w Europie notowanym na giełdzie właścicielem, deweloperem i zarządcą nieruchomości logistycznych i przemysłowych pod względem powierzchni najmu brutto, posiadającym 13,8 mln mkw. powierzchni GLA w 10 krajach (stan na 30 września 2025 r.). CTP certyfikuje wszystkie nowe budynki zgodnie z BREEAM na poziomie bardzo dobrym lub lepszym i uzyskał ocenę ESG o znikomym ryzyku od Sustainalytics, podkreślając swoje zaangażowanie w zrównoważony rozwój. Więcej informacji można znaleźć na stronie korporacyjnej CTP: www.ctp.eu

Zastrzeżenie

Niniejszy komunikat zawiera pewne stwierdzenia dotyczące przyszłości w odniesieniu do sytuacji finansowej, wyników działalności i działalności CTP. Te stwierdzenia dotyczące przyszłości można zidentyfikować poprzez użycie terminologii dotyczącej przyszłości, w tym terminów "uważa", "szacuje", "planuje", "projektuje", "przewiduje", "oczekuje", "zamierza", "cele", "może", "dąży", "prawdopodobnie", "byłby", "mógłby", "może mieć", "będzie" lub "powinien" lub, w każdym przypadku, ich negatywnych lub innych odmian lub porównywalnej terminologii. Stwierdzenia dotyczące przyszłości mogą i często różnią się istotnie od rzeczywistych wyników. W związku z tym nie należy przywiązywać nadmiernej wagi do jakichkolwiek stwierdzeń dotyczących przyszłości. Niniejsza informacja prasowa zawiera informacje poufne w rozumieniu art. 7 ust. 1 rozporządzenia (UE) nr 596/2014 z dnia 16 kwietnia 2014 r. (rozporządzenie w sprawie nadużyć na rynku).

[1] W przypadku połączenia lokalnego wskaźnika CPI oraz wskaźnika CPI w UE-27/strefie euro, tylko ograniczona liczba ograniczeń.

Zapisz się do naszego newslettera

Otrzymuj najświeższe informacje od lidera rynku nieruchomości przemysłowych prosto do swojej skrzynki odbiorczej.