A CTP N.V. 2025. első negyedéves eredményei

CTP REPORTS STRONG acceleration of leasing activity in Q1-2025 (+24%) and like-for-like rental growth of 4.2%; EPRA NTA per share up to €18.58

AMSTERDAM, 8 May 2025 – CTP N.V. (CTPNV.AS), (“CTP”, the “Group” or the “Company”) recorded in Q1-2025 Gross Rental Income of €182.5 million, up 15.9% y-o-y, and like-for-like y-o-y rental growth of 4.2%, mainly driven by indexation and reversion on renegotiations and expiring leases. Leasing accelerated in the first quarter with 24% more leases signed y-o-y. The average monthly rent on the new leases signed increased by 3% y-o-y[1].

As at 31 March 2025, the annualised rental income came to €748 million, while occupancy remained at 93% and the rent collection rate was 99.7%.

In the first quarter, CTP delivered 95,000 sqm at a Yield on Cost (“YoC”) of 10.0% with 100% let at completion, bringing the Group’s standing portfolio to 13.4 million sqm of GLA, while the Gross Asset Value (“GAV”) increased by 2.3% to €16.3 billion, and 16.7% y-o-y. EPRA NTA per share increased by 2.8% in Q1 to €18.58 and 12.6% y-o-y.

Company specific adjusted EPRA earnings increased by 12.9% y-o-y to €98.7 million. CTP’s Company-specific adjusted EPRA EPS amounted to €0.21, an increase of 6.9%, on track to reach the guidance. The Group confirms its €0.86 – €0.88 Company-specific adjusted EPRA EPS guidance for 2025, which represents a 8 – 10% growth compared to 2024.

As at 31 March 2025, projects under construction totalled 1.9 million sqm, with a potential rental income of €148 million when fully leased and an expected YoC of 10.3%.

The Group’s landbank amounted to 26.4 million sqm, of which 21.9 million sqm is owned and on-balance sheet. This landbank secures substantial future growth potential for CTP, mostly around the existing business parks. Combined with its industry-leading YoC, CTP expects to continue to generate double-digit NTA growth in the years to come.

The US trade tariffs drive further nearshoring, with companies producing in Europe for Europe, while export from the CEE region to the US is limited. Especially Asian companies are also looking for alternative end markets, Europe, which is around 25% of the world’s GDP, is an attractive location for them.

As the CEE region offers the best-cost location in Europe, we benefit particularly from the nearshoring trend, which is shown by the growth with Asian manufacturing tenants, who made up around 20% of our overall leasing activity in the last 12 months, compared to an over 10% share of our overall portfolio.”

The annualised rental income amounted to €748 million, illustrating the strong cash flow generation of our standing portfolio with a rent collection rate of 99.7%. While the next growth phase is already locked in with our 1.9 million sqm of GLA under construction and a landbank of over 26.4 million sqm, we will continue to generate double-digit NTA growth over the next years. In addition to the pre-letting for the current pipeline, we have another 75,000 sqm of leases signed for future projects, on which we plan to start construction shortly.

Főbb jellemzők

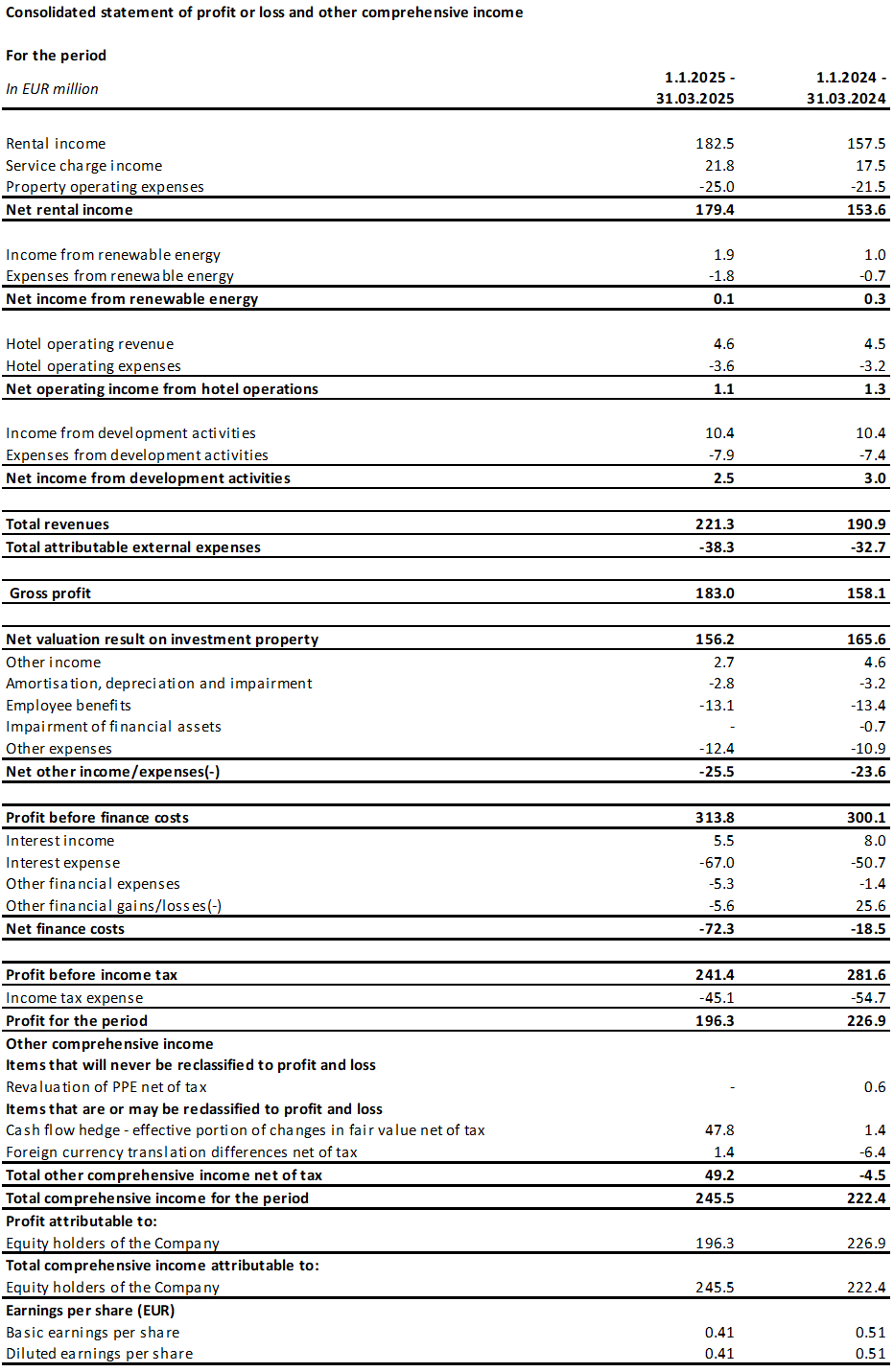

| Millió euróban | 2025 első negyedévére | Q1-2024 | % változás |

| bérbeadásból származó bruttó bevétel | 182.5 | 157.5 | +15.9% |

| Nettó bérleti bevétel | 179.4 | 153.6 | +16.8% |

| Befektetési célú ingatlanok nettó értékelési eredménye | 156.2 | 165.6 | -5.6% |

| Az időszak nyeresége | 196.3 | 226.9 | -13.5% |

| Vállalatspecifikus korrigált EPRA eredmény | 98.7 | 87.4 | +12.9% |

| €-ban | 2025 első negyedévére | Q1-2024 | % változás |

| Vállalatspecifikus korrigált EPRA EPS | 0.21 | 0.20 | +6.9% |

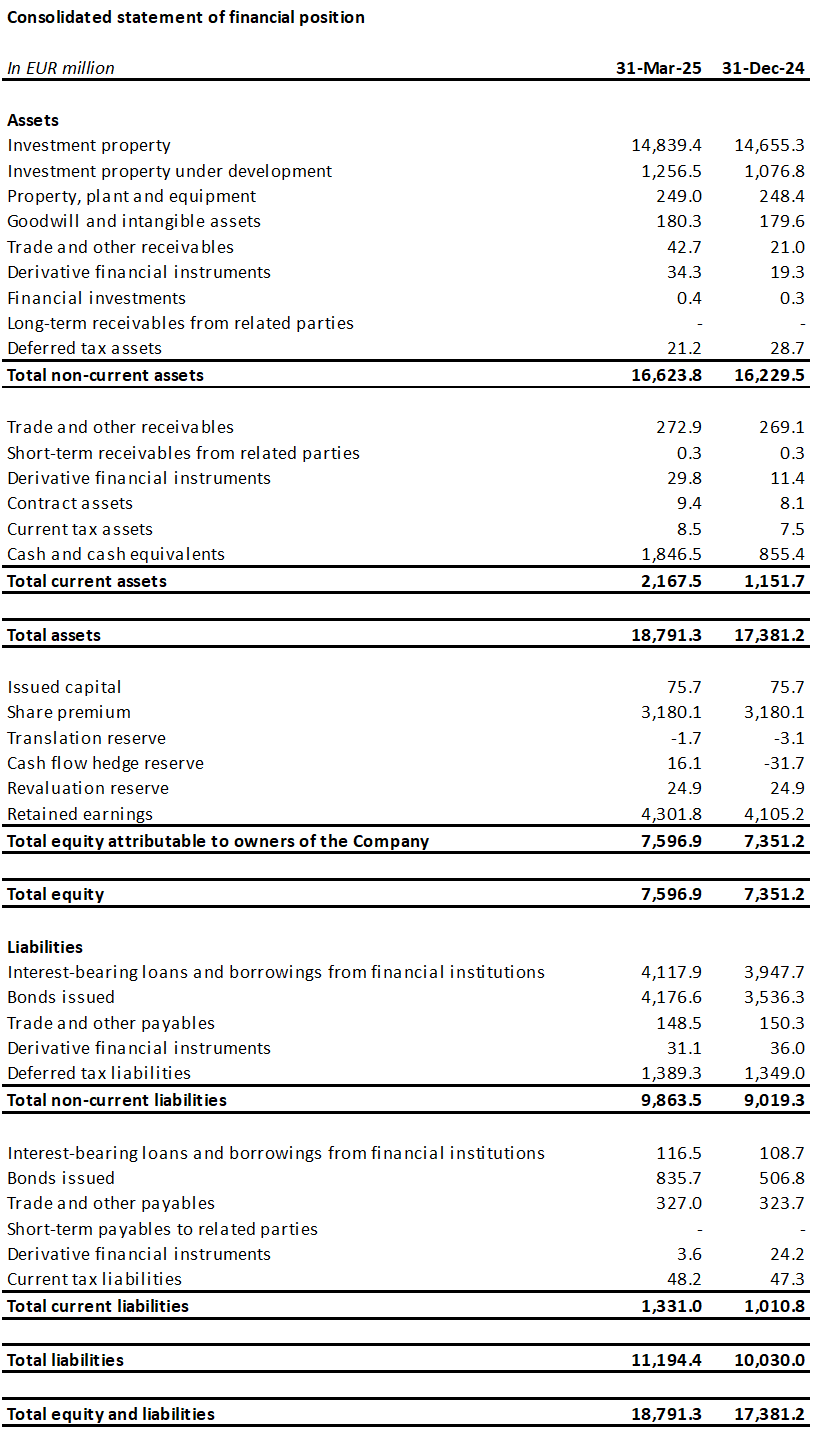

| Millió euróban | 31 March 2025 | 2024. december 31. | % változás |

| Befektetési célú ingatlanok ("IP") | 14,839.4 | 14,655.3 | +1.3% |

| Fejlesztés alatt álló befektetési célú ingatlanok ("IPuD") | 1,256.5 | 1,076.8 | +16.7% |

| 31 March 2025 | 2024. december 31. | % változás | |

| EPRA NTA részvényenként | €18.58 | €18.08 | +2.8% |

| Az építés alatt álló projektek várható teljesítési ideje | 10.3% | 10.3% | |

| LTV | 45.3% | 45.3% |

A továbbra is erős bérlői kereslet ösztönzi a bérleti díjak növekedését

In Q1-2025, CTP signed leases for 416,000 sqm, an increase of 24% compared to the same period in 2024, with an average monthly rent per sqm of €6.17 (Q1-2024: €5.65). Adjusting for the differences among the country mix, rents increased on average by 3%.

| Aláírt bérleti szerződések négyzetméterenként | Q1 | Q2 | Q3 | Q4 | FY |

| 2023 | 297,000 | 552,000 | 585,000 | 542,000 | 1,976,000 |

| 2024 | 336,000 | 582,000 | 577,000 | 618,000 | 2,113,000 |

| 2025 | 416,000 | ||||

| Éves növekedés | +24% |

| Átlagos havi bérleti díjak négyzetméterenként (€) | Q1 | Q2 | Q3 | Q4 | FY |

| 2023 | 5.31 | 5.56 | 5.77 | 5.81 | 5.69 |

| 2024 | 5.65 | 5.55 | 5.69 | 5.79 | 5.68 |

| 2025 | 6.17 |

A bérleti szerződések körülbelül kétharmadát meglévő bérlőkkel kötötték, összhangban a CTP üzleti modelljével, amely a meglévő parkokban a meglévő bérlőkkel együtt növekszik.

Cashflow generálás állandó portfólión és felvásárlásokon keresztül

CTP’s average market share in the Czech Republic, Romania, Hungary, and Slovakia came to 28.6% as at 31 March 2025 and it remains the largest owner and developer of industrial and logistics real estate assets in those markets. The Group is also the market leader in Serbia and Bulgaria.

With more than 1,500 clients, CTP has a wide and diversified international tenant base, consisting of blue-chip companies with strong credit ratings. CTP’s tenants represent a broad range of industries, including manufacturing, high-tech/IT, automotive, e-commerce, retail, wholesale, and 3PLs. The tenant base is highly diversified, with no single tenant accounting for more than 2.5% of the Company’s annual rent roll, which leads to a stable income stream. CTP’s top 50 tenants only account for 34.1% of its rent roll and most rent space in multiple CTParks.

The Company’s occupancy came to 93% (FY-2024: 93%). The Group’s client retention rate remains strong at 86% (FY-2024: 87%) and demonstrates CTP’s ability to leverage long-standing client relationships. The portfolio WAULT stood at 6.5 years (FY-2024: 6.4 years), in line with the Company’s target of >6 years.

Rent collection level stood at 99.7% in Q1-2025 (FY-2024: 99.8%), with no deterioration in the payment profile of tenants.

Rental income in Q1-2025 amounted to €182.5 million, up 15.9% y-o-y on an absolute basis, mainly driven by deliveries and like-for-like growth. On a like-for-like basis, rental income grew 4.2%, thanks to indexation and reversion on renegotiations and expiring leases.

The Group has put measures in place to limit service charge leakage, which resulted in the improvement of the Net Rental Income to Rental Income ratio from 97.5% in Q1-2024 to 98.3% in Q1-2025. Consequently, the Net Rental Income increased 16.8% y-o-y.

An increasing proportion of the rental income generated by CTP’s investment portfolio benefits from inflation protection. Since end-2019, all the Group’s new lease agreements include a CPI linked indexation clause, which calculates annual rental increases as the higher of:

- évi 1,5%-2,5% fix emelés; vagy

- a fogyasztói árindex[2].

As at 31 March 2025, 72% of income generated by the Group’s portfolio includes this double indexation clause, and the Group expects this to increase further.

The reversionary potential stayed stable at 14.4%. New leases have been signed continuously above the Estimated Rental Value (“ERV”), illustrating continued strong market rental growth and supporting valuations.

The annualised rental income came to €748 million as at 31 March 2025, an increase of 14.2% y-o-y, showcasing the strong cash flow growth of CTP’s investment portfolio.

Q1 developments delivered with a 10.0% YoC and 100% let at delivery

A CTP folytatta fegyelmezett beruházásait a rendkívül jövedelmező csővezetékébe.

In Q1-2025, the Group completed 95,000 sqm of GLA (Q1-2024: 169,000 sqm). The developments were delivered at a YoC of 10.0%, 100% let and will generate contracted annual rental income of €5.9 million. As usual the deliveries in 2025, are skewed to the fourth quarter.

While average construction costs in 2022 were around €550 per sqm, in 2023 and 2024 they came to €500 per sqm and remained stable in Q1-2025. This allows the Group to continue to deliver its industry-leading YoC above 10%, which is also supported by CTP’s unique park model and in-house construction and procurement expertise.

As at 31 March 2025, the Group had 1.9 million sqm of buildings under construction with a potential rental income of €148 million and an expected YoC of 10.3%. CTP has a long track record of delivering sustainable growth through its tenant-led development in its existing parks. 78% of the Group’s projects under construction are in existing parks, while 9% are in new parks which have the potential to be developed to more than 100,000 sqm of GLA. Planned 2025 deliveries are 42% pre-let, up from 35% as at FY-2024. CTP expects to reach 80%-90% pre-letting at delivery, in line with historical performance. As CTP acts as general contractor in most markets, it is fully in control of the process and timing of deliveries, allowing the Company to speed-up or slow-down depending on tenant demand, while also offering tenants flexibility in terms of their building requirements.

In 2025 the Group is expecting to deliver between 1.2 – 1.7 million sqm, depending on tenant demand. The 75,000 sqm of leases that are already signed for future projects—construction of which hasn’t started yet—are a further illustration of continued occupier demand.

CTP’s landbank amounted to 26.4 million sqm as at 31 March 2025 (31 December 2024: 26.4 million sqm), which allows the Company to reach its target of 20 million sqm GLA by the end of the decade. The Group is focusing on mobilising the existing landbank, while maintaining disciplined capital allocation in landbank replenishment. 58% of the landbank is located within CTP’s existing parks, while 31% is in, or is adjacent to, new parks which have the potential to grow to more than 100,000 sqm. 17% of the landbank was secured by options, while the remaining 83% was owned and accordingly reflected in the balance sheet.

Assuming a build-up ratio of 2 sqm of land to 1 sqm of GLA, CTP can build over 13 million sqm of GLA on its secured landbank. CTP’s land is held on balance sheet at around €60 per sqm and construction costs amount on average to approximately €500 per sqm, bringing total investment costs to approximately €620 per sqm. The Group’s standing portfolio, excluding the older former Deutsche Industrie REIT portfolio, is valued around €1,030 per sqm, resulting in a revaluation potential of around €400 per sqm.

Az energiaüzlet monetizálása

A CTP folytatja a fotovoltaikus rendszerek kiépítésére vonatkozó bővítési tervét. A csoport átlagosan ~750 000 €/MWp költséggel 15% YoC-t céloz meg ezekre a beruházásokra.

CTP has an installed PV capacity of 138 MWp, of which 80 MWp is fully operational.

In Q1-2025 the revenues from renewable energy came to €1.9 million, up 104% y-o-y mainly driven by the increase in capacity installed throughout 2024.

A CTP fenntarthatósági törekvései együtt járnak azzal, hogy egyre több bérlő kéri a fotovoltaikus rendszereket, mivel azok i) nagyobb energiabiztonságot, ii) alacsonyabb lakhatási költségeket, iii) a fokozott szabályozásnak való megfelelést, iv) az ügyfelek követelményeinek való megfelelést és v) saját ESG ambícióik teljesítésének lehetőségét biztosítják számukra.

Az értékelési eredményeket a folyamatban lévő portfólió pozitív átértékelése és a folyamatban lévő értékesítési folyamat vezérelte

Investment Property (“IP”) valuation increased from €14.7 billion as at 31 December 2024 to €14.8 billion as at 31 March 2025, driven mainly by the transfer of completed projects from Investment Property under Development (“IPuD”) to IP.

IPuD increased by 16.7% from 31 December 2024 to €1.3 billion as at 31 March 2025, driven by the CAPEX spent, the revaluation due to increase pre-letting and construction progress, and the start of new construction projects in Q1-2025.

GAV increased to €16.3 billion as at 31 March 2025, up 2.3% compared to 31 December 2024.

Revaluation in Q1-2025 came to €156.2 million, driven by the revaluation of IPuD projects.

The Group’s portfolio has conservative valuation yields of 7.1%. CTP saw the first yield compression during the second half of 2024 and CTP expects further yield compression over the course of 2025. The yield differential between CEE and Western European logistics is expected to decrease over time, driven by the higher growth expectations for the CEE region and increasing activity in the investment markets.

CTP expects further positive ERV growth on the back of continued tenant demand, which is positively impacted by the secular growth drivers in the CEE region. CEE rental levels remain affordable; despite the strong growth seen as they have started from significantly lower absolute levels than in Western European countries. In real terms, rents in many CEE markets are still below 2010 levels.

EPRA NTA per share increased from €18.08 as at 31 December 2024 to €18.58 as at 31 March 2025, representing an y-o-y increase of 12.6% and q-o-q increase of 2.8%. The increase is mainly driven by the revaluation (+€0.33) and Company specific adjusted EPRA EPS (+€0.21).

Robusztus mérleg és erős likviditási pozíció

A proaktív és prudens megközelítéssel összhangban a Csoport szilárd likviditási pozícióval rendelkezik, amely lehetővé teszi növekedési törekvéseinek finanszírozását, fix adósságköltséggel és konzervatív törlesztési profillal.

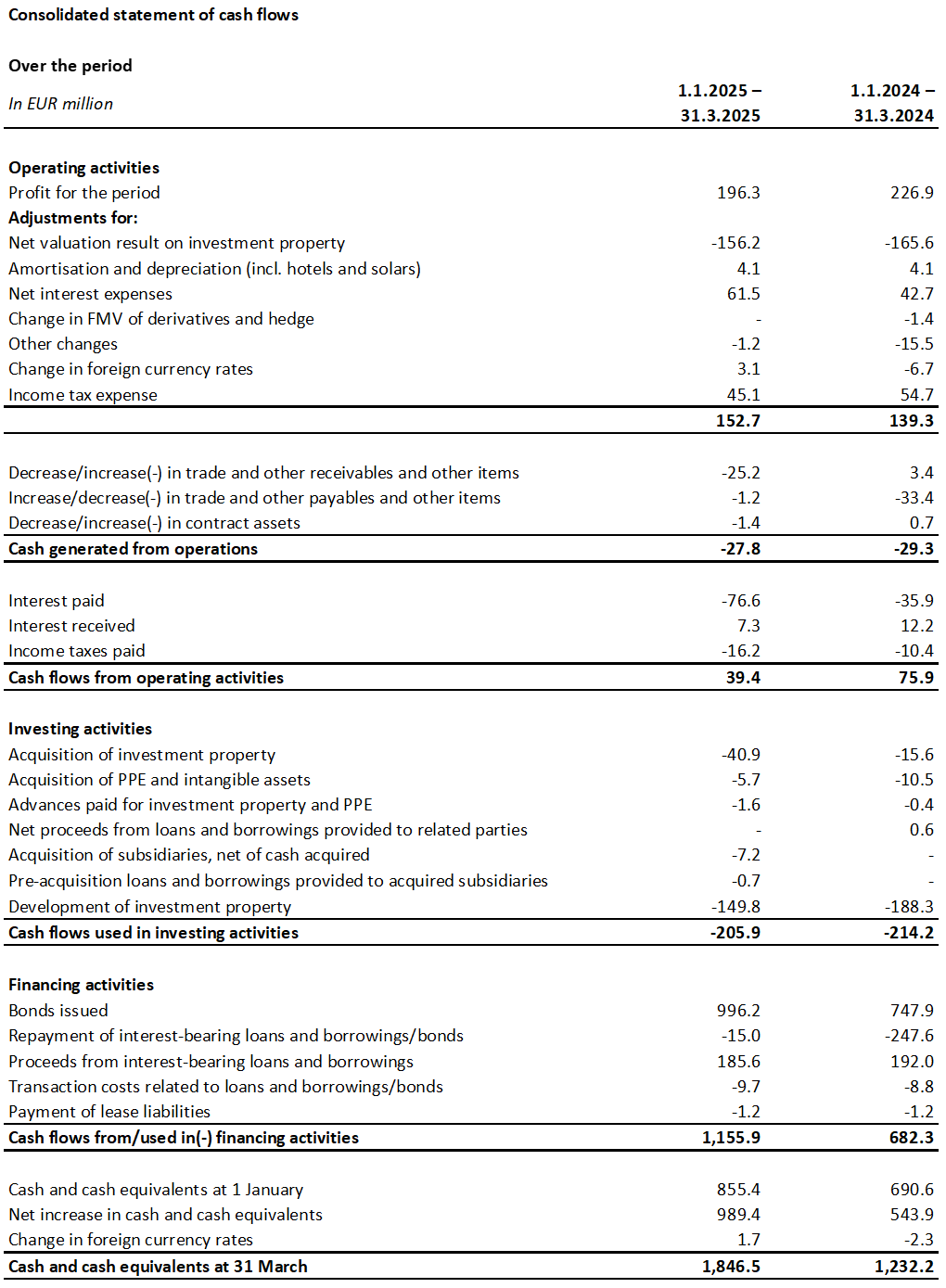

During Q1-2025, the Group raised €1.2 billion:

- A €1.0 billion dual-tranche green bond with a €500 million six-year tranche at MS +145bps at a coupon of 3.625% and a €500 million ten-year tranche at MS +188bps at a coupon of 4.25%; and

- A JPY30 billion (€185 million equivalent) five-year unsecured loan facility with a syndicate of Asian banks at TONAR +130bps and fixed all-in cost of 4.1%.

The inaugural Samurai loan further contributes to our objective of further funding diversification.

CTP continued to actively manage its bank loan portfolio in Q1-2025 and negotiated margin reductions on a further €159 million of secured bank loans.

The Group’s liquidity position stood at €3.1 billion, comprised of €1.8 billion of cash and cash equivalents, and an undrawn RCF of €1.3 billion.

CTP’s average cost of debt stood at 2.94% (FY-2024: 3.09%), slightly down compared to year-end 2024, due to margin reductions that were negotiated on a large part of the secured loans in Q4-2024. 99.9% of the debt is fixed rate or hedged until maturity.

The Group doesn’t capitalise interest on developments, therefore all interest expenses are included in the P&L. The average debt maturity came to 5.1 years (FY-2024: 5.0 years).

The Group’s first material upcoming maturity is a €272 million bond due in June 2025, which will be repaid from available cash reserves.

CTP’s LTV remained at 45.3% as at 31 March 2025 stable from 31 December 2024.

The Group’s higher yielding assets, thanks to their gross portfolio yield of 6.6%, lead to a healthy level of cash flow leverage that is also reflected in the normalized Net Debt to EBITDA of 9.1x (FY-2024: 9.1x), which the Group targets to keep below 10x.

The Group had 68% unsecured debt and 32% secured debt as at 31 March 2025, with ample headroom under its Secured Debt Test and Unencumbered Asset Test covenants.

A kötvénypiaci árazás racionalizálódásával a feltételek immár versenyképesebbek, mint a banki hitelpiaci árazás, ami lehetővé teszi a Csoport számára, hogy jobban egyensúlyba kerüljön a fedezetlen hitelezés irányába.

| 31 March 2025 | Szövetség | |

| Biztosított adósságteszt | 15.6% | 40% |

| Tehermentes eszköz teszt | 179.6% | 125% |

| kamatfedezeti arány | 2,5-szeres | 1.5x |

2024 harmadik negyedévében mind a Moody's, mind az S&P megerősítette a CTP Baa3, illetve BBB- hitelminősítését stabil kilátásokkal. 2025 januárjában a japán JCR hitelminősítő intézet A- hitelminősítést adott a CTP-nek stabil kilátásokkal.

Útmutatás

Leasing dynamics remain strong, with robust occupier demand, and decreasing new supply leading to continued rental growth. CTP is well positioned to benefit from these trends. The Group’s pipeline is highly profitable, and tenant led. The YoC for CTP’s current pipeline remained at industry leading 10.3%. The next stage of growth is built in and financed, with 1.9 million sqm under construction as at 31 March 2025, with a target to deliver between 1.2 – 1.7 million sqm in 2025.

CTP’s robust capital structure, disciplined financial policy, strong credit market access, industry-leading landbank, in-house construction expertise and deep tenant relationships allow CTP to deliver on its targets. CTP expects to reach €1.0 billion rental income in 2027, driven by development completions, indexation and reversion, and is on track to reach 20 million sqm of GLA and €1.2 billion rental income before the end of the decade.

A Csoport 2025-re 0,86–0,88 eurós, vállalatspecifikus korrigált EPRA EPS-t határoz meg. Ezt az erős mögöttes növekedésünk vezérli, körülbelül 4% összehasonlítható növekedéssel, amelyet részben ellensúlyoz a 2024-es és 2025-ös (re)finanszírozás miatti magasabb átlagos adósságköltség.

Osztalék

The AGM approved a final dividend of €0.30 per ordinary share for the financial year 2024, which will be paid on 15 May 2025. This will bring the total 2024 dividend to €0.59 per ordinary share, which represents a Company specific adjusted EPRA EPS pay-out of 74% – in line with the Groups’ dividend policy to pay-out 70%-80% – and growth of 12.4% compared to 2023.

Az alapértelmezett osztalék csekély, de a részvényesek választhatják az osztalék készpénzben történő kifizetését.

WEBCAST ÉS KONFERENCIAHÍVÁS ELEMZŐK ÉS BEFEKTETŐK SZÁMÁRA

Ma 9 órakor (GMT) és 10 órakor (CET) a vállalat élő internetes közvetítés és hangos konferenciahívás keretében videóbemutatót és kérdezz-feleleket tart az elemzők és befektetők számára.

Az élő webcast megtekintéséhez kérjük, regisztráljon a következő címen:

https://www.investis-live.com/ctp/67ebaefa0a60c3001548a1b7/perfa

Ha telefonon szeretne csatlakozni az előadáshoz, kérjük, tárcsázza az alábbi számok egyikét, és adja meg a résztvevői hozzáférési kódot 3639182025.

Németország +49 32 22109 8334

Franciaország +33 9 70 73 39 58

Hollandia +31 85 888 7233

Egyesült Királyság +44 20 3936 2999

Egyesült Államok +1 646 233 4753

Nyomja meg a *1-et a kérdés feltevéséhez, a *2-t a kérdés visszavonásához, vagy a *0-t a kezelői segítséghez.

Az előadásról készült felvétel az előadást követő 24 órán belül elérhető lesz a CTP honlapján: https://ctp.eu/investors/financial-results/

CTP PÉNZÜGYI NAPTÁR

| Akció | Dátum |

| H1-2025 eredmények | 2025. augusztus 7 |

| Tőkepiaci Napok (Wuppertal, Németország) | 2025. szeptember 24-25 |

| Q3-2025 eredmények | 2025. november 6 |

| 2025-ös pénzügyi év eredményei | 2026. február 26. |

AZ ELEMZŐI ÉS BEFEKTETŐI MEGKERESÉSEK ELÉRHETŐSÉGEI:

Maarten Otte, Befektetői kapcsolatok vezetője

Mobil: +420 730 197 500

E-mail: maarten.otte@ctp.eu

ELÉRHETŐSÉGEK A MÉDIA MEGKERESÉSÉRE:

Patryk Statkiewicz, a csoport marketing és PR vezetője

Mobil: +31 (0) 629 596 119

E-mail: patryk.statkiewicz@ctp.eu

A CTP-ről

A CTP Európa legnagyobb tőzsdén jegyzett logisztikai és ipari ingatlan tulajdonosa, fejlesztője és kezelője bruttó bérbeadható terület alapján, 2025. március 31-én 10 országban 13,4 millió négyzetméter bérbeadható területet birtokolva. A CTP minden új épületet BREEAM Very good vagy jobb minősítéssel lát el, és a Sustainalytics elhanyagolható kockázatú ESG minősítést kapott, kiemelve elkötelezettségét a fenntartható vállalkozás iránt. További információkért látogasson el a CTP vállalati weboldalára: www.ctp.eu

Felelősségi nyilatkozat

Ez a közlemény bizonyos, a jövőre vonatkozó kijelentéseket tartalmaz a CTP pénzügyi helyzetével, működési eredményeivel és üzleti tevékenységével kapcsolatban. Ezek a jövőre vonatkozó kijelentések azonosíthatók a jövőre vonatkozó terminológia használatával, beleértve a "úgy véli", "becslések", "tervez", "tervez", "tervez", "előrevetít", "várakozik", "szándékozik", "céloz", "lehet", "céloz", "valószínű", "lenne", "lehetne", "lehet", "lehet", "lesz" vagy "kellene" kifejezéseket, illetve minden esetben ezek negatív vagy más változatait vagy hasonló terminológiát. A jövőre vonatkozó kijelentések jelentősen eltérhetnek a tényleges eredményektől, és ez gyakran így is van. Ennek eredményeképpen nem szabad túlzott befolyást gyakorolni egyetlen jövőre vonatkozó kijelentésre sem. Ez a sajtóközlemény a 2014. április 16-i 596/2014/EU rendelet (a piaci visszaélésekről szóló rendelet) 7. cikkének (1) bekezdésében meghatározott bennfentes információkat tartalmaz.

[1] Adjusted for a country mix.

[2] Helyi és EU-27 / eurózóna fogyasztói árindex keverékével, csak korlátozott számú felső határ.

Iratkozz fel a hírlevelünkre

Iratkozz fel hírlevelünkre, hogy megkapd az ipariingatlan-piac vezetőjének legfrissebb elemzéseit.