A CTP N.V. eredményei a 2024-es pénzügyi évben

A CTP rekordot jelentett, 1,1 milliárd eurós nettó bérleti díjbevételről, amely 19,01%-kal nőtt az előző év azonos időszakához képest, a vállalatspecifikus korrigált EPRA részvényenkénti nyeresége 0,80 euró volt, az egy részvényre jutó EPRA nettó nyeresége pedig 13,61%-kal, 18,08 euróra nőtt.

AMSZTERDAM, 2025. február 27. – A CTP NV (CTPNV.AS), („CTP”, a „Csoport” vagy a „Társaság”) bruttó bérleti díjbevétele 664,1 millió euró volt az évben, ami 16,11 TP5 billió eurós növekedést jelent az előző évhez képest, az összehasonlítható éves bérleti díj növekedés pedig 4,01 TP5 billió euró volt, amit főként az újratárgyalások és a lejáró bérleti szerződések indexálása és visszaforgatása okozott. 2024. december 31-én az évesített bérleti díjbevétel 742,6 millió eurót, a kihasználtság pedig 931 TP5 billió eurót tett ki.

2024-ben a CTP 1 286 000 négyzetméternyi irodaterületet adott át 10,1% költségarányos hozam mellett („YoC”), amelyből 92% volt bérbeadva a befejezéskor, így a Csoport meglévő portfóliója 13,3 millió négyzetméterre emelkedett az bruttó eszközérték (GLA) tekintetében, míg a bruttó eszközérték („GAV”) 17,2%-vel 16,0 milliárd euróra nőtt. Az egy részvényre jutó EPRA nettó eszközérték (NTA) 13,6%-vel 18,08 euróra nőtt.

A vállalatspecifikus korrigált EPRA eredmény 12,51%-kal, 5%-kal, 364,0 millió euróra nőtt az előző év azonos időszakához képest. A CTP vállalatspecifikus korrigált EPRA egy részvényre jutó eredménye 0,80 eurót tett ki, ami 9,91%-os 5%-os növekedést jelent, összhangban az iránymutatással. A Csoport 0,86–0,88 eurós vállalatspecifikus korrigált EPRA egy részvényre jutó eredményre vonatkozó iránymutatást határoz meg 2025-re.

2024. december 31-én az építés alatt álló projektek összterülete 1,8 millió négyzetméter volt, a teljes bérbeadás esetén a potenciális bérleti bevétel 142 millió euró, a várható éves értékesítési árbevétel pedig 10,31 TP5T.

A Csoport földterülete 26,4 millió négyzetméterre nőtt, amelyből 21,7 millió négyzetméter saját tulajdonú és mérlegben szereplő. Ez a földterület jelentős jövőbeli növekedési potenciált biztosít a CTP számára, főként a meglévő üzleti parkok körül. Az iparágvezető éves árbevétellel együtt a CTP arra számít, hogy az elkövetkező években is kétszámjegyű nettó telekbevétel-növekedést fog produkálni.

2024 folyamán a CTP sikeresen befejezte első gyorsított jegyzésbuildjét a tőzsdei bevezetés után – többszörösen túljegyezve –, 300 millió euró tőkét gyűjtve, ami elegendő erőforrást adott a fejlesztések felgyorsítására és akvizíciókra, mint például a düsseldorfi belvárosban található 830 000 négyzetméteres barnamezős fejlesztés.

Az évesített bérleti díjbevétel 743 millió eurót tett ki, ami jól mutatja a meglévő portfóliónk erős cash flow-termelését, 99,8% bérleti díjbevételi rátával. Míg a következő növekedési fázis már beindult az építés alatt álló 1,8 millió négyzetméternyi bérbeadható területtel és a több mint 26,4 millió négyzetméteres földterülettel, továbbra is kétszámjegyű nettó bérbeadási növekedést fogunk elérni. A jelenlegi projektekhez kapcsolódó előbérleti szerződések mellett további 80 000 négyzetméternyi bérleti szerződést írtunk alá jövőbeli projektekre, amelyeket hamarosan elindítunk.

A közép-kelet-európai régióban az ipari és logisztikai ingatlanok iránti keresletet strukturális keresleti tényezők vezérlik, mint például az ellátási láncok professzionalizálódása a 3PL-ek (harmadik fél logisztikai szolgáltatók) által, az e-kereskedelem folyamatos növekedése, valamint a bérlők nearshoring és friend-shoring tevékenysége. Mivel a közép-kelet-európai régió kínálja Európa legjobb költségű helyszínét, különösen profitálunk a nearshoring trendből, amit az ázsiai gyártócégek Európában Európának termelő bérlőinek számának növekedése is mutat, akik 2024-ben a teljes bérleti tevékenységünk mintegy 201,5 milliárd forintját tették ki, szemben a teljes portfóliónk 101,5 milliárd forintos részarányával.

Főbb jellemzők[1]

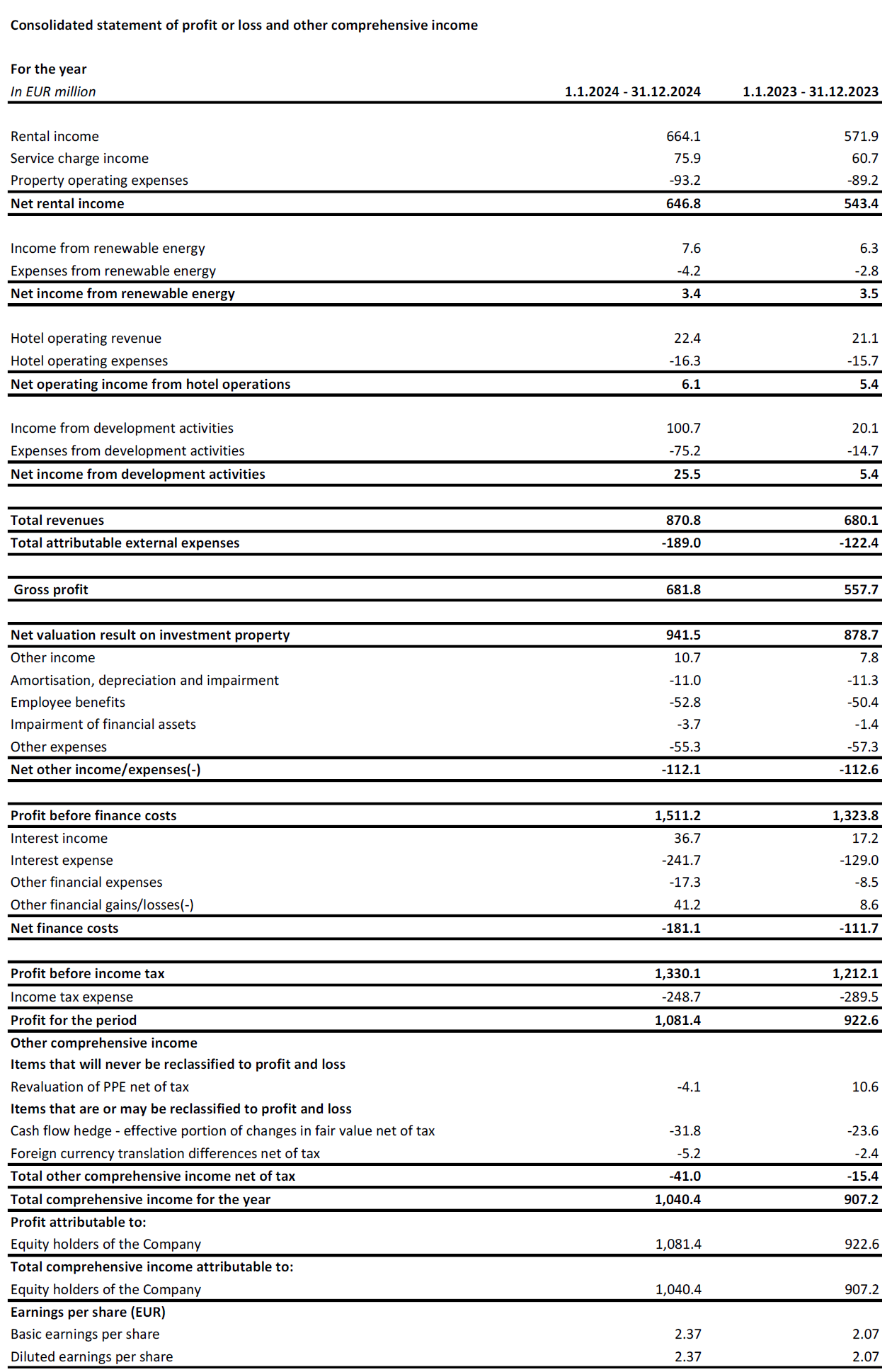

| Millió euróban | 2024 | 2023 | % változás | 2024. negyedik negyedév | Q4-2023 | % változás |

| bérbeadásból származó bruttó bevétel | 664.1 | 571.9 | +16.1% | 175.7 | 150.3 | +16.9% |

| Nettó bérleti bevétel | 646.8 | 543.4 | +19.0% | 170.9 | 140.9 | +21.3% |

| Befektetési célú ingatlanok nettó értékelési eredménye | 941.5 | 878.7 | +7.1% | 337.4 | 222.4 | +51.7% |

| Az időszak nyeresége | 1,081.4 | 922.6 | +17.2% | 344.3 | 189.9 | +81.3% |

| Vállalatspecifikus korrigált EPRA eredmény | 364.0 | 323.5 | +12.5% | 94.2 | 85.0 | +10.7% |

| €-ban | 2024 | 2023 | % változás | 2024. negyedik negyedév | Q4-2023 | % változás |

| Vállalatspecifikus korrigált EPRA EPS | 0.80 | 0.73 | +9.9% | 0.20 | 0.19 | +4.8% |

| Millió euróban | 2024. december 31. | 2023. december 31. | % változás | |||

| Befektetési célú ingatlanok ("IP") | 14,655.3 | 12,039.2 | +21.7% | |||

| Fejlesztés alatt álló befektetési célú ingatlanok ("IPuD") | 1,076.8 | 1,359.6 | -20.8% | |||

| 2024. december 31. | 2023. december 31. | % változás | ||||

| EPRA NTA részvényenként | €18.08 | €15.92 | +13.6% | |||

| Az építés alatt álló projektek várható teljesítési ideje | 10.3% | 10.3% | ||||

| LTV | 45.3% | 46.0% |

A továbbra is erős bérlői kereslet ösztönzi a bérleti díjak növekedését

2024 folyamán a CTP 2 113 000 négyzetméterre kötött bérleti szerződést, ami 71 TP5 billió százalékos növekedést jelent 2023-hoz képest, a szerződéses éves bérleti bevétel 144,0 millió euró, az átlagos havi bérleti díj pedig négyzetméterenként 5,68 euró volt (2023: 5,69 euró). Az országok közötti különbségeket kiigazítva a bérleti díjak átlagosan 31 TP5 billió százalékkal emelkedtek.

| Aláírt bérleti szerződések négyzetméterenként | Q1 | Q2 | Q3 | Q4 | FY |

| 2022 | 441,000 | 452,000 | 505,000 | 485,000 | 1,883,000 |

| 2023 | 297,000 | 552,000 | 585,000 | 542,000 | 1,976,000 |

| 2024 | 336,000 | 582,000 | 577,000 | 618,000 | 2,113,000 |

| Éves növekedés | +13% | +5% | -1% | +14% | +7% |

| Átlagos havi bérleti díjak négyzetméterenként (€) | Q1 | Q2 | Q3 | Q4 | FY |

| 2022 | 4.87 | 4.89 | 4.75 | 4.80 | 4.82 |

| 2023 | 5.31 | 5.56 | 5.77 | 5.81 | 5.69 |

| 2024 | 5.65 | 5.55 | 5.69 | 5.79 | 5.68 |

A bérleti szerződések körülbelül kétharmadát meglévő bérlőkkel kötötték, összhangban a CTP üzleti modelljével, amely a meglévő parkokban a meglévő bérlőkkel együtt növekszik.

Cashflow generálás állandó portfólión és felvásárlásokon keresztül

A CTP átlagos piaci részesedése Csehországban, Romániában, Magyarországon és Szlovákiában 2024. december 31-én 28,81 TP5T-re nőtt, és továbbra is a legnagyobb ipari és logisztikai ingatlanok tulajdonosa és fejlesztője ezeken a piacokon. A Csoport Szerbiában és Bulgáriában is piacvezető.

A CTP közel 1500 ügyfelével széles és diverzifikált nemzetközi bérlői bázissal rendelkezik, amely erős hitelminősítésű, vezető vállalatokból áll. A CTP bérlői az iparágak széles skáláját képviselik, beleértve a gyártást, a high-tech/IT-t, az autóipart, az e-kereskedelmet, a kiskereskedelmet, a nagykereskedelmet és a harmadik féltől származó logisztikát. A bérlői bázis rendkívül diverzifikált, egyetlen bérlő sem teszi ki a vállalat éves bérleti díjainak több mint 2,51 TP5 billióját, ami stabil bevételi forrást jelent. A CTP 50 legnagyobb bérlője a bérleti díjak mindössze 35,21 TP5 billióját teszi ki, és a legtöbb kiadó területet birtokolja több CTParkban.

A Társaság kihasználtsága 93% volt (2023: 94%). A Csoport ügyfélmegtartási rátája továbbra is erős, 87% (2023: 90%), ami jól mutatja a CTP azon képességét, hogy kihasználja a régóta fennálló ügyfélkapcsolatokat. A portfólió WAULT értéke 6,4 év volt (2023: 6,5 év), összhangban a Társaság >6 éves célkitűzésével.

A bérleti díj beszedési szintje 2024-ben 99,81 TP5T volt (2023: 99,91 TP5T), a bérlők fizetési profiljában nem történt romlás.

A bérleti díjbevétel 664,1 millió eurót tett ki, ami abszolút értékben 16,11 TP5 billió euróval magasabb éves szinten, főként az átadásoknak, valamint a 2024 első félévében Romániában 270 000 négyzetméter bérbeadható terület növekedésének köszönhetően, 91 TP5 billió feletti hozam mellett. Összehasonlítható alapon a bérleti díjbevétel 4,01 TP5 billió euróval nőtt, főként az újratárgyalások és a lejáró bérleti szerződések indexálása és visszaforgatása miatt.

A Csoport intézkedéseket hozott a szolgáltatási díjak elszivárgásának korlátozására, aminek eredményeként a nettó bérleti díjbevétel és a bérleti díjbevétel aránya 95,0%-ről (2023) 97,4%-re (2024) javult. Következésképpen a nettó bérleti díjbevétel éves szinten 19,0%-vel nőtt.

A CTP befektetési portfóliójából származó bérleti díjbevétel egyre nagyobb hányada részesül inflációvédelemben. 2019 vége óta a Csoport minden új bérleti szerződésében szerepel a kettős indexálási záradék, amely az éves bérleti díjnövekedést a következők közül a magasabbiknak megfelelően számítja ki:

- évi 1,5%-2,5% fix emelés; vagy

- a fogyasztói árindex[2].

2024. december 31-én a Csoport portfóliója által generált bevétel 711 TP5 billegése tartalmazta ezt a kettős indexálási záradékot, és a Csoport arra számít, hogy ez tovább fog növekedni.

A megtérülési potenciál stabil maradt 14,5% értéken. Az új bérleti szerződések folyamatosan az ERV-nél magasabb szinten érkeznek, ami a piaci bérleti díjak folyamatos erős növekedését mutatja, és alátámasztja az értékeléseket.

Az évesített bérleti díjbevétel 2024. december 31-én 742,6 millió eurót tett ki, ami 15,31 millió eurós növekedést jelent az előző évhez képest, és a CTP befektetési portfóliójának erős cash flow-növekedését mutatja.

2024-ben átadott fejlesztések, 10.1% éves építési engedéllyel és 92% bérbeadással az átadáskor

A CTP folytatta fegyelmezett befektetéseit a rendkívül jövedelmező portfóliójába. 2024-ben a Csoport rekord mennyiségű, 1,3 millió négyzetméternyi bérbeadható területet (2023: 1,2 millió négyzetméter) fejezett be. A fejlesztések 10,11 TP5T éves árbevétellel, azaz 921 TP5T bérbeadható értékkel kerültek átadásra, és 83,4 millió eurós éves bérleti díjbevételt fognak termelni, további 7,3 millió eurós várható bevétellel, amikor elérik a teljes kihasználtságot.

A 2024-es év főbb átadásai a következők voltak: 169 000 m2 a CTPark Warsaw Westben (Lengyelország), 120 000 m2 a CTPark Budapest Szigetszentmiklóson (Magyarország), 87 000 m2 a CTPark Ploiestiben (Románia), 67 000 m2 a CTPark Bucharest Westben (Románia), 57 000 m2 a CTPark Warsaw Southban (Lengyelország), 52 000 m2 a CTPark Novi Sad Eastben (Szerbia), 48 000 m2 a CTPark Zabrze-ban (Lengyelország), 44 000 m2 a CTPark Weidenben (Németország), 37 000 m2 a CTPark Budapest Ecserben (Magyarország), 37 000 m2 a CTPark Žilina Airportban (Szlovákia).

Míg 2022-ben az átlagos építési költségek négyzetméterenként körülbelül 550 eurót tettek ki, 2023-ban és 2024-ben már 500 eurót értek el négyzetméterenként. Ez lehetővé teszi a Csoport számára, hogy továbbra is az iparágvezető, 10% feletti éves árbevételt érje el, amit a CTP egyedi parkmodellje, valamint házon belüli építési és beszerzési szakértelme is támogat.

2024. december 31-én a Csoport 1,8 millió négyzetméternyi épületet épült, amelyek potenciális bérleti bevétele 142 millió euró, a várható éves értékesítési árbevétele pedig 10,31 TP5T. A CTP hosszú múltra tekint vissza a fenntartható növekedés megvalósításában a meglévő parkjaiban a bérlők által vezérelt fejlesztések révén. A Csoport építés alatt álló projektjei közül 801 TP5T meglévő parkokban található, míg 71 TP5T új parkokban, amelyek több mint 100 000 négyzetméter bérbeadható területtel rendelkeznek. A 2025-re tervezett átadások közül 351 TP5T előbérbe adott. A CTP a történelmi teljesítménynek megfelelően a szállítások időpontjában 801 TP5T-901 TP5T előbérbeadási arányt vár. Mivel a CTP a legtöbb piacon generálkivitelezőként működik, teljes mértékben ellenőrzi a szállítások folyamatát és ütemezését, lehetővé téve a Társaság számára, hogy a bérlői igényektől függően felgyorsítsa vagy lelassítsa a szállítást, miközben rugalmasságot kínál a bérlőknek az építési követelmények tekintetében.

A Csoport 2025-ben 1,2-1,7 millió négyzetméternyi terület átadására számít, a bérlői igényektől függően. A jövőbeli projektekre már aláírt 80 000 négyzetméternyi bérleti szerződés – amelyek építése még nem kezdődött meg – a bérlői kereslet folyamatosságát mutatja.

A CTP telekállománya 2024. december 31-én 26,4 millió négyzetmétert tett ki (2023. december 31.: 23,4 millió négyzetméter), ami lehetővé teszi a Társaság számára, hogy az évtized végére elérje a 20 millió négyzetméteres bérbeadható területre vonatkozó célját. A Csoport a meglévő telekállomány mobilizálására összpontosít, miközben fegyelmezett tőkeallokációt tart fenn a telekállomány feltöltése során. A telekállomány 57%-je a CTP meglévő parkjaiban található, míg a 33% új parkokban, vagy azok mellett található, amelyek potenciálisan több mint 100 000 négyzetméterre növekedhetnek. A telekállomány 18%-jét opciókkal biztosították, míg a fennmaradó 82%-t a Társaság saját tulajdonban tartotta, és ennek megfelelően szerepeltette a mérlegben.

2 négyzetméter telek és 1 négyzetméter bérbeadható terület beépítési arányát feltételezve a CTP több mint 13 millió négyzetméter bérbeadható területet építhet a biztosított telkén. A CTP földterülete a mérlegben körülbelül 60 euró/négyzetméter áron szerepel, az építési költségek átlagosan körülbelül 500 eurót tesznek ki négyzetméterenként, így a teljes beruházási költség négyzetméterenként körülbelül 620 eurót tesz ki. A Csoport meglévő portfóliójának értéke, a régebbi, korábbi Deutsche Industrie REIT portfólió nélkül, négyzetméterenként körülbelül 1030 euró.

Az energiaüzlet monetizálása

A CTP folytatja a fotovoltaikus rendszerek kiépítésére vonatkozó bővítési tervét. A csoport átlagosan ~750 000 €/MWp költséggel 15% YoC-t céloz meg ezekre a beruházásokra.

2024 végére a CTP 138 MWp telepített fotovoltaikus kapacitással rendelkezett, amelyből 66 MWp üzemel.

2024-ben a megújuló energiából származó bevételek elérték a 7,6 millió eurót, ami 221 billegett/5 billegett növekedést jelent az előző évhez képest.

A CTP fenntarthatósági törekvései együtt járnak azzal, hogy egyre több bérlő kéri a fotovoltaikus rendszereket, mivel azok i) nagyobb energiabiztonságot, ii) alacsonyabb lakhatási költségeket, iii) a fokozott szabályozásnak való megfelelést, iv) az ügyfelek követelményeinek való megfelelést és v) saját ESG ambícióik teljesítésének lehetőségét biztosítják számukra.

Az értékelési eredményeket a folyamatban lévő portfólió pozitív átértékelése és a folyamatban lévő értékesítési folyamat vezérelte

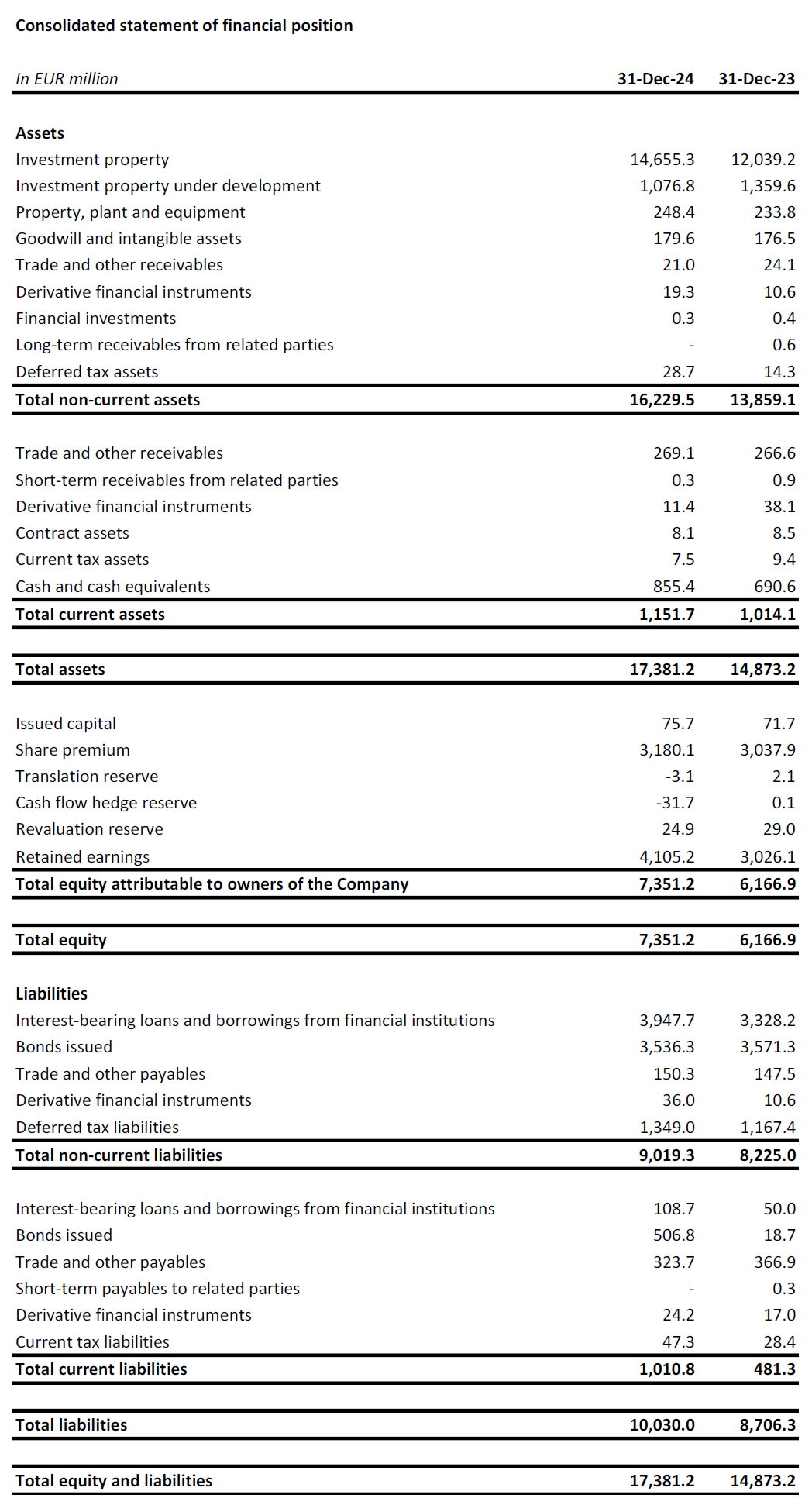

A befektetési ingatlanok („IP”) értékelése 12,0 milliárd euróról 2023. december 31-re 14,7 milliárd euróra emelkedett, főként a befejezett projekteknek a fejlesztés alatt álló befektetési ingatlanokból („IPuD”) az IP-be való átsorolása, akkreditív akvizíciók és a pozitív átértékelések miatt.

Az IPuD 20,8%-vel 1,1 milliárd euróra csökkent 2024. december 31-én, amit a 2024 negyedik negyedévében jelentős mennyiségű szállítás és a 2025 első negyedévében megkezdett új építési projektek okoztak.

A bruttó érték (BAV) 2024. december 31-én 16,0 milliárd euróra nőtt, ami 17,2% növekedést jelent 2023. december 31-hez képest.

A 2024-es átértékelés 941,5 millió eurót tett ki, amit az IPuD projektek (+380,4 millió euró), a földterület (+61,2 millió euró) és a fennálló eszközök (+499,9 millió euró) pozitív átértékelése eredményezett. Az összehasonlítható eszközök átértékelése 5,9% volt, főként a hasonló eszközökhöz viszonyított pozitív, 4,9%-s ERV-növekedésnek köszönhetően.

A Csoport portfóliója konzervatív értékelési hozamokkal rendelkezik, a hozamok az elmúlt két és fél évben 70 bázisponttal nőttek, így elérték a 7,1%-t. A CTP arra számít, hogy a hozamok elérték a csúcsot a közép-kelet-európai régió ipari és logisztikai szektorában. A nyugat-európai piacok nagyobb hozammozgásaival a közép-kelet-európai és a nyugat-európai logisztika közötti hozamkülönbség visszatért a hosszú távú átlaghoz. A CTP arra számít, hogy a hozamkülönbség idővel tovább csökken, amit a közép-kelet-európai régió magasabb növekedési várakozásai vezérelnek.

A CTP további pozitív ERV-növekedést vár a bérlők folyamatos keresletének hátterében, amelyet pozitívan befolyásolnak a kelet-közép-európai régió szekuláris növekedési mozgatórugói. A közép-kelet-európai bérleti díjak továbbra is megfizethetőek; és a tapasztalt erős növekedés ellenére lényegesen alacsonyabb abszolút szintről indultak, mint a nyugat-európai országokban. Reálértéken a bérleti díjak sok kelet-közép-európai piacon még mindig a 2010-es szint alatt maradnak.

Az egy részvényre jutó EPRA nettó nyereség (NTA) 15,92 euróról 2023. december 31-re 18,08 euróra nőtt, ami 13,61%-os növekedést jelent 5T-ben. A növekedés főként az átértékelésnek (+1,98 euró) és a vállalatspecifikusan kiigazított EPRA részvényenkénti nyereségnek (+0,80 euró) köszönhető, amelyet részben ellensúlyozott a kifizetett osztalék (-0,57 euró).

Robusztus mérleg és erős likviditási pozíció

A proaktív és prudens megközelítéssel összhangban a Csoport szilárd likviditási pozícióval rendelkezik, amely lehetővé teszi növekedési törekvéseinek finanszírozását, fix adósságköltséggel és konzervatív törlesztési profillal.

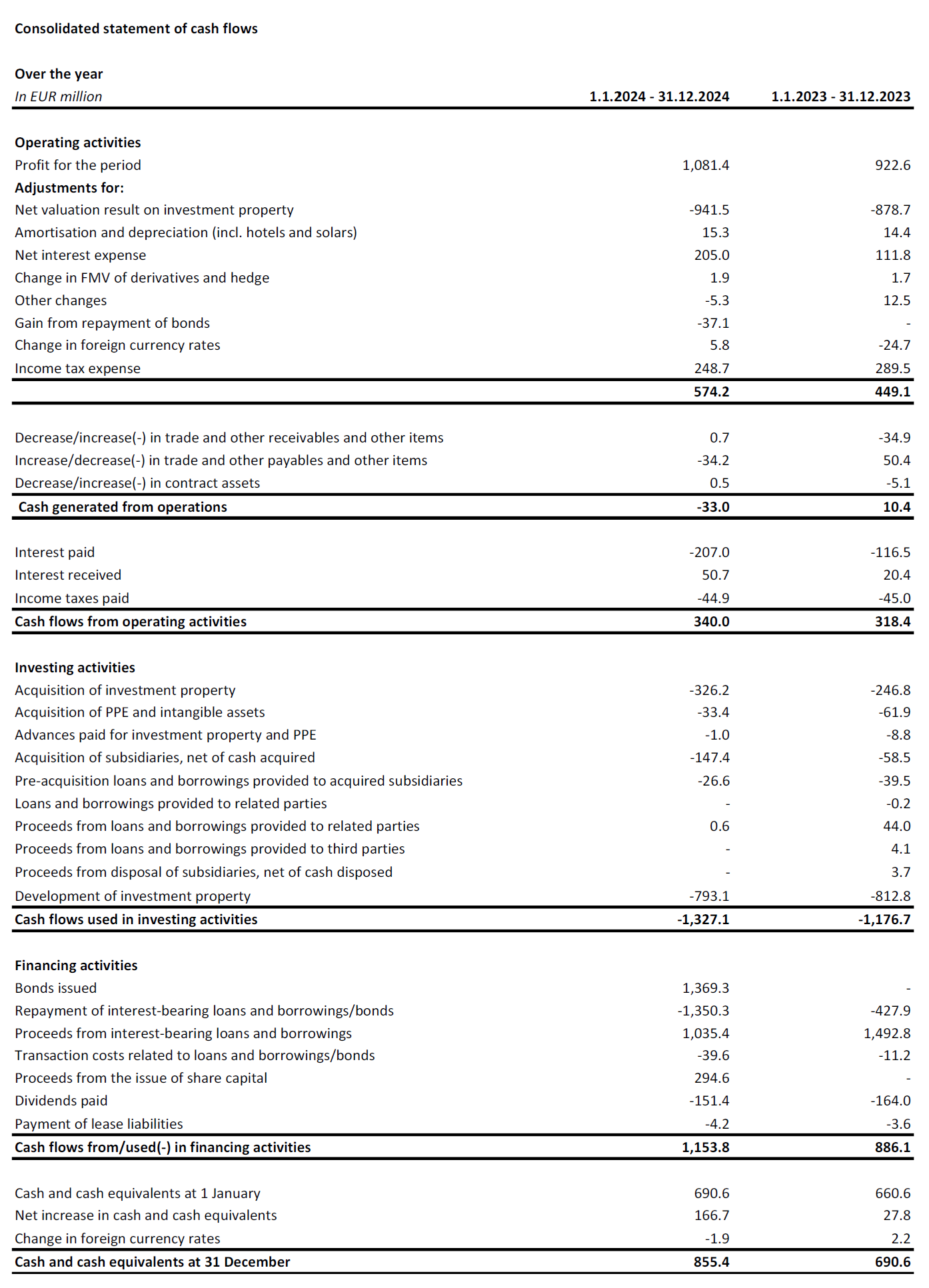

Az év során a Csoport 2,4 milliárd eurót gyűjtött össze:

- 100 millió eurós hatéves fedezett hitelkonstrukció olasz és cseh bankok szindikátusával, fix all-in költséggel 4,91 TP3T;

- 750 millió eurós hatéves zöld kötvény MS +220 bp-on 4,75% kamatszelvény mellett;

- 90 millió eurós, hét évre szóló fedezett hitelkeret egy osztrák banknál, fix összköltséggel 4,91 TP3T;

- 168 millió eurós hét évre biztosított hitelkonstrukció egy szlovák és osztrák bankok szindikátusával 5,11 TP3T fix all-in költséggel;

- A februárban kibocsátott hatéves zöld kötvény 75 millió eurós lehívása MS +171 bázisponttal;

- Egy 500 millió eurós, ötéves futamidejű, fedezetlen hitelkeret nemzetközi bankok szindikátusával, fix 4,7% összköltséggel;

- Egy 150 millió eurós, hétéves futamidejű, fedezettel biztosított hitelkeret, amelyet olasz és cseh bankok szindikátusával egészítettek ki, fix 4,35% összköltséggel;

- Egy 500 millió eurós, nyolcéves futamidejű zöld kötvény MS +173 bázispont kamattal és 3,875% kuponnal; és

- 50 millió eurós, ötéves futamidejű zöld kötvény MS +125 bázispont kamattal, 3,427% kuponnal.

Az év során a CTP három kötvényvásárlási ajánlatot is teljesített, 950 millió euró értékben vásárolt vissza rövid lejáratú kötvényeket, 37,1 millió euró tőkenyereséget realizált, csökkentette a 2025-ös és 2026-os adósságlejáratokat, és proaktívan meghosszabbította a lejárati profilját. Ahogy a kamatkülönbözetek csökkentek, a CTP 569,9 millió euró értékben tárgyalt lemarzscsökkentésről, és további 378,8 millió euró értékben fizetett vissza fedezettel biztosított bankhitelt.

A csoport likviditási pozíciója 2,2 milliárd euró volt, amely 0,9 milliárd euró készpénzből és készpénz-egyenértékesekből, valamint egy le nem hívott, 550 millió euróról 1,3 milliárd euróra megnövelt RCF-ből állt.

A CTP átlagos adósságköltsége 3,091 TP5T volt (2023. december 31.: 1,951 TP5T), amelyből 99,91 TP5T fix vagy fedezett volt a lejáratig. A Csoport nem aktiválja a fejlesztések kamatait, ezért minden kamatráfordítás szerepel az eredménykimutatásban. Az adósság átlagos futamideje 5,0 év volt (2023. december 31.: 5,3 év).

A Csoport első lényeges lejárata 272 millió euró[3] 2025 júniusában esedékes kötvény, amelyet a rendelkezésre álló készpénztartalékból törlesztenek.

A CTP LTV értéke 2024. december 31-én 45,3% volt, szemben a 2023. december 31-i 46,0%-vel, a 2024 szeptemberi tőkeemelésnek és az év végi átértékelésnek köszönhetően.

A Csoport magasabb hozamú eszközei a 6,6% bruttó portfólióhozamnak köszönhetően egészséges cash flow tőkeáttételt eredményeznek, ami a normalizált nettó adósság/EBITDA arányban is tükröződik, ami 9,1x (2023. december 31.: 9,2x), és amelyet a Csoport 10x alatt kíván tartani.

A Csoport 2024. december 31-én 641 TP5T fedezetlen és 361 TP5T biztosított adóssággal rendelkezett, bőséges mozgástérrel a fedezett adósságteszt és a tehermentes eszközök tesztjén alapuló kovenánsok keretében.

A kötvénypiaci árazás racionalizálódásával a feltételek immár versenyképesebbek, mint a banki hitelpiaci árazás, ami lehetővé teszi a Csoport számára, hogy jobban egyensúlyba kerüljön a fedezetlen hitelezés irányába.

| 2024. december 31. | Szövetség | |

| Biztosított adósságteszt | 16.9% | 40% |

| Tehermentes eszköz teszt | 193.2% | 125% |

| kamatfedezeti arány | 2,6x | 1.5x |

2024 harmadik negyedévében mind a Moody's, mind az S&P megerősítette a CTP Baa3, illetve BBB- hitelminősítését stabil kilátásokkal. 2025 januárjában a japán JCR hitelminősítő intézet A- hitelminősítést adott a CTP-nek stabil kilátásokkal.

Útmutatás

A bérleti dinamika továbbra is erős, a bérlők részéről erős a kereslet, és a csökkenő új kínálat folyamatos bérleti díj növekedést eredményez. A CTP jó helyzetben van ahhoz, hogy profitáljon ezekből a trendekből. A Csoport ingatlanportfóliója rendkívül nyereséges, és a bérlők vezérlik. A CTP ingatlanportfóliójának éves árbevétele 10,31 TP5T-re nőtt a csökkenő építési költségeknek és a bérleti díjak növekedésének köszönhetően. A növekedés következő szakasza beépült és finanszírozott, 2024. december 31-én 1,8 millió négyzetméter építés alatt állt, a cél pedig 2025-re 1,2-1,7 millió négyzetméter közötti átadása.

A CTP robusztus tőkeszerkezete, fegyelmezett pénzügyi politikája, erős hitelpiaci hozzáférése, piacvezető bankja, házon belüli építőipari szakértelme és mély bérlői kapcsolatai lehetővé teszik a CTP számára, hogy elérje céljait. A CTP várakozásai szerint 2027-ben eléri az 1,0 milliárd eurós bérbeadási bevételt a fejlesztések befejezésének, az indexálásnak és a visszaállításnak köszönhetően, és jó úton halad, hogy az évtized vége előtt elérje a 20 millió négyzetméter GLA-t és az 1,2 milliárd eurós bérleti bevételt.

A Csoport 2025-re 0,86–0,88 eurós, vállalatspecifikus korrigált EPRA EPS-t határoz meg. Ezt az erős mögöttes növekedésünk vezérli, körülbelül 4% összehasonlítható növekedéssel, amelyet részben ellensúlyoz a 2024-es és 2025-ös (re)finanszírozás miatti magasabb átlagos adósságköltség.

Osztalék

A CTP a 2024-es végleges osztalékot törzsrészvényenként 0,30 euróban javasolja, amelyet a közgyűlés jóváhagyásától függően 2025. május 15-én fizetnek ki. Ezáltal a teljes 2024-es osztalék törzsrészvényenként 0,59 euróra emelkedik, ami 74% vállalatspecifikus, korrigált EPRA EPS kifizetést jelent – összhangban a Csoport 70%-80% osztalékpolitikájával –, és 12,4% növekedést a 2023-as évhez képest.

Az alapértelmezett osztalék csekély, de a részvényesek választhatják az osztalék készpénzben történő kifizetését.

WEBCAST ÉS KONFERENCIAHÍVÁS ELEMZŐK ÉS BEFEKTETŐK SZÁMÁRA

A vállalat ma 12:00 (GMT) és 13:00 (CET) órakor videó prezentációt és kérdéseket feltenni kívánó ülést tart elemzők és befektetők számára élő webcast és audiokonferencia-hívás formájában.

Az élő webcast megtekintéséhez kérjük, regisztráljon a következő címen:

https://www.investis-live.com/ctp/678e4096cddd8c000f42d182/mabgk

Ha telefonon szeretne csatlakozni az előadáshoz, kérjük, tárcsázza az alábbi számok egyikét, és adja meg a résztvevői hozzáférési kódot 527498.

Németország +49 32 22109 8334

Franciaország +33 9 70 73 39 58

Hollandia +31 85 888 7233

Egyesült Királyság +44 20 3936 2999

Egyesült Államok +1 646 233 4753

Nyomja meg a *1-et a kérdés feltevéséhez, a *2-t a kérdés visszavonásához, vagy a *0-t a kezelői segítséghez.

Az előadásról készült felvétel az előadást követő 24 órán belül elérhető lesz a CTP honlapján: https://www.ctp.eu/investors/financial-reports/

CTP PÉNZÜGYI NAPTÁR

| Akció | Dátum |

| Éves közgyűlés | 2025. április 22 |

| Q1-2025 eredmények | 2025. május 8 |

| H1-2025 eredmények | 2025. augusztus 7 |

| Tőkepiaci Napok (Wuppertal, Németország) | 2025. szeptember 24-25 |

| Q3-2025 eredmények | 2025. november 6 |

AZ ELEMZŐI ÉS BEFEKTETŐI MEGKERESÉSEK ELÉRHETŐSÉGEI:

Maarten Otte, Befektetői kapcsolatok vezetője

Mobil: +420 730 197 500

E-mail: [email protected]

ELÉRHETŐSÉGEK A MÉDIA MEGKERESÉSÉRE:

Patryk Statkiewicz, a csoport marketing és PR vezetője

Mobil: +31 (0) 629 596 119

E-mail: [email protected]

A CTP-ről

A CTP Európa legnagyobb tőzsdén jegyzett logisztikai és ipari ingatlan tulajdonosa, fejlesztője és kezelője bruttó bérbeadható terület alapján, 2024. december 31-én 10 országban 13,3 millió négyzetméter bérbeadható területet birtokolva. A CTP minden új épületet BREEAM Very good vagy jobb minősítéssel lát el, és a Sustainalytics elhanyagolható kockázatú ESG minősítést kapott, kiemelve elkötelezettségét a fenntartható vállalkozás iránt. További információkért látogasson el a CTP vállalati weboldalára: www.ctp.eu

Felelősségi nyilatkozat

A törvény által előírt könyvvizsgálók általi ellenőrzési eljárások folyamatban vannak.

Ez a közlemény bizonyos, a jövőre vonatkozó kijelentéseket tartalmaz a CTP pénzügyi helyzetével, működési eredményeivel és üzleti tevékenységével kapcsolatban. Ezek a jövőre vonatkozó kijelentések azonosíthatók a jövőre vonatkozó terminológia használatával, beleértve a "úgy véli", "becslések", "tervez", "tervez", "tervez", "előrevetít", "várakozik", "szándékozik", "céloz", "lehet", "céloz", "valószínű", "lenne", "lehetne", "lehet", "lehet", "lesz" vagy "kellene" kifejezéseket, illetve minden esetben ezek negatív vagy más változatait vagy hasonló terminológiát. A jövőre vonatkozó kijelentések jelentősen eltérhetnek a tényleges eredményektől, és ez gyakran így is van. Ennek eredményeképpen nem szabad túlzott befolyást gyakorolni egyetlen jövőre vonatkozó kijelentésre sem. Ez a sajtóközlemény a 2014. április 16-i 596/2014/EU rendelet (a piaci visszaélésekről szóló rendelet) 7. cikkének (1) bekezdésében meghatározott bennfentes információkat tartalmaz.

[1] Nem auditált

[2] Helyi és EU-27 / eurózóna fogyasztói árindex keverékével, csak korlátozott számú felső határ.

[3] A pályázati ajánlat 2024. június 28-i elszámolását követően fennálló összeg.

Iratkozz fel a hírlevelünkre

Iratkozz fel hírlevelünkre, hogy megkapd az ipariingatlan-piac vezetőjének legfrissebb elemzéseit.