Risultati dell'esercizio finanziario 2024 di CTP N.V.

CTP REPORTS RECORD PROFIT OF €1.1 BILLION NET RENTAL INCOME UP 19.0% YOY, COMPANY SPECIFIC ADJUSTED EPRA EPS OF €0.80 AND EPRA NTA PER SHARE UP 13.6% TO €18.08

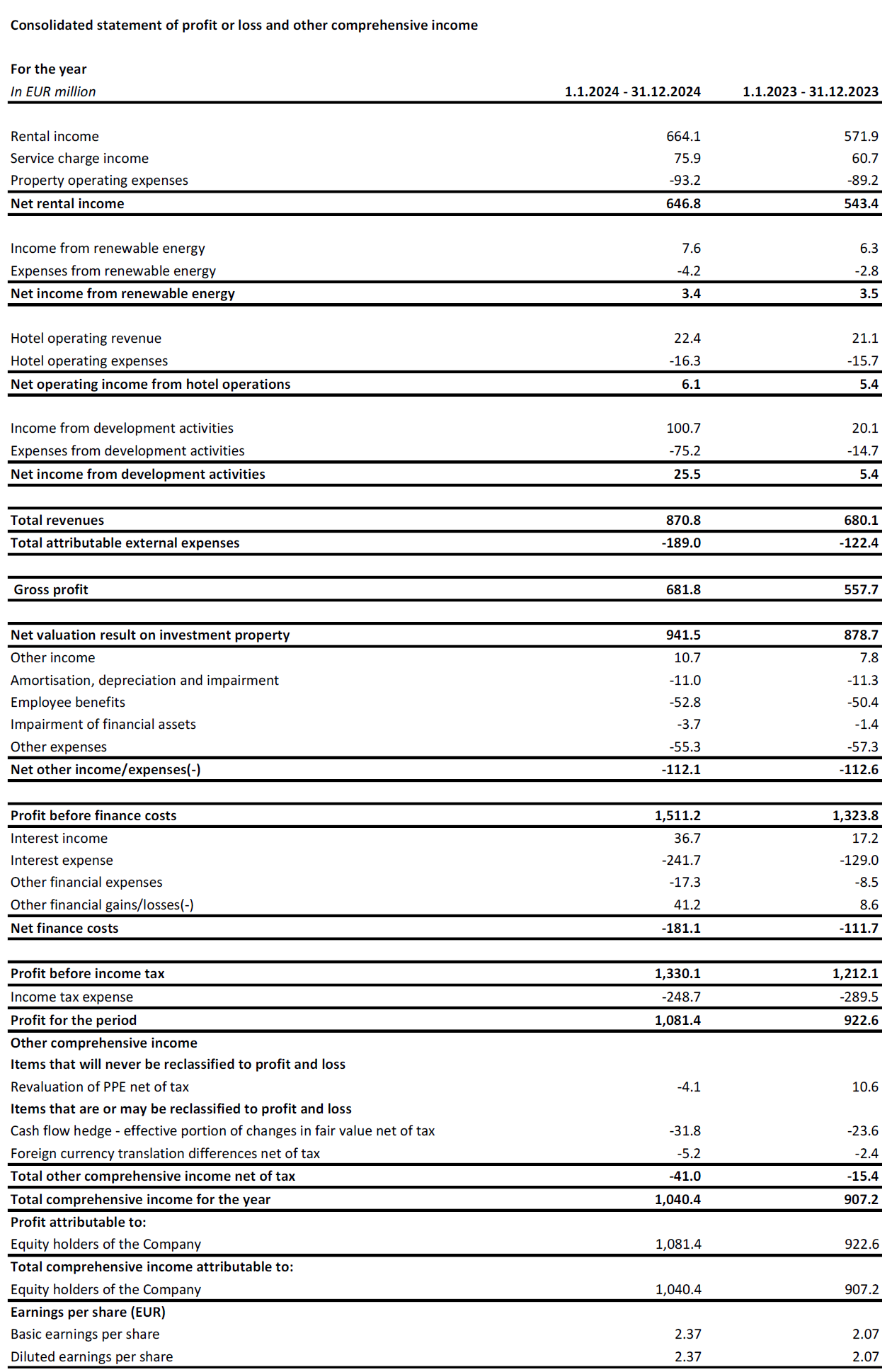

AMSTERDAM, 27 February 2025 – CTP N.V. (CTPNV.AS), (“CTP”, the “Group” or the “Company”) recorded Gross Rental Income of €664.1 million in the year, up 16.1% y-o-y, and like-for-like y-o-y rental growth of 4.0%, mainly driven by indexation and reversion on renegotiations and expiring leases. As at 31 December 2024, the annualised rental income came to €742.6 million and occupancy came to 93%.

In 2024, CTP delivered 1,286,000 sqm at a Yield on Cost (“YoC”) of 10.1% with 92% let at completion, bringing the Group’s standing portfolio to 13.3 million sqm of GLA, while the Gross Asset Value (“GAV”) increased by 17.2% to €16.0 billion. EPRA NTA per share increased by 13.6% to €18.08.

Company specific adjusted EPRA earnings increased by 12.5% y-o-y to €364.0 million. CTP’s Company-specific adjusted EPRA EPS amounted to €0.80, an increase of 9.9%, in line with guidance. The Group sets a €0.86 – €0.88 Company-specific adjusted EPRA EPS guidance for 2025.

As at 31 December 2024, projects under construction totalled 1.8 million sqm, with a potential rental income of €142 million when fully leased and an expected YoC of 10.3%.

The Group’s landbank increased to 26.4 million sqm, of which 21.7 million sqm is owned and on-balance sheet. This landbank secures substantial future growth potential for CTP, mostly around the existing business parks. Combined with its industry-leading YoC, CTP expects to continue to generate double-digit NTA growth in the years to come.

During 2024, CTP also successfully completed its first accelerated bookbuild – several times oversubscribed – after the IPO, raising €300 million of equity, giving the firepower to accelerate developments and do acquisitions, like the 830,000 sqm brownfield redevelopment down-town Dusseldorf.

The annualised rental income amounted to €743 million, illustrating the strong cash flow generation of our standing portfolio with a rent collection rate of 99.8%. While the next growth phase is already locked in with our 1.8 million sqm of GLA under construction and a landbank of over 26.4 million sqm, we will continue to generate double-digit NTA growth. In addition to the pre-letting for the current pipeline, we have another 80,000 sqm of leases signed for future projects, which we plan to start shortly.

Demand for industrial and logistics real estate in the CEE region is driven by structural demand drivers, such as the professionalisation of supply chains by 3PLs, ongoing growth in e-commerce, and occupiers nearshoring and friend-shoring. As the CEE region offers the best-cost location in Europe, we benefit particularly from the nearshoring trend, which is shown by the growth with Asian manufacturing tenants producing in Europe for Europe, who made up around 20% of our overall leasing activity in 2024, compared to a 10% share of our overall portfolio.”

Punti salienti[1]

| In milioni di € | 2024 | 2023 | % modifica | Q4-2024 | Q4-2023 | % modifica |

| Reddito lordo da locazione | 664.1 | 571.9 | +16.1% | 175.7 | 150.3 | +16.9% |

| Reddito netto da locazione | 646.8 | 543.4 | +19.0% | 170.9 | 140.9 | +21.3% |

| Risultato netto della valutazione degli immobili di investimento | 941.5 | 878.7 | +7.1% | 337.4 | 222.4 | +51.7% |

| Utile del periodo | 1,081.4 | 922.6 | +17.2% | 344.3 | 189.9 | +81.3% |

| Utili EPRA rettificati specifici dell'azienda | 364.0 | 323.5 | +12.5% | 94.2 | 85.0 | +10.7% |

| In € | 2024 | 2023 | % modifica | Q4-2024 | Q4-2023 | % modifica |

| EPS EPRA rettificato specifico dell'azienda | 0.80 | 0.73 | +9.9% | 0.20 | 0.19 | +4.8% |

| In milioni di € | 31 dicembre 2024 | 31 Dec 2023 | % modifica | |||

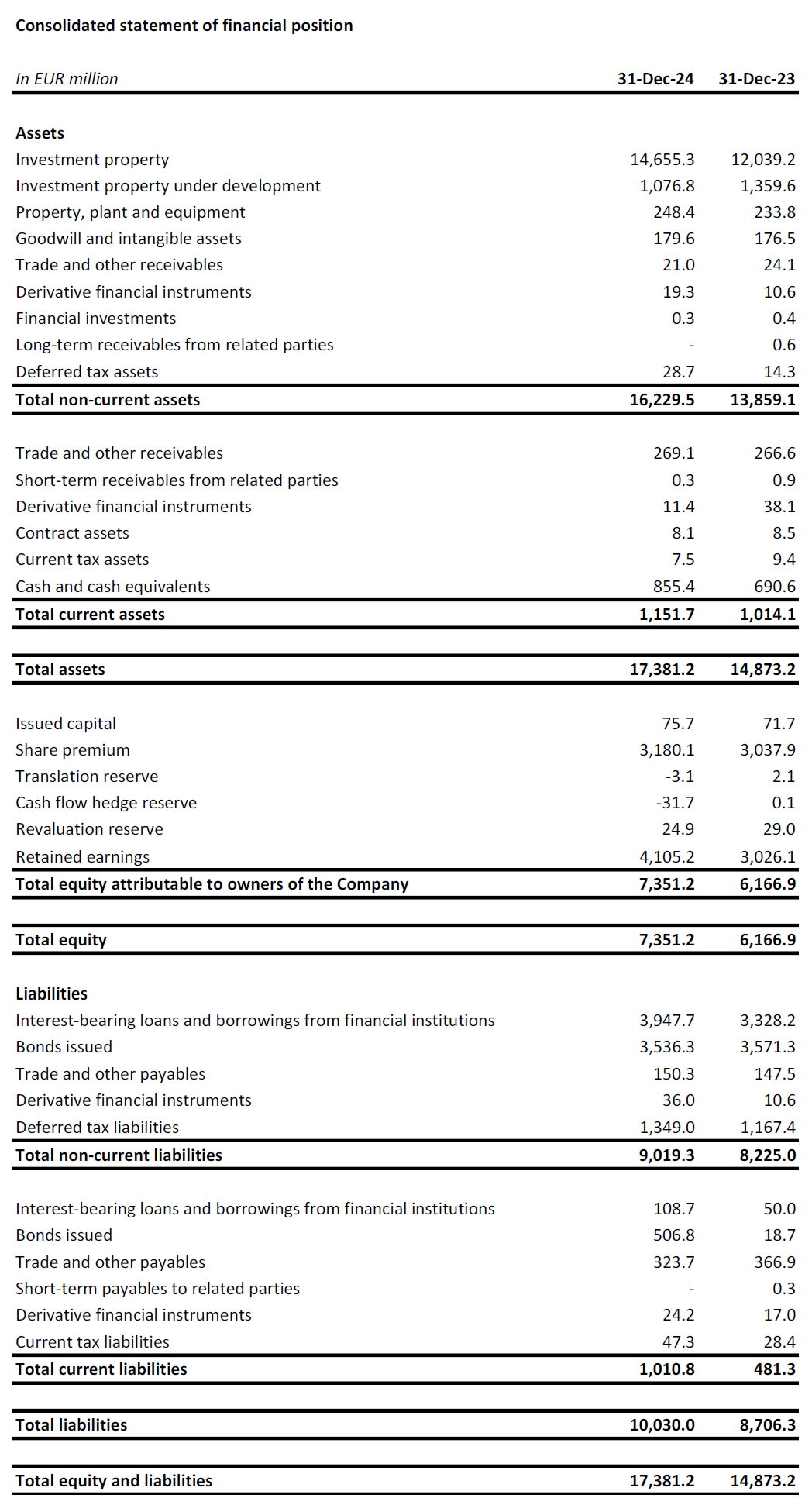

| Proprietà di investimento ("IP") | 14,655.3 | 12,039.2 | +21.7% | |||

| Proprietà di investimento in fase di sviluppo ("IPuD") | 1,076.8 | 1,359.6 | -20.8% | |||

| 31 dicembre 2024 | 31 Dec 2023 | % modifica | ||||

| EPRA NTA per azione | €18.08 | €15.92 | +13.6% | |||

| YoC previsto dei progetti in costruzione | 10.3% | 10.3% | ||||

| LTV | 45.3% | 46.0% |

La continua e forte domanda da parte dei locatari spinge la crescita degli affitti

During 2024, CTP signed leases for 2,113,000 sqm, an increase of 7% compared to 2023, with contracted annual rental income of €144.0 million, and an average monthly rent per sqm of €5.68 (2023: €5.69). Adjusting for the differences among the country mix, rents increased on average by 3%.

| Locazioni stipulate per mq | Q1 | Q2 | Q3 | Q4 | FY |

| 2022 | 441,000 | 452,000 | 505,000 | 485,000 | 1,883,000 |

| 2023 | 297,000 | 552,000 | 585,000 | 542,000 | 1,976,000 |

| 2024 | 336,000 | 582,000 | 577,000 | 618,000 | 2,113,000 |

| Crescita su base annua | +13% | +5% | -1% | +14% | +7% |

| Affitto medio mensile contratti di locazione stipulati per mq (€) | Q1 | Q2 | Q3 | Q4 | FY |

| 2022 | 4.87 | 4.89 | 4.75 | 4.80 | 4.82 |

| 2023 | 5.31 | 5.56 | 5.77 | 5.81 | 5.69 |

| 2024 | 5.65 | 5.55 | 5.69 | 5.79 | 5.68 |

Circa due terzi dei contratti di locazione firmati sono stati stipulati con inquilini esistenti, in linea con il modello aziendale di CTP che prevede la crescita con gli inquilini esistenti nei parchi esistenti.

Generazione di flussi di cassa attraverso il portafoglio in piedi e le acquisizioni

CTP’s average market share in the Czech Republic, Romania, Hungary, and Slovakia increased to 28.8% as at 31 December 2024 and it remains the largest owner and developer of industrial and logistics real estate assets in those markets. The Group is also the market leader in Serbia and Bulgaria.

With nearly 1,500 clients, CTP has a wide and diversified international tenant base, consisting of blue-chip companies with strong credit ratings. CTP’s tenants represent a broad range of industries, including manufacturing, high-tech/IT, automotive, e-commerce, retail, wholesale, and third-party logistics. The tenant base is highly diversified, with no single tenant accounting for more than 2.5% of the Company’s annual rent roll, which leads to a stable income stream. CTP’s top 50 tenants only account for 35.2% of its rent roll and most rent space in multiple CTParks.

The Company’s occupancy came to 93% (2023: 94%). The Group’s client retention rate remains strong at 87% (2023: 90%) and demonstrates CTP’s ability to leverage long-standing client relationships. The portfolio WAULT stood at 6.4 years (2023: 6.5 years), in line with the Company’s target of >6 years.

Rent collection level stood at 99.8% in 2024 (2023: 99.9%), with no deterioration in the payment profile of tenants.

Rental income amounted to €664.1 million, up 16.1% y-o-y on an absolute basis, mainly driven by deliveries, as well as by the accretive acquisition of 270,000 sqm of GLA in Romania in H1-2024 at an over 9% reversionary yield. On a like-for-like basis, rental income grew 4.0%, mainly driven by indexation and reversion on renegotiations and expiring leases.

The Group has put measures in place to limit service charge leakage, which resulted in the improvement of the Net Rental Income to Rental Income ratio from 95.0% in 2023 to 97.4% in 2024. Consequently, the Net Rental Income increased 19.0% y-o-y.

Una quota crescente dei redditi da locazione generati dal portafoglio investimenti di CTP beneficia della protezione dall'inflazione. Dalla fine del 2019, tutti i nuovi contratti di locazione del Gruppo includono una clausola di doppia indicizzazione, che calcola gli aumenti annuali del canone di locazione in base al maggiore tra:

- un aumento fisso di 1,5%-2,5% all'anno; oppure

- l'indice dei prezzi al consumo[2].

As at 31 December 2024, 71% of income generated by the Group’s portfolio includes this double indexation clause, and the Group expects this to increase further.

The reversionary potential stayed stable at 14.5%. New leases have been signed continuously above ERV’s, illustrating continued strong market rental growth and supporting valuations.

The annualised rental income came to €742.6 million as at 31 December 2024, an increase of 15.3% y-o-y, showcasing the strong cash flow growth of CTP’s investment portfolio.

2024 developments delivered with a 10.1% YoC and 92% let at delivery

CTP continued its disciplined investment in its highly profitable pipeline. In 2024, the Group completed a record number of 1.3 million sqm of GLA (2023: 1.2 million sqm). The developments were delivered at a YoC of 10.1%, 92% let and will generate contracted annual rental income of €83.4 million, with another €7.3 million of expected income when these reach full occupancy.

Some of the main deliveries during 2024 were: 169,000 sqm in CTPark Warsaw West (Poland), 120,000 sqm in CTPark Budapest Szigetszentmiklós (Hungary), 87,000 sqm in CTPark Ploiesti (Romania), 67,000 sqm in CTPark Bucharest West (Romania), 57,000 sqm in CTPark Warsaw South (Poland), 52,000 sqm in CTPark Novi Sad East (Serbia), 48,000 sqm in CTPark Zabrze (Poland), 44,000 sqm in CTPark Weiden (Germany), 37,000 sqm in CTPark Budapest Ecser (Hungary), 37,000 sqm In CTPark Žilina Airport (Slovakia).

While average construction costs in 2022 were around €550 per sqm, in 2023 and 2024 they came to €500 per sqm. This allows the Group to continue to deliver its industry-leading YoC above 10%, which is also supported by CTP’s unique park model and in-house construction and procurement expertise.

As at 31 December 2024, the Group had 1.8 million sqm of buildings under construction with a potential rental income of €142 million and an expected YoC of 10.3%. CTP has a long track record of delivering sustainable growth through its tenant-led development in its existing parks. 80% of the Group’s projects under construction are in existing parks, while 7% are in new parks which have the potential to be developed to more than 100,000 sqm of GLA. Planned 2025 deliveries are 35% pre-let. CTP expects to reach 80%-90% pre-letting at delivery, in line with historical performance. As CTP acts in most markets as general contractor, it is fully in control of the process and timing of deliveries, allowing the Company to speed-up or slow-down depending on tenant demand, while also offering tenants flexibility in terms of building requirements.

In 2025 the Group is expecting to deliver between 1.2 – 1.7 million sqm, depending on tenant demand. The 80,000 sqm of leases that are already signed for future projects—construction of which hasn’t started yet—are a further illustration of continued occupier demand.

CTP’s landbank amounted to 26.4 million sqm as at 31 December 2024 (31 December 2023: 23.4 million sqm), which allows the Company to reach its target of 20 million sqm GLA by the end of the decade. The Group is focusing on mobilising the existing landbank, while maintaining disciplined capital allocation in landbank replenishment. 57% of the landbank is located within CTP’s existing parks, while 33% is in, or is adjacent to, new parks which have the potential to grow to more than 100,000 sqm. 18% of the landbank was secured by options, while the remaining 82% was owned and accordingly reflected in the balance sheet.

Assuming a build-up ratio of 2 sqm of land to 1 sqm of GLA, CTP can build over 13 million sqm of GLA on its secured landbank. CTP’s land is held on balance sheet at around €60 per sqm and construction costs amount on average to approximately €500 per sqm, bringing total investment costs to approximately €620 per sqm. The Group’s standing portfolio, excluding the older former Deutsche Industrie REIT portfolio, is valued around €1,030 per sqm.

Monetizzazione del business dell'energia

CTP continua il suo piano di espansione per l'installazione di impianti fotovoltaici. Con un costo medio di ~750.000 euro per MWp, il Gruppo punta a un YoC di 15% per questi investimenti.

By year-end 2024, CTP had installed PV capacity of 138 MWp, of which 66 MWp is operational.

In 2024 the revenues from renewable energy came to €7.6 million, up 22% y-o-y.

L'ambizione di sostenibilità di CTP va di pari passo con il fatto che sempre più inquilini richiedono energia verde da impianti fotovoltaici, poiché questi ultimi garantiscono loro i) una maggiore sicurezza energetica, ii) un costo di occupazione inferiore, iii) la conformità a normative più stringenti, iv) la conformità ai requisiti dei clienti e v) la capacità di soddisfare le proprie ambizioni ESG.

Risultati di valutazione trainati dalla pipeline e dalla rivalutazione positiva del portafoglio in piedi

Investment Property (“IP”) valuation increased from €12.0 billion as at 31 December 2023 to €14.7 billion as at 31 December 2024, driven mainly by the transfer of completed projects from Investment Property under Development (“IPuD”) to IP, accretive acquisitions and positive revaluations.

IPuD decreased by 20.8% to €1.1 billion as at 31 December 2024, driven by a significant amount of deliveries in Q4-2024, and the start of new construction projects in Q1-2025.

GAV increased to €16.0 billion as at 31 December 2024, up 17.2% compared to 31 December 2023.

Revaluation in 2024 came to €941.5 million, driven by the positive revaluation of IPuD projects (+€380.4 million), landbank (+€61.2 million), and the standings assets (+€499.9 million). The like-for-like revaluation came to 5.9%, mainly driven by positive like-for-like ERV growth of 4.9%.

The Group’s portfolio has conservative valuation yields, with 70bps of reversionary yield widening in the last two and half years, bringing it to 7.1%. CTP expects yields to have peaked in the Industrial & Logistics sector in the CEE region. With the larger yield movements in Western European markets, the yield differential between CEE and Western European logistics is back to the long-term average. CTP expects the yield differential to decrease further over time, driven by the higher growth expectations for the CEE region.

CTP expects further positive ERV growth on the back of continued tenant demand, which is positively impacted by the secular growth drivers in the CEE region. CEE rental levels remain affordable; and despite the strong growth seen, they have started from significantly lower absolute levels than in Western European countries. In real terms, rents in many CEE markets are still below 2010 levels.

EPRA NTA per share increased from €15.92 as at 31 December 2023 to €18.08 as at 31 December 2024, representing an increase of 13.6%. The increase is mainly driven by the revaluation (+€1.98) and Company specific adjusted EPRA EPS (+€0.80), partly offset by the dividend paid out (-€0.57).

Bilancio solido e forte liquidità

In linea con il suo approccio proattivo e prudente, il Gruppo beneficia di una solida posizione di liquidità per finanziare le sue ambizioni di crescita, con un costo fisso del debito e un profilo di rimborso conservativo.

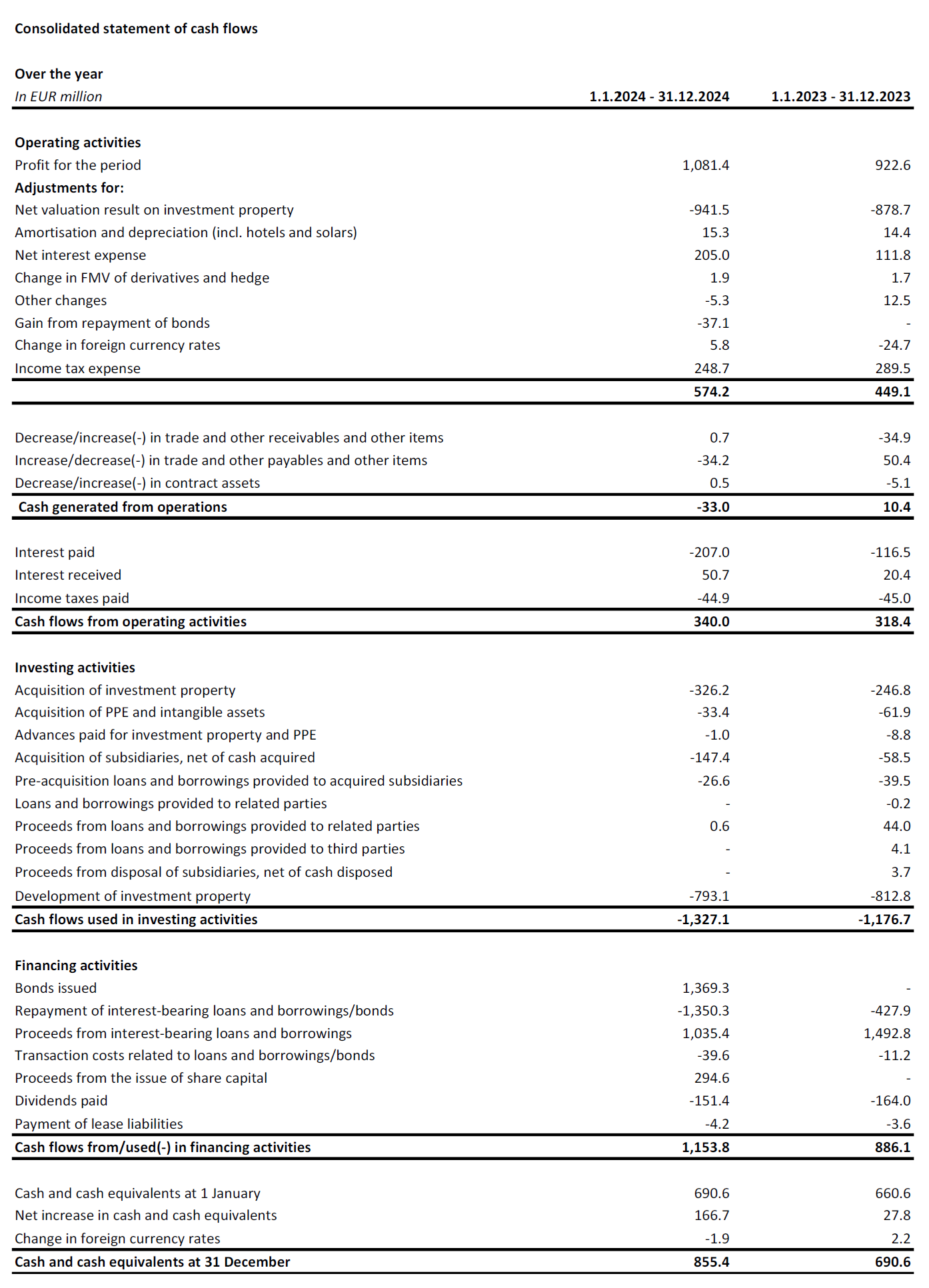

During the year, the Group raised €2.4 billion:

- A €100 million six-year secured loan facility with a syndicate of Italian and Czech banks at a fixed all-in cost of 4.9%;

- A €750 million six-year green bond at MS +220 bps at a coupon of 4.75%;

- Un prestito garantito di 90 milioni di euro della durata di sette anni con una banca austriaca a un costo fisso complessivo di 4,9%;

- Una linea di credito garantita di 168 milioni di euro a sette anni con un consorzio di banche slovacche e austriache a un costo fisso complessivo di 5,1%;

- A €75 million tap of the six-year green bond issued in February at MS +171 bps;

- A €500 million five-year unsecured loan facility with a syndicate of international banks at a fixed all-in cost of 4.7%;

- A €150 million seven-year secured loan facility top-up with a syndicate of Italian and Czech banks at a fixed all-in cost of 4.35%;

- A €500 million eight-year green bond at MS +173 bps at a coupon of 3.875%; and

- A €50 million five-year green bond at MS +125 bps at a coupon of 3.427%.

During the year CTP also completed three bond tender offers, buying back €950 million of short-dated bonds, realizing a capital gain of €37.1 million, reducing 2025 and 2026 debt maturities and proactively extending its maturity profile. As the spreads came down, CTP negotiated margin reduction on €569.9 million and repaid another €378.8 million of secured bank loans.

The Group’s liquidity position stood at €2.2 billion, comprised of €0.9 billion of cash and cash equivalents, and an undrawn RCF, which was upsized from €550 million to €1.3 billion.

CTP’s average cost of debt stood at 3.09% (31 December 2023: 1.95%), with 99.9% of the debt fixed or hedged until maturity. The Group doesn’t capitalise interest on developments, therefore all interest expenses are included in the P&L. The average debt maturity came to 5.0 years (31 December 2023: 5.3 years).

La prima scadenza materiale imminente del Gruppo è di 272 milioni di euro[3] obbligazione con scadenza a giugno 2025, che verrà rimborsata utilizzando le riserve di liquidità disponibili.

CTP’s LTV came to 45.3% as at 31 December 2024, down from 46.0% at 31 December 2023, thanks to the equity raise in September 2024 and revaluation at the end of year.

The Group’s higher yielding assets, thanks to their gross portfolio yield of 6.6%, lead to a healthy level of cash flow leverage that is also reflected in the normalized Net Debt to EBITDA of 9.1x (31 December 2023: 9.2x), which the Group targets to keep below 10x.

The Group had 64% unsecured debt and 36% secured debt as at 31 December 2024, with ample headroom under its Secured Debt Test and Unencumbered Asset Test covenants.

Con la razionalizzazione dei prezzi sul mercato obbligazionario, le condizioni sono ora più competitive rispetto a quelle del mercato dei prestiti bancari, il che consentirà al Gruppo di riequilibrarsi maggiormente verso i prestiti non garantiti.

| 31 December 2024 | Alleanza | |

| Test sui debiti garantiti | 16.9% | 40% |

| Test delle attività non vincolate | 193.2% | 125% |

| Rapporto di copertura degli interessi | 2.6x | 1.5x |

In Q3-2024, both Moody’s and S&P confirmed, respectively, CTP’s Baa3 and BBB- credit rating with a stable outlook. In January 2025, CTP was assigned an A- credit rating with a stable outlook by the Japanese rating agency JCR.

Guida

Leasing dynamics remain strong, with robust occupier demand, and decreasing new supply leading to continued rental growth. CTP is well positioned to benefit from these trends. The Group’s pipeline is highly profitable, and tenant led. The YoC for CTP’s pipeline increased to 10.3%, thanks to decreasing construction costs and rental growth. The next stage of growth is built in and financed, with 1.8 million sqm under construction as at 31 December 2024, with a target to deliver between 1.2 – 1.7 million sqm in 2025.

La solida struttura patrimoniale di CTP, la politica finanziaria disciplinata, il solido accesso al mercato del credito, la banca dati immobiliare leader del settore, la competenza edilizia interna e le solide relazioni con gli inquilini consentono a CTP di raggiungere i propri obiettivi. CTP prevede di raggiungere 1,0 miliardi di euro di reddito da locazione nel 2027, trainato dal completamento degli sviluppi, dall'indicizzazione e dalla reversione, ed è sulla buona strada per raggiungere 20 milioni di mq di GLA e 1,2 miliardi di euro di reddito da locazione entro la fine del decennio.

The Group sets a guidance of €0.86 – €0.88 Company-specific adjusted EPRA EPS for 2025. This is driven by our strong underlying growth, with around 4% like-for-like growth, partly offset by a higher average cost of debt due to the (re)-financing in 2024 and 2025.

Dividendo

CTP proposes a final 2024 dividend of €0.30 per ordinary share, which will, subject to approval by the AGM, be paid on 15 May 2025. This will bring the total 2024 dividend to €0.59 per ordinary share, which represents a Company specific adjusted EPRA EPS pay-out of 74% – in line with the Groups’ dividend policy to pay-out 70%-80% – and growth of 12.4% compared to 2023.

The default dividend is scrip, but shareholders can opt for payment of the dividend in cash.

WEBCAST E TELECONFERENZA PER ANALISTI E INVESTITORI

Today at 12:00 (GMT) and 13:00 (CET), the Company will host a video presentation and Q&A session for analysts and investors, via a live webcast and audio conference call.

Per vedere il webcast in diretta, registrarsi prima all'indirizzo:

https://www.investis-live.com/ctp/678e4096cddd8c000f42d182/mabgk

Per partecipare alla presentazione per telefono, comporre uno dei seguenti numeri e inserire il codice di accesso per i partecipanti 527498.

Germany +49 32 22109 8334

France +33 9 70 73 39 58

Paesi Bassi +31 85 888 7233

Regno Unito +44 20 3936 2999

United States +1 646 233 4753

Premere *1 per porre una domanda, *2 per ritirare la domanda o *0 per richiedere l'assistenza dell'operatore.

La registrazione sarà disponibile sul sito web della CTP entro 24 ore dalla presentazione: https://www.ctp.eu/investors/financial-reports/

CALENDARIO FINANZIARIO DELLA CTP

| Operazione | Data |

| Assemblea generale annuale | 22 April 2025 |

| Q1-2025 results | 8 May 2025 |

| H1-2025 results | 7 August 2025 |

| Giornate del mercato dei capitali (Wuppertal, Germania) | 24-25 settembre 2025 |

| Risultati del terzo trimestre 2025 | 6 novembre 2025 |

I DATI DI CONTATTO PER LE RICHIESTE DEGLI ANALISTI E DEGLI INVESTITORI:

Maarten Otte, responsabile delle relazioni con gli investitori

Cellulare: +420 730 197 500

E-mail: [email protected]

DATI DI CONTATTO PER RICHIESTE DA PARTE DEI MEDIA:

Patryk Statkiewicz, responsabile marketing e pubbliche relazioni del Gruppo

Cellulare: +31 (0) 629 596 119

E-mail: [email protected]

Informazioni su CTP

CTP è il più grande proprietario, sviluppatore e gestore di immobili logistici e industriali quotato in Europa per superficie lorda affittabile, con una GLA di 13,3 milioni di mq in 10 paesi al 31 dicembre 2024. CTP certifica tutti i nuovi edifici con la certificazione BREEAM "Molto buono" o "superiore" e ha ottenuto un rating ESG "rischio trascurabile" da Sustainalytics, a conferma del suo impegno per la sostenibilità. Per ulteriori informazioni, visita il sito web aziendale di CTP: www.ctp.eu

Esclusione di responsabilità

The audit procedures by statutory auditors are in progress.

Il presente annuncio contiene alcune dichiarazioni previsionali relative alla condizione finanziaria, ai risultati delle operazioni e all'attività di CTP. Queste dichiarazioni previsionali possono essere identificate dall'uso di terminologia previsionale, tra cui i termini “crede”, “stima”, “pianifica”, “progetta”, “anticipa”, “si aspetta”, “intende”, “mira”, “obiettivi”, “può”, “mira”, “probabile”, “vorrebbe”, “potrebbe”, “può avere”, “avrà” o "dovrebbe" o, in ogni caso, le loro variazioni negative o terminologia comparabile. Le dichiarazioni previsionali possono differire, e spesso lo fanno, in modo sostanziale dai risultati effettivi. Di conseguenza, non si dovrebbe attribuire un'influenza eccessiva a nessuna dichiarazione previsionale. Il presente comunicato stampa contiene informazioni privilegiate ai sensi dell'articolo 7(1) del Regolamento (UE) 596/2014 del 16 aprile 2014 (il Regolamento sugli abusi di mercato).

[1] Unaudited

[2] Con un mix di IPC locale e dell'UE-27 / Eurozona, solo un numero limitato di massimali.

[3] Importo residuo dopo la liquidazione dell'offerta pubblica di acquisto il 28 giugno 2024.

Iscriviti alla nostra newsletter

Ricevi nella tua casella di posta elettronica le ultime novità dal leader del mercato immobiliare industriale.