CTP NV Q3-2024 Ergebnisse

CTP meldet Anstieg der Nettomieteinnahmen um 18,21 TP3T im Vergleich zum Vorjahr, unternehmensspezifischer, bereinigter EPRA-Gewinn pro Aktie von 0,60 € auf Kurs zur Erreichung der Prognose und Anstieg des EPRA-Gewinns pro Aktie um 10,11 TP3T auf 17,52 €

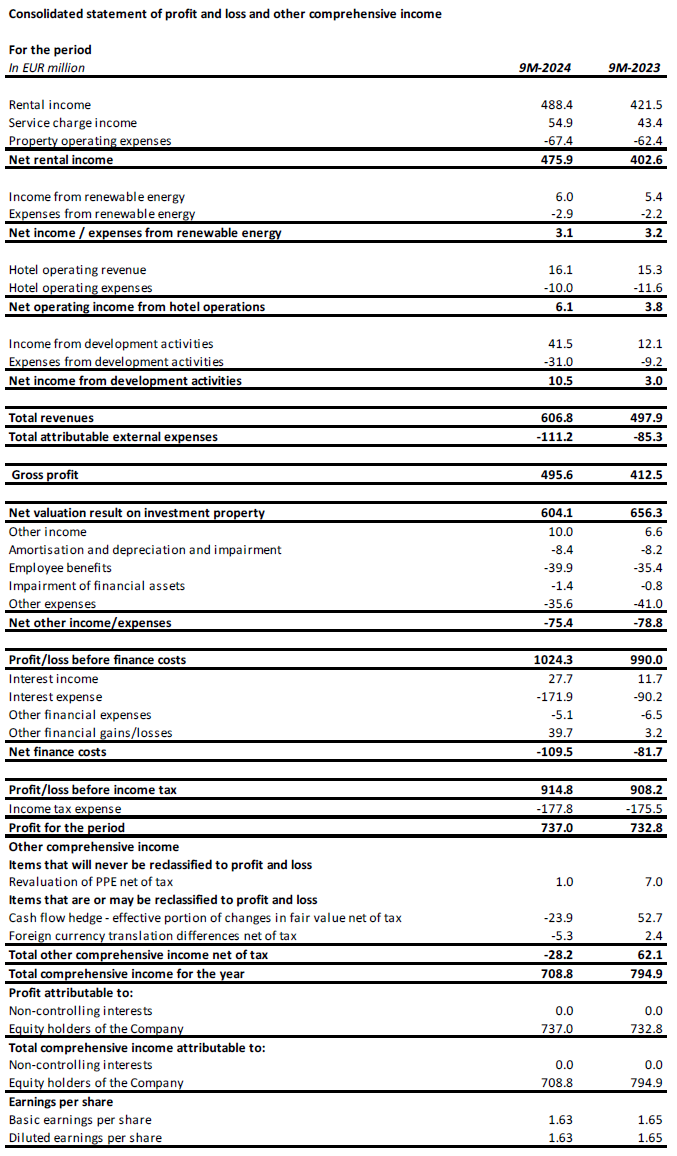

AMSTERDAM, 6. November 2024 – CTP NV (CTPNV.AS), („CTP“, die „Gruppe“ oder das „Unternehmen“) verzeichnete in den ersten neun Monaten des Jahres Mieteinnahmen in Höhe von 488,4 Millionen Euro, ein Anstieg von 15,91 TP3T im Vergleich zum Vorjahr. Das vergleichbare Mietwachstum im Vergleich zum Vorjahr betrug 4,41 TP3T, hauptsächlich bedingt durch Indexierung und Rücknahme bei Neuverhandlungen und auslaufenden Mietverträgen. Zum 30. September 2024 beliefen sich die jährlichen Mieteinnahmen auf 702,0 Millionen und die Auslastung auf 931 TP3T.

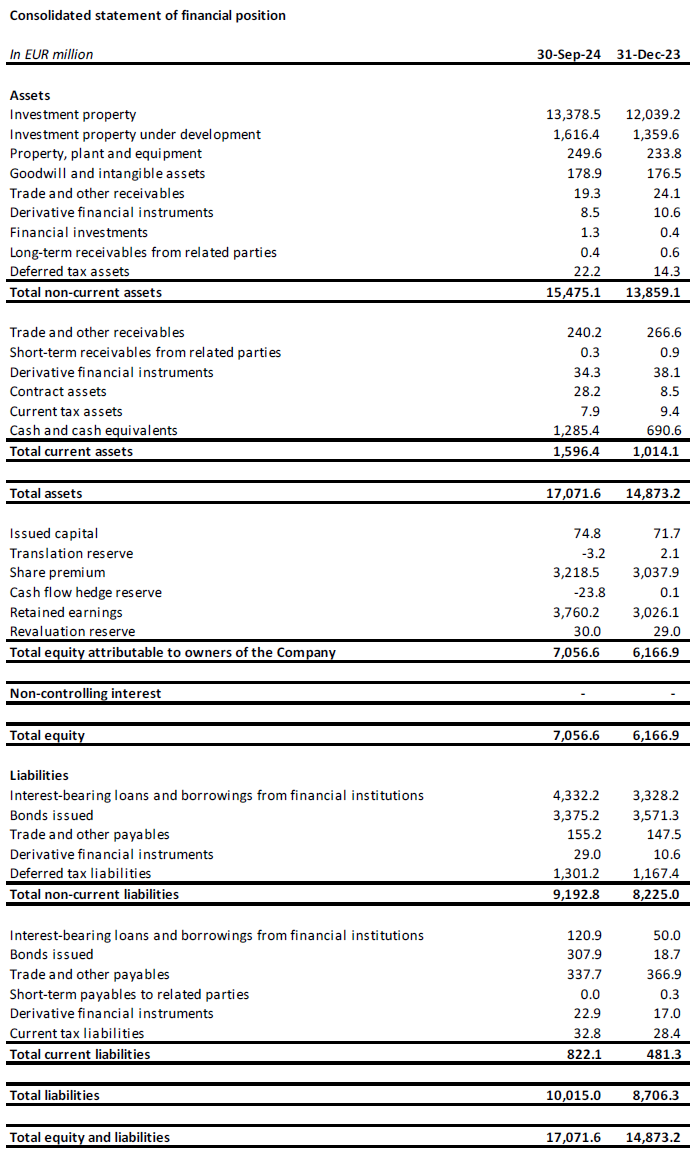

In den ersten neun Monaten lieferte CTP 545.000 m² zu einem Yield on Cost („YoC“) von 10,11 TP3T und vermietete bei Fertigstellung 951 TP3T, wodurch das Bestandsportfolio der Gruppe auf 12,6 Millionen m² GLA anstieg, während der Bruttovermögenswert („GAV“) um 11,81 TP3T auf 15,2 Milliarden Euro stieg. Der EPRA NTA pro Aktie stieg im ersten Halbjahr um 10,11 TP3T auf 17,52 Euro.

Der unternehmensspezifische bereinigte EPRA-Gewinn stieg im Vergleich zum Vorjahr um 13,21 TP3T auf 269,8 Millionen Euro. Der unternehmensspezifische bereinigte EPRA-Gewinn pro Aktie von CTP belief sich auf 0,60 Euro, ein Anstieg um 11,71 TP3T. Die Gruppe bestätigt ihre Prognose für den unternehmensspezifischen bereinigten EPRA-Gewinn pro Aktie von 0,80 bis 0,82 Euro für 2024.

Zum 30. September 2024 beliefen sich die im Bau befindlichen Projekte auf insgesamt 1,9 Millionen Quadratmeter, mit einem potenziellen Mieteinkommen von 142 Millionen Euro bei vollständiger Vermietung und einem erwarteten YoC von 10,41 TP3T. Ein erheblicher Teil davon wird im Jahr 2024 fertiggestellt, da CTP erwartet, in diesem Jahr zwischen 1,2 und 1,3 Millionen Quadratmeter fertigzustellen.

Der Grundstücksbestand der Gruppe erhöhte sich auf 27,1 Millionen Quadratmeter, von denen 20,9 Millionen Quadratmeter Eigentum und in der Bilanz sind, und sicherte CTP erhebliches zukünftiges Wachstumspotenzial. Mit seinem branchenführenden YoC geht CTP davon aus, auch in den kommenden Jahren zweistelliges NTA-Wachstum erzielen zu können.

Die jährlichen Mieteinnahmen beliefen sich auf 702 Millionen Euro und verdeutlichen die starke Cashflow-Generierung unseres Bestandsportfolios mit einer Mieteinnahmerate von 99,81 TP3T. Während die nächste Wachstumsphase mit unseren 1,9 Millionen Quadratmetern im Bau befindlicher vermietbarer Fläche und einem Grundstücksbestand von über 27 Millionen Quadratmetern bereits gesichert ist, werden wir weiterhin ein zweistelliges NTA-Wachstum erzielen. Zusätzlich zur Vorvermietung für die aktuelle Pipeline haben wir weitere 177.000 Quadratmeter an Mietverträgen für zukünftige Projekte unterzeichnet, die wir in Kürze starten wollen.

Die Nachfrage nach Industrie- und Logistikimmobilien in der CEE-Region wird von strukturellen Nachfragetreibern wie der Professionalisierung von Lieferketten durch 3PLs, E-Commerce und Nearshoring und Friend-Shoring der Nutzer getrieben, da die CEE-Region die kostengünstigsten Standorte in Europa bietet. Wir haben jetzt über 101 TP3T unseres Portfolios an asiatische Mieter vermietet, die in Europa für Europa produzieren, was rund 201 TP3T unserer gesamten Vermietungsaktivität im Jahr 2024 ausmacht.“

Wichtigste Highlights

| In Mio. € | 9M-2024 | 9M-2023 | %-Änderung | 3. Quartal 2024 | Q3-2023 | %-Änderung |

| Bruttomieteinnahmen | 488.4 | 421.5 | +15.9% | 167.5 | 141.1 | +18.8% |

| Netto-Mieteinnahmen | 475.9 | 402.6 | +18.2% | 162.1 | 134.1 | +20.8% |

| Netto-Bewertungsergebnis aus als Finanzinvestition gehaltenen Immobilien | 604.1 | 656.3 | -8.0% | 167.4 | 239.1 | -30.0% |

| Gewinn des Berichtszeitraums | 737.0 | 732.8 | +0.6% | 203.3 | 263.1 | -22.7% |

| Unternehmensspezifisches bereinigtes EPRA-Ergebnis | 269.8 | 238.4 | +13.2% | 92.3 | 80.4 | +14.8% |

| In € | 9M-2024 | 9M-2023 | %-Änderung | 3. Quartal 2024 | Q3-2023 | %-Änderung |

| Unternehmensspezifisches bereinigtes EPRA EPS | 0.60 | 0.54 | +11.7% | 0.20 | 0.18 | +12.7% |

| In Mio. € | 30. September 2024 | 31. Dez. 2023 |

%-Änderung | |||

| Als Finanzinvestition gehaltene Immobilien ("IP") | 13,378.5 | 12,039.2 | +11.1% | |||

| Als Finanzinvestition gehaltene Immobilien in Entwicklung ("IPuD") | 1,616.4 | 1,359.6 | +18.9% | |||

| 30. September 2024 | 31. Dez. 2023 |

%-Änderung | ||||

| EPRA NTA je Aktie | €17.52 | €15.92 | +10.1% | |||

| Erwartetes Jahresergebnis der im Bau befindlichen Projekte | 10.4% | 10.3% | ||||

| LTV | 44.9% | 46.0% |

Anhaltend starke Mieternachfrage treibt Mietwachstum

In den ersten neun Monaten des Jahres 2024 unterzeichnete CTP Mietverträge über 1.495.000 m², ein Anstieg von 41 TP3T im Vergleich zu 9M-2023, mit vertraglich vereinbarten jährlichen Mieteinnahmen von 100,9 Millionen Euro und einer durchschnittlichen Monatsmiete pro m² von 5,63 Euro (9M-2023: 5,60 Euro). Bereinigt um den Unterschied im Ländermix stiegen die Mieten im Durchschnitt um 31 TP3T.

| Unterzeichnete Mietverträge nach Quadratmetern | Q1 | Q2 | Q3 | YTD | Q4 | FY |

| 2022 | 441,000 | 452,000 | 505,000 | 1,398,000 | 485,000 | 1,883,000 |

| 2023 | 297,000 | 552,000 | 585,000 | 1,435,000 | 542,000 | 1,976,000 |

| 2024 | 336,000 | 582,000 | 577,000 | 1,495,000 |

| Durchschnittliche monatliche Mietverträge pro Quadratmeter (€) | Q1 | Q2 | Q3 | YTD | Q4 | FY |

| 2022 | 4.87 | 4.89 | 4.75 | 4.82 | 4.80 | 4.82 |

| 2023 | 5.31 | 5.56 | 5.77 | 5.60 | 5.81 | 5.69 |

| 2024 | 5.65 | 5.55 | 5.69 | 5.63 |

Etwa zwei Drittel dieser Mietverträge wurden mit bestehenden Mietern abgeschlossen, was dem Geschäftsmodell von CTP entspricht, mit bestehenden Mietern in bestehenden Parks zu wachsen.

Cashflow-Generierung durch Bestandsportfolio und Akquisitionen

Der durchschnittliche Marktanteil von CTP in der Tschechischen Republik, Rumänien, Ungarn und der Slowakei stieg zum 30. September 2024 auf 28,51 TP3T und das Unternehmen bleibt der größte Eigentümer und Entwickler von Industrie- und Logistikimmobilien in diesen Märkten. Die Gruppe ist auch Marktführer in Serbien und Bulgarien.

Mit über 1.000 Kunden verfügt CTP über einen breiten und diversifizierten internationalen Mieterstamm, der aus Blue-Chip-Unternehmen mit starker Kreditwürdigkeit besteht. Die Mieter von CTP repräsentieren ein breites Spektrum an Branchen, darunter Fertigung, Hightech/IT, Automobil, E-Commerce, Einzelhandel, Großhandel und Logistik von Drittanbietern. Der Mieterstamm ist stark diversifiziert, wobei kein einzelner Mieter mehr als 2,51 TP3T der jährlichen Mieteinnahmen ausmacht, was zu einem stabilen Einkommensstrom führt. Die 50 größten Mieter von CTP machen nur 33,41 TP3T der jährlichen Mieteinnahmen aus und die meisten befinden sich in mehreren CTParks.

Die Belegungsrate des Unternehmens belief sich auf 931 TP3T (Q3-2023: 931 TP3T). Die Kundenbindungsrate der Gruppe bleibt mit 911 TP3T (Q3-2023: 921 TP3T) stark und zeigt die Fähigkeit von CTP, langjährige Kundenbeziehungen zu nutzen. Der Portfolio-WAULT lag bei 6,5 Jahren (Q3-2023: 6,6 Jahre) und entspricht damit dem Ziel des Unternehmens von >6 Jahren.

Die Mieteinnahmen beliefen sich in den ersten neun Monaten 2024 auf 99,81 TP3T (9M-2023: 99,81 TP3T), wobei sich das Zahlungsprofil der Mieter nicht verschlechterte.

Die Mieteinnahmen beliefen sich auf 488,4 Millionen Euro, was einem absoluten Anstieg von 15,91 TP3B gegenüber dem Vorjahr entspricht. Auf vergleichbarer Basis stiegen die Mieteinnahmen um 4,41 TP3B, was hauptsächlich auf Indexierung und Rücknahme bei Neuverhandlungen und auslaufenden Mietverträgen zurückzuführen ist.

Die Gruppe hat Maßnahmen ergriffen, um den Verlust von Servicegebühren zu begrenzen, was zu einer Verbesserung des Verhältnisses zwischen Nettomieteinnahmen und Mieteinnahmen von 95,51 TP3T in den ersten neun Monaten 2023 auf 97,41 TP3T in den ersten neun Monaten 2024 führte. Folglich stiegen die Nettomieteinnahmen im Vergleich zum Vorjahr um 18,21 TP3T.

Ein zunehmender Anteil der Mieteinnahmen aus dem Anlageportfolio von CTP profitiert von einem Inflationsschutz. Seit Ende 2019 enthalten alle neuen Mietverträge der Gruppe eine doppelte Indexierungsklausel, die die jährlichen Mieterhöhungen als den höheren der folgenden Werte berechnet:

- eine feste Erhöhung von 1,5%-2,5% pro Jahr; oder

- der Verbraucherpreisindex[1].

Zum 30. September 2024 enthalten 70% der durch das Portfolio der Gruppe generierten Erträge diese doppelte Indexierungsklausel, und die Gruppe erwartet, dass dieser Wert weiter steigen wird.

Das Umkehrpotenzial blieb stabil bei 15,11 TP3T. Es wurden kontinuierlich neue Mietverträge über dem ERV abgeschlossen, was ein anhaltend starkes Wachstum der Marktmieten und unterstützende Bewertungen zeigt.

Die annualisierten Mieteinnahmen beliefen sich zum 30. September 2024 auf 702,0 Millionen Euro, ein Anstieg von 19,31 TP3T im Vergleich zum Vorjahr, was das starke Cashflow-Wachstum des Anlageportfolios von CTP verdeutlicht.

9M-2024 Entwicklungen mit einem 10.1% YoC und 95% bei Auslieferung ausgeliefert

CTP setzte seine disziplinierten Investitionen in seine hochprofitable Pipeline fort. In den ersten neun Monaten stellte die Gruppe 545.000 m² GLA (9M-2023: 566.000 m²) fertig, etwas weniger als im Vorjahr, als mehrere Projekte online gingen, die im Jahr 2022 aufgrund der höheren Baukosten verschoben wurden. Die Entwicklungen wurden mit einem YoC von 10,11 TP3T fertiggestellt, 951 TP3T vermietet und werden vertraglich vereinbarte jährliche Mieteinnahmen von 33,0 Millionen Euro generieren, wobei weitere 2,0 Millionen Euro Einnahmen erwartet werden, wenn sie vollständig belegt sind.

Zu den wichtigsten Lieferungen in den ersten neun Monaten des Jahres 2024 zählten: 169.000 m² im CTPark Warschau West (Polen), 48.000 m² im CTPark Zabrze (Polen), 37.000 m² im CTPark Budapest Ecser (Ungarn), 37.000 m² im CTPark Novi Sad Ost (Serbien), 30.000 m² im CTPark Weiden (Deutschland), 26.000 m² im CTPark Bukarest West (Rumänien), 27.000 m² im CTPark Katowice (Polen) und 23.000 m² im CTPark Arad West (Rumänien).

Während die durchschnittlichen Baukosten im Jahr 2022 bei rund 550 € pro Quadratmeter lagen, beliefen sie sich im Jahr 2023 und in den ersten neun Monaten 2024 auf 500 € pro Quadratmeter. CTP geht davon aus, dass sie bis 2024 auf diesem Niveau bleiben werden. Dies ermöglicht es der Gruppe, weiterhin ihr branchenführendes YoC von über 10% zu erreichen, was auch durch das einzigartige Parkmodell von CTP und die hauseigene Bau- und Beschaffungskompetenz unterstützt wird.

Zum 30. September 2024 hatte die Gruppe 1,9 Millionen Quadratmeter an Gebäuden im Bau mit potenziellen Mieteinnahmen von 142 Millionen Euro und einem erwarteten YoC von 10,41 TP3T. CTP hat eine lange Erfolgsgeschichte in der Erzielung nachhaltigen Wachstums durch die mietergeführte Entwicklung in seinen bestehenden Parks. 761 TP3T der im Bau befindlichen Projekte der Gruppe befinden sich in bestehenden Parks, während 151 TP3T in neuen Parks liegen, die das Potenzial haben, auf mehr als 100.000 Quadratmeter GLA entwickelt zu werden. Von den für 2024 geplanten Lieferungen sind 641 TP3T vorvermietet. CTP erwartet, bei Lieferung 801–901 TP3T vorvermietet zu erreichen, was der bisherigen Leistung entspricht. Da CTP in den meisten Märkten als Generalunternehmer auftritt, hat es die volle Kontrolle über den Prozess und den Zeitpunkt der Lieferungen, was es dem Unternehmen ermöglicht, je nach Mieternachfrage zu beschleunigen oder zu verlangsamen und den Mietern gleichzeitig Flexibilität in Bezug auf die Gebäudeanforderungen zu bieten.

Im Jahr 2024 rechnet die Gruppe damit, je nach Mieternachfrage zwischen 1,2 und 1,3 Millionen Quadratmeter zu liefern. Die derzeit unterzeichneten Mietverträge für 177.000 Quadratmeter für zukünftige Projekte, deren Bau noch nicht begonnen hat, sind ein weiteres Beispiel für die anhaltende Nachfrage der Mieter.

Der Landbestand von CTP belief sich zum 30. September 2024 auf 27,1 Millionen Quadratmeter (31. Dezember 2023: 23,4 Millionen Quadratmeter), wodurch das Unternehmen sein Ziel von 20 Millionen Quadratmetern Bruttomietfläche bis zum Ende des Jahrzehnts erreichen kann. Die Gruppe konzentriert sich auf die Mobilisierung des bestehenden Landbestands und behält gleichzeitig eine disziplinierte Kapitalallokation bei der Aufstockung des Landbestands bei. 601 TP3T des Landbestands befinden sich in den bestehenden Parks von CTP, während sich 301 TP3T in neuen Parks befinden oder an diese angrenzen, die das Potenzial haben, auf über 100.000 Quadratmeter zu wachsen. 231 TP3T des Landbestands waren durch Optionen gesichert, während die restlichen 771 TP3T Eigentum waren und dementsprechend in der Bilanz ausgewiesen wurden.

Bei einem Bauverhältnis von 2 m² Grundstück zu 1 m² Bruttomietfläche kann CTP auf seinem gesicherten Grundstücksbestand über 13 Millionen m² Bruttomietfläche bauen. CTPs Grundstücke werden in der Bilanz mit rund 50 € pro m² verbucht und die Baukosten betragen durchschnittlich rund 500 € pro m², was Gesamtinvestitionskosten von rund 600 € pro m² bedeutet. Das Bestandsportfolio der Gruppe, mit Ausnahme des älteren ehemaligen Portfolios der Deutschen Industrie REIT, wird mit rund 1.000 € pro m² bewertet.

Monetarisierung des Energiegeschäfts

CTP setzt seinen Expansionsplan für den Ausbau von Photovoltaikanlagen fort. Bei durchschnittlichen Kosten von ~750.000 € pro MWp strebt die Gruppe für diese Investitionen einen YoC von 15% an.

In den ersten neun Monaten hat die Gruppe weitere 19 MWp auf den Dächern installiert, die derzeit ans Netz angeschlossen werden. Die insgesamt installierte Leistung beträgt damit 119 MWp.

In den ersten neun Monaten des Jahres 2024 beliefen sich die Einnahmen aus erneuerbaren Energien auf 6,0 Millionen Euro, ein Anstieg von 101 TP3T gegenüber dem Vorjahr.

Die Nachhaltigkeitsbestrebungen von CTP gehen Hand in Hand mit der Tatsache, dass immer mehr Mieter Photovoltaikanlagen nachfragen, da sie ihnen i) eine verbesserte Energiesicherheit, ii) niedrigere Nutzungskosten, iii) die Einhaltung strengerer Vorschriften, iv) die Erfüllung der Anforderungen ihrer Kunden und v) die Möglichkeit bieten, ihre eigenen ESG-Ambitionen zu erfüllen.

Bewertungsergebnisse getrieben durch Pipeline und positive Neubewertung des Bestandsportfolios

Die Bewertung der als Finanzinvestition gehaltenen Immobilien („IP“) stieg von 12,0 Milliarden Euro zum 31. Dezember 2023 auf 13,4 Milliarden Euro zum 30. September 2024, was hauptsächlich auf die Übertragung abgeschlossener Projekte von als Finanzinvestition gehaltenen Immobilien in Entwicklung („IPuD“) zu IP, wertsteigernde Akquisitionen und positive Neubewertungen zurückzuführen ist.

Die IPuD stiegen zum 30. September 2024 um 18,91 TP3T auf 1,6 Milliarden Euro, was auf den Entwicklungsfortschritt zurückzuführen ist, wobei die meisten Projekte wie üblich im vierten Quartal des Jahres abgeschlossen werden sollen.

Der GAV stieg zum 30. September 2024 auf 15,2 Milliarden Euro, ein Anstieg um 11,81 TP3T gegenüber dem 31. Dezember 2023.

Für die Ergebnisse von Q1 und Q3 werden nur die IPuD-Projekte neu bewertet. Die Neubewertung für Q3-2024 betrug 167,4 Millionen Euro, was die Neubewertung in den ersten 9 Monaten auf 604,1 Millionen Euro bringt, was auf die positive Neubewertung von IPuD-Projekten (+351,2 Millionen Euro), der Landbank (+26,1 Millionen Euro) und der Bestandsanlagen (+226,9 Millionen Euro) zurückzuführen ist.

Das Portfolio der Gruppe weist konservative Bewertungsrenditen auf, wobei sich die Renditen in den letzten zwei Jahren um 80 Basispunkte auf 7,21 TP3T erhöht haben. CTP geht davon aus, dass die Renditen im Industrie- und Logistiksektor in der CEE-Region ihren Höhepunkt erreicht haben. Mit den größeren Renditeschwankungen in den westeuropäischen Märkten ist die Renditedifferenz zwischen der CEE- und der westeuropäischen Logistik wieder auf dem langfristigen Durchschnitt. CTP geht davon aus, dass die Renditedifferenz im Laufe der Zeit weiter sinken wird, bedingt durch die höheren Wachstumserwartungen für die CEE-Region.

CTP erwartet aufgrund der anhaltenden Mieternachfrage, die durch die langfristigen Wachstumstreiber in der CEE-Region positiv beeinflusst wird, ein weiteres positives ERV-Wachstum. Die Mieten in CEE bleiben erschwinglich und trotz des starken Wachstums liegen sie von einem deutlich niedrigeren absoluten Niveau aus als in westeuropäischen Ländern. Real liegen die Mieten in vielen CEE-Märkten immer noch unter dem Niveau von 2010.

Der EPRA NTA pro Aktie stieg von 15,92 € zum 31. Dezember 2023 auf 17,52 € zum 30. September 2024, was einem Anstieg von 10,11 TP3T entspricht. Der Anstieg ist hauptsächlich auf die Neubewertung (+1,29 €), das unternehmensspezifische bereinigte EPRA EPS (+0,60 €) zurückzuführen, teilweise ausgeglichen durch die ausgezahlte Dividende (-0,28 €).

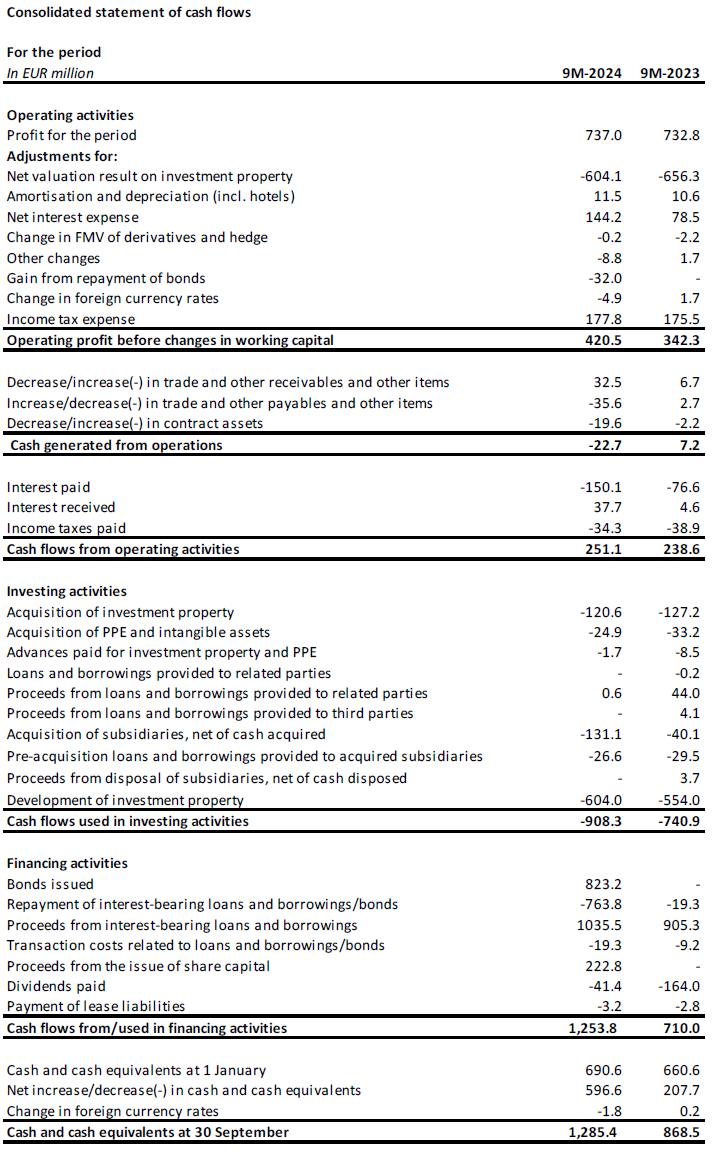

Robuste Bilanz und starke Liquiditätsposition

Im Einklang mit ihrem proaktiven und umsichtigen Ansatz profitiert die Gruppe von einer soliden Liquiditätsposition, um ihre Wachstumsambitionen zu finanzieren, mit festen Kosten für Schulden und einem konservativen Rückzahlungsprofil.

In den ersten neun Monaten des Jahres sammelte die Gruppe 1,8 Milliarden Euro ein:

- Eine besicherte Kreditfazilität in Höhe von 100 Millionen Euro mit einer Laufzeit von sechs Jahren und einem Konsortium aus italienischen und tschechischen Banken zu festen Gesamtkosten von 4,91 TP3T;

- Eine grüne Anleihe im Wert von 750 Millionen Euro mit sechsjähriger Laufzeit zu MS +220 Basispunkten und einem Kupon von 4,751 TP3T;

- Ein besicherter Kredit in Höhe von 90 Millionen Euro mit einer Laufzeit von sieben Jahren bei einer österreichischen Bank zu festen Gesamtkosten von 4,91 TP3T;

- Eine besicherte Kreditfazilität in Höhe von 168 Millionen Euro mit einer Laufzeit von sieben Jahren und einem Konsortium aus slowakischen und österreichischen Banken zu festen Gesamtkosten von 5,11 TP3T;

- Eine Aufstockung der im Februar 2024 ausgegebenen sechsjährigen grünen Anleihe um 75 Millionen Euro bei MS +171 Basispunkten;

- Eine unbesicherte Kreditfazilität über 500 Millionen Euro mit einer Laufzeit von fünf Jahren bei einem Konsortium internationaler Banken zu festen Gesamtkosten von 4,71 TP3T; und

- Eine Aufstockung des besicherten Kreditrahmens in Höhe von 150 Millionen Euro mit einer Laufzeit von sieben Jahren durch ein Konsortium italienischer und tschechischer Banken zu festen Gesamtkosten von 4,351 TP3T.

Im Laufe des Jahres schloss CTP außerdem zwei Anleihe-Tenderangebote ab, kaufte kurzfristige Anleihen im Wert von 750 Millionen Euro zurück, erzielte einen Kapitalgewinn von 31,9 Millionen Euro, reduzierte die Laufzeiten der Schulden in den Jahren 2025 und 2026 und verlängerte proaktiv sein Fälligkeitsprofil.

Die Liquiditätsposition der Gruppe belief sich auf 1,8 Milliarden Euro, davon 1,3 Milliarden Euro in Barmitteln und Barmitteläquivalenten sowie einem nicht in Anspruch genommenen RCF von 550 Millionen Euro.

Die durchschnittlichen Fremdkapitalkosten von CTP beliefen sich auf 2,731 TP3T (31. Dezember 2023: 1,951 TP3T), wobei 99,71 TP3T der Schulden bis zur Fälligkeit festgeschrieben oder abgesichert waren. Die Gruppe kapitalisiert keine Zinsen auf Entwicklungen, daher sind alle Zinsaufwendungen in der Gewinn- und Verlustrechnung enthalten. Die durchschnittliche Laufzeit der Schulden betrug 5,0 Jahre (31. Dezember 2023: 5,3 Jahre).

Die erste wesentliche bevorstehende Fälligkeit des Konzerns ist ein[2] Anleihe mit Fälligkeit im Juni 2025, die aus verfügbaren Barreserven zurückgezahlt wird.

Der LTV von CTP belief sich zum 30. September 2024 auf 44,9%, verglichen mit 46,2% zum 30. Juni 2024, dank der ABB[3]CTP erwartet einen Rückgang des LTV, da die Neubewertungen der Entwicklungen der Gruppe vollständig ausgebucht sind.

Die ertragreicheren Vermögenswerte der Gruppe führen dank ihrer Bruttoportfoliorendite von 6,51 TP3T zu einem gesunden Maß an Cashflow-Hebelwirkung. Dies spiegelt sich auch im normalisierten Verhältnis von Nettoverschuldung zu EBITDA von 9,0x (31. Dezember 2023: 9,2x) wider, das die Gruppe unter dem 10-fachen halten möchte.

Die Gruppe verfügte zum 30. September 2024 über 591 TP3T unbesicherte Schulden und 411 TP3T besicherte Schulden, mit reichlich Spielraum im Rahmen ihrer Verpflichtungen aus dem Secured Debt Test und dem Unencumbered Asset Test.

Im Zuge der Rationalisierung der Preisgestaltung auf dem Anleihemarkt sind die Konditionen nun wettbewerbsfähiger als auf dem Bankkreditmarkt. Dies wird es dem Konzern ermöglichen, sich stärker auf unbesicherte Kredite zu konzentrieren.

| 30. September 2024 | Bund | |

| Test für besicherte Schulden | 19.5% | 40% |

| Test unbelasteter Vermögenswerte | 190.6% | 125% |

| Zinsdeckungsgrad | 2,75-fach | 1.5x |

Im dritten Quartal 2024 bestätigten sowohl Moody's als auch S&P das Kreditrating von CTP (Baa3 bzw. BBB-) mit stabilem Ausblick.

Dividende und Prognose bestätigt

Die Dynamik bei der Vermietung bleibt stark, die Nachfrage der Mieter ist robust und das sinkende Angebot an neuen Objekten führt zu einem anhaltenden Mietwachstum. CTP ist gut positioniert, um von diesen Trends zu profitieren. Die Pipeline der Gruppe ist hochprofitabel und wird von den Mietern geleitet. Der YoC für die Pipeline von CTP stieg dank sinkender Baukosten und Mietwachstum auf 10,41 TP3T. Die nächste Wachstumsphase ist gebaut und finanziert, wobei sich zum 30. September 2024 1,9 Millionen Quadratmeter im Bau befinden, mit dem Ziel, im Jahr 2024 zwischen 1,2 und 1,3 Millionen Quadratmeter auszuliefern.

Dank der robusten Kapitalstruktur, der disziplinierten Finanzpolitik, des guten Zugangs zum Kreditmarkt, der branchenführenden Grundstücksbank, der hauseigenen Baukompetenz und der intensiven Mieterbeziehungen von CTP kann CTP seine Ziele erreichen. CTP geht davon aus, im Jahr 2027 Mieteinnahmen in Höhe von 1,0 Mrd.

Der Konzern bestätigt seine unternehmensspezifische, angepasste EPRA-EPS-Prognose von 0,80 bis 0,82 Euro für 2024, die aufgrund des Aktienanstiegs nach dem ABB im September eher am unteren Ende erwartet wird.

Die Dividendenpolitik von CTP besteht darin, 70% - 80% des unternehmensspezifischen bereinigten EPRA EPS auszuschütten. Die Standarddividende ist eine Aktiendividende, aber die Aktionäre können sich auch für eine Barauszahlung der Dividende entscheiden.

WEBCAST UND TELEFONKONFERENZ FÜR ANALYSTEN UND INVESTOREN

Heute um 9 Uhr (GMT) und 10 Uhr (MEZ) wird das Unternehmen eine Videopräsentation und eine Fragerunde für Analysten und Investoren über einen Live-Webcast und eine Telefonkonferenz abhalten.

Um den Live-Webcast zu sehen, registrieren Sie sich bitte im Voraus unter:

https://www.investis-live.com/ctp/6707916fb2cedb000e393936/laper

Um an der Präsentation per Telefon teilzunehmen, wählen Sie bitte eine der folgenden Nummern und geben Sie den Teilnehmer-Zugangscode ein 427163.

Deutschland +49 32 22109 8334

Frankreich +33 9 70 73 39 58

Niederlande +31 85 888 7233

Vereinigtes Königreich +44 20 3936 2999

Vereinigte Staaten +1 646 787 9445

Drücken Sie *1, um eine Frage zu stellen, *2, um Ihre Frage zurückzuziehen, oder *0 für die Unterstützung durch die Vermittlung.

Eine Aufzeichnung wird innerhalb von 24 Stunden nach der Präsentation auf der Website des CTP zur Verfügung stehen: https://www.ctp.eu/investors/financial-reports/

CTP-FINANZKALENDER

| Aktion | Datum |

| Ergebnisse für das Geschäftsjahr 2024 | 27. Februar 2025 |

| Jahreshauptversammlung | 22. April 2025 |

| Ergebnisse Q1-2025 | 8. Mai 2025 |

| Ergebnisse H1-2025 | 7. August 2025 |

| Kapitalmarkttage | 24.-25. September 2025 |

| Ergebnisse Q3-2025 | 6. November 2025 |

KONTAKTINFORMATIONEN FÜR ANALYSTEN- UND INVESTORENANFRAGEN:

Maarten Otte, Leiter der Abteilung Investor Relations

Mobil: +420 730 197 500

E-Mail: [email protected]

KONTAKTANGABEN FÜR MEDIENANFRAGEN:

Patryk Statkiewicz, Gruppenleiter für Marketing und PR

Mobil: +31 (0) 629 596 119

E-Mail: [email protected]

Über CTP

CTP ist Europas größter börsennotierter Eigentümer, Entwickler und Verwalter von Logistik- und Industrieimmobilien nach vermietbarer Gesamtfläche und besitzt zum 30. September 2024 12,6 Millionen Quadratmeter vermietbare Gesamtfläche in 10 Ländern. CTP zertifiziert alle neuen Gebäude nach BREEAM „Sehr gut“ oder besser und erhielt von Sustainalytics ein ESG-Rating mit vernachlässigbarem Risiko, was sein Engagement für ein nachhaltiges Unternehmen unterstreicht. Weitere Informationen finden Sie auf der Unternehmenswebsite von CTP: www.ctp.eu

Haftungsausschluss

Diese Mitteilung enthält bestimmte zukunftsgerichtete Aussagen über die Finanzlage, die Betriebsergebnisse und die Geschäftstätigkeit von CTP. Diese zukunftsgerichteten Aussagen können durch die Verwendung von zukunftsgerichteter Terminologie identifiziert werden, einschließlich der Begriffe "glaubt", "schätzt", "plant", "projiziert", "antizipiert", "erwartet", "beabsichtigt", "zielt ab", "kann", "zielt ab", "wahrscheinlich", "würde", "könnte", "kann haben", "wird" oder "sollte" oder, in jedem Fall, deren negative oder andere Varianten oder vergleichbare Terminologie. Zukunftsgerichtete Aussagen können und werden oft erheblich von den tatsächlichen Ergebnissen abweichen. Aus diesem Grund sollte kein unangemessener Einfluss auf zukunftsgerichtete Aussagen genommen werden. Diese Pressemitteilung enthält Insiderinformationen im Sinne von Artikel 7 Absatz 1 der Verordnung (EU) 596/2014 vom 16. April 2014 (Marktmissbrauchsverordnung).

[1] Mit einer Mischung aus lokalem und EU-27-/Eurozonen-VPI, nur begrenzte Anzahl an Obergrenzen.

[2] Ausstehender Betrag nach Abwicklung des Übernahmeangebots am 28. Juni 2024.

[3] Am 30. September 2024 wurden nur die 227 Millionen Euro an Streubesitzaktien abgerechnet, die 73 Millionen Euro an vom CEO und Gründer gezeichneten Aktien wurden in der ersten Oktoberwoche nach der Dividendenzahlung abgerechnet.

Melden Sie sich für unseren Newsletter an

Erhalten Sie die neuesten Erkenntnisse vom Marktführer für Industrieimmobilien direkt in Ihren Posteingang.