Výsledky CTP NV Q3-2024

CTP VYKAZUJE ČISTÝ PRÍJEM Z PRENÁJMU 18,21 TP3T MROČNE, SPOLOČNOSŤ ŠPECIFICKÝ UPRAVENÝ EPRA EPS 0,60 EUR NA CESTE K DOSIAHNUTÍ PORADENSTVA A EPRA NTA NA AKCIU AŽ 10,11 TP3T NA 17,52 EUR

AMSTERDAM, 6. novembra 2024 – CTP NV (CTPNV.AS), („CTP“, „Skupina“ alebo „Spoločnosť“) zaznamenala za prvých 9 mesiacov roka príjem z prenájmu vo výške 488,4 milióna eur, čo je medziročný nárast o 15,91 TP3T. Rovnaký medziročný rast nájomného o 4,41 TP3T, najmä vďaka indexácii a reverzii pri opätovných rokovaniach a končiacich lízingoch. K 30. septembru 2024 dosiahol ročný príjem z prenájmu 702,0 milióna a obsadenosť 93%.

Za prvých 9 mesiacov dodala CTP 545 000 m2 pri výnose z nákladov (“YoC”) 10,1% a 95% prenájmu po dokončení, čím sa portfólio skupiny zvýšilo na 12,6 milióna m2 GLA, zatiaľ čo hrubá hodnota aktív (“GAV” ) vzrástol o 11,81 TP3T na 15,2 miliardy EUR. EPRA NTA na akciu vzrástla v prvom polroku o 10,11 TP3T na 17,52 EUR.

Upravený zisk EPRA pre jednotlivé spoločnosti vzrástol medziročne o 13,21 TP3T na 269,8 milióna EUR. Špecifický upravený EPRA EPS CTP spoločnosti CTP dosiahol 0,60 EUR, čo predstavuje nárast o 11,71 TP3T. Skupina potvrdzuje svoje špecifické usmernenia EPRA EPS na rok 2024 v hodnote 0,80 – 0,82 EUR.

K 30. septembru 2024 mali projekty vo výstavbe celkovo 1,9 milióna m2 s potenciálnym príjmom z prenájmu vo výške 142 miliónov EUR pri úplnom prenájme a očakávaným YoC 10,41 TP3T. Z toho podstatná časť bude dodaná v roku 2024, keďže CTP tento rok očakáva dodanie 1,2 – 1,3 milióna m2.

Pozemná banka skupiny sa zväčšila na 27,1 milióna m2, z čoho 20,9 milióna m2 je vo vlastníctve a v súvahe, a zabezpečila významný potenciál budúceho rastu pre CTP. CTP očakáva, že vďaka svojmu špičkovému YoC v odvetví bude môcť v nasledujúcich rokoch naďalej generovať dvojciferný rast NTA.

Anualizovaný príjem z prenájmu dosiahol 702 miliónov EUR, čo ilustruje silný cash flow nášho stáleho portfólia s mierou výberu nájomného 99,81 TP3T. Zatiaľ čo ďalšia fáza rastu je už uzavretá s našimi 1,9 milióna m2 GLA vo výstavbe a pozemkom s rozlohou viac ako 27 miliónov m2, budeme aj naďalej vytvárať dvojciferný rast NTA. Okrem predbežného prenájmu súčasného plynovodu sme mali podpísaných ďalších 177 000 m2 nájomných zmlúv na budúce projekty, s ktorými plánujeme začať už čoskoro.

Dopyt po priemyselných a logistických nehnuteľnostiach v regióne CEE je poháňaný štrukturálnymi hnacími silami dopytu, ako je profesionalizácia dodávateľských reťazcov prostredníctvom 3PL, e-commerce a nearshoring a friend-shoring, keďže región CEE ponúka najlacnejšiu lokalitu v Európe. V súčasnosti máme viac ako 101 TP3T nášho portfólia prenajatých ázijským nájomcom, ktorí vyrábajú v Európe pre Európu, čo predstavuje približne 201 TP3T našej celkovej lízingovej aktivity v roku 2024.

Kľúčové informácie

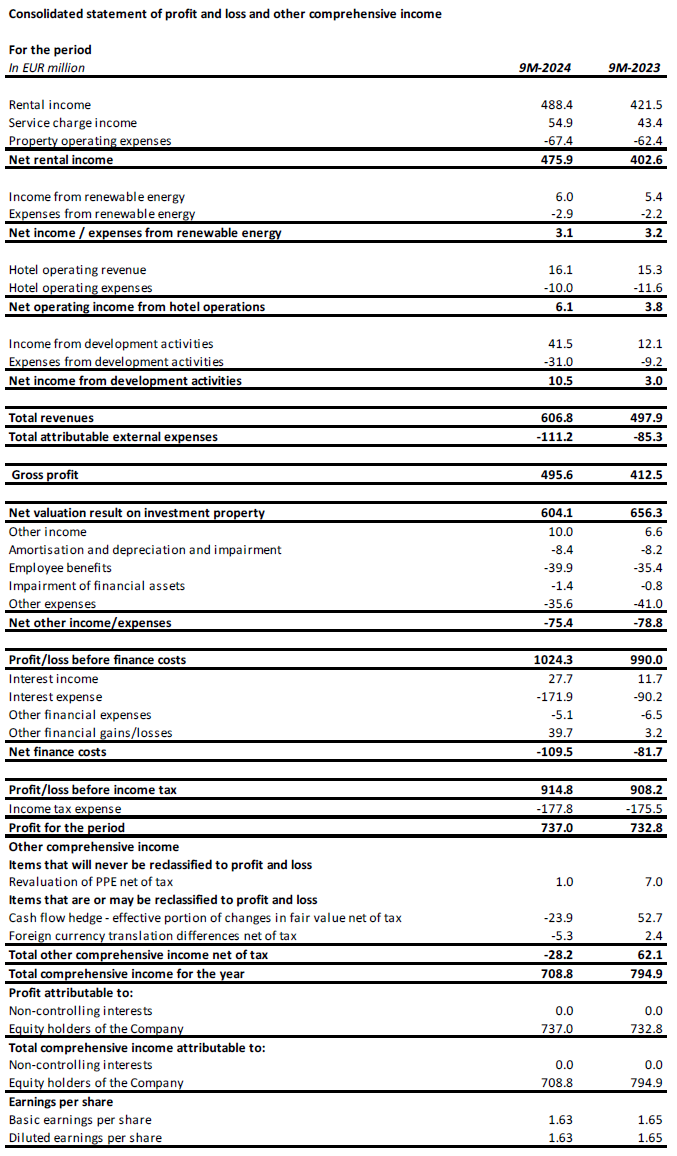

| V miliónoch EUR | 9M-2024 | 9M-2023 | Zmena % | 3. štvrťrok 2024 | Q3-2023 | Zmena % |

| Hrubý príjem z prenájmu | 488.4 | 421.5 | +15.9% | 167.5 | 141.1 | +18.8% |

| Čistý príjem z prenájmu | 475.9 | 402.6 | +18.2% | 162.1 | 134.1 | +20.8% |

| Čistý výsledok ocenenia investícií do nehnuteľností | 604.1 | 656.3 | -8.0% | 167.4 | 239.1 | -30.0% |

| Zisk za obdobie | 737.0 | 732.8 | +0.6% | 203.3 | 263.1 | -22.7% |

| Upravený zisk EPRA podľa spoločnosti | 269.8 | 238.4 | +13.2% | 92.3 | 80.4 | +14.8% |

| V € | 9M-2024 | 9M-2023 | Zmena % | 3. štvrťrok 2024 | Q3-2023 | Zmena % |

| Upravený zisk na akciu EPRA špecifický pre spoločnosť | 0.60 | 0.54 | +11.7% | 0.20 | 0.18 | +12.7% |

| V miliónoch EUR | 30. septembra 2024 | 31. dec. 2023 |

Zmena % | |||

| Investície do nehnuteľností ("IP") | 13,378.5 | 12,039.2 | +11.1% | |||

| Investície do nehnuteľností vo výstavbe ("IPuD") | 1,616.4 | 1,359.6 | +18.9% | |||

| 30. septembra 2024 | 31. dec. 2023 |

Zmena % | ||||

| EPRA NTA na akciu | €17.52 | €15.92 | +10.1% | |||

| Očakávaná ročná hodnota projektov vo výstavbe | 10.4% | 10.3% | ||||

| LTV | 44.9% | 46.0% |

Pokračujúci silný dopyt nájomcov poháňa rast nájomného

Počas prvých 9 mesiacov roku 2024 CTP podpísala nájomné zmluvy na 1 495 000 m2, čo predstavuje nárast o 4% v porovnaní s 9. mesiacom – 2023, so zmluvným ročným príjmom z prenájmu vo výške 100,9 milióna eur a priemerným mesačným nájmom na meter štvorcový vo výške 5,63 eur (9 mesiacov – 2023: 5,60 €). Po očistení o rozdiel v mixe krajín sa nájomné zvýšilo v priemere o 31 TP3T.

| Podpísané nájomné zmluvy podľa m2 | Q1 | Q2 | Q3 | YTD | Q4 | FY |

| 2022 | 441,000 | 452,000 | 505,000 | 1,398,000 | 485,000 | 1,883,000 |

| 2023 | 297,000 | 552,000 | 585,000 | 1,435,000 | 542,000 | 1,976,000 |

| 2024 | 336,000 | 582,000 | 577,000 | 1,495,000 |

| Priemerný mesačný nájom podpísaných zmlúv na m2 (€) | Q1 | Q2 | Q3 | YTD | Q4 | FY |

| 2022 | 4.87 | 4.89 | 4.75 | 4.82 | 4.80 | 4.82 |

| 2023 | 5.31 | 5.56 | 5.77 | 5.60 | 5.81 | 5.69 |

| 2024 | 5.65 | 5.55 | 5.69 | 5.63 |

Približne dve tretiny týchto nájomných zmlúv boli uzatvorené s existujúcimi nájomcami, čo je v súlade s obchodným modelom spoločnosti CTP, ktorý spočíva v raste s existujúcimi nájomcami v existujúcich parkoch.

Generovanie cashflow prostredníctvom stáleho portfólia a akvizícií

Priemerný trhový podiel CTP v Českej republike, Rumunsku, Maďarsku a na Slovensku sa k 30. septembru 2024 zvýšil na 28,51 TP3T a zostáva najväčším vlastníkom a developerom priemyselných a logistických nehnuteľností na týchto trhoch. Skupina je tiež lídrom na trhu v Srbsku a Bulharsku.

S viac ako 1 000 klientmi má CTP širokú a diverzifikovanú medzinárodnú základňu nájomcov, ktorá pozostáva z blue-chip spoločností so silným úverovým ratingom. Nájomníci CTP zastupujú široké spektrum odvetví vrátane výroby, high-tech/IT, automobilového priemyslu, elektronického obchodu, maloobchodu, veľkoobchodu a logistiky tretích strán. Nájomná základňa je vysoko diverzifikovaná, pričom žiadny jeden nájomca nepredstavuje viac ako 2,51 TP3T z ročného nájomného, čo vedie k stabilnému toku príjmov. 50 najlepších nájomcov CTP predstavuje len 33,41 TP3T z jej nájomnej role a väčšina je vo viacerých CTParkoch.

Spoločná obsadenosť dosiahla 93% (Q3-2023: 93%). Miera udržania klientov skupiny zostáva vysoká na úrovni 91% (Q3-2023: 92%) a demonštruje schopnosť CTP využiť dlhodobé vzťahy s klientmi. Portfólio WAULT dosiahlo 6,5 roka (Q3-2023: 6,6 roka), čo je v súlade s cieľom Spoločnosti >6 rokov.

Úroveň inkasa nájomného bola 99,81 TP3T za 9. mesiac 2024 (9. mesiac 2023: 99,81 TP3T) bez zhoršenia platobného profilu nájomcov.

Príjem z prenájmu dosiahol 488,4 milióna eur, čo je medziročný nárast o 15,91 TP3T na absolútnej báze. Na rovnakom základe, výnosy z prenájmu vzrástli o 4,41 TP3T, najmä vďaka indexácii a reverzii pri opätovných prerokovaniach a končiacich lízingoch.

Skupina zaviedla opatrenia na obmedzenie úniku servisných poplatkov, čo viedlo k zlepšeniu pomeru čistého príjmu z prenájmu k príjmu z prenájmu z 95,51 TP3T v 9. mesiaci 2023 na 97,41 TP3T v 9. mesiaci 2024. V dôsledku toho sa čistý príjem z prenájmu medziročne zvýšil o 18,21 TP3T.

Stále väčšia časť príjmov z prenájmu, ktoré generuje investičné portfólio CTP, je chránená proti inflácii. Od konca roka 2019 obsahujú všetky nové nájomné zmluvy skupiny doložku o dvojitej indexácii, ktorá vypočítava ročné zvýšenie nájomného ako vyššiu z týchto hodnôt:

- fixné zvýšenie o 1,5%-2,5% ročne alebo

- index spotrebiteľských cien[1].

K 30. septembru 2024 70% výnosov generovaných portfóliom Skupiny zahŕňa túto doložku o dvojitej indexácii a Skupina očakáva, že sa bude ďalej zvyšovať.

Reverzný potenciál zostal stabilný na 15,11 TP3T. Nové nájomné zmluvy boli neustále podpísané nad ERV, čo ilustruje pokračujúci silný rast trhového nájomného a podporuje oceňovanie.

Anualizovaný príjem z prenájmu dosiahol k 30. septembru 2024 702,0 milióna EUR, čo predstavuje medziročný nárast o 19,31 TP3T, čo svedčí o silnom raste peňažných tokov investičného portfólia CTP.

Vývoj 9M-2024 dodaný s 10.1% YoC a 95% pri dodaní

CTP pokračovala v disciplinovaných investíciách do svojho vysoko ziskového potrubia. Za prvých 9 mesiacov Skupina dokončila 545 000 m2 GLA (9M-2023: 566 000 m2), čo je o niečo menej ako v minulom roku, keď bolo online niekoľko projektov, ktoré boli v priebehu roka 2022 odložené z dôvodu vyšších stavebných nákladov. Projekty boli dodané za rok 10,11 TP3T, 951 TP3T prenájmu a budú generovať zmluvný ročný príjem z prenájmu vo výške 33,0 milióna EUR, s ďalšími 2,0 miliónmi EUR očakávaného príjmu, keď budú plne obsadené.

Niektoré z hlavných dodávok počas prvých 9 mesiacov roku 2024 boli: 169 000 m2 v CTPark Warsaw West (Poľsko), 48 000 m2 v CTPark Zabrze (Poľsko), 37 000 m2 v CTPark Budapest Ecser (Maďarsko), 37 000 m2 v CTParku Sadi Sadi Sadk (Srbsko), 30 000 m2 v CTPark Weiden (Nemecko), 26 000 m2 v CTPark Bucharest West (Rumunsko), 27 000 m2 v CTPark Katowice (Poľsko) a 23 000 m2 v CTPark Arad West (Rumunsko).

Kým v roku 2022 sa priemerné stavebné náklady pohybovali okolo 550 eur za m2, v rokoch 2023 a 9M-2024 dosiahli 500 eur za m2. CTP očakáva, že sa na tejto úrovni udržia do roku 2024. Skupine to umožňuje pokračovať v dosahovaní svojho najlepšieho ukazovateľa indexu výkonnosti v odvetví nad 10%, čo je podporené aj jedinečným modelom parku CTP a vlastnými odbornými znalosťami v oblasti výstavby a obstarávania.

K 30. septembru 2024 mala Skupina vo výstavbe 1,9 milióna m2 budov s potenciálnym príjmom z prenájmu vo výške 142 miliónov EUR a očakávaným YoC 10,41 TP3T. CTP má dlhoročné skúsenosti s poskytovaním udržateľného rastu prostredníctvom rozvoja vedeného nájomcami vo svojich existujúcich parkoch. 76% projektov Skupiny vo výstavbe sa nachádza v existujúcich parkoch, zatiaľ čo 15% je v nových parkoch, ktoré majú potenciál rozšíriť sa na viac ako 100 000 m2 GLA. Plánované dodávky na rok 2024 sú predprenajaté 64%. CTP očakáva, že pri dodaní dosiahne predbežný prenájom 80%-90% v súlade s historickou výkonnosťou. Keďže CTP pôsobí na väčšine trhov ako generálny dodávateľ, má plnú kontrolu nad procesom a načasovaním dodávok, čo umožňuje spoločnosti zrýchľovať alebo spomaľovať v závislosti od dopytu nájomcov a zároveň ponúka nájomcom flexibilitu z hľadiska požiadaviek budovy.

V roku 2024 Skupina očakáva dodávku 1,2 – 1,3 milióna m2 v závislosti od dopytu nájomcov. 177 000 m2 nájomných zmlúv, ktoré sú v súčasnosti podpísané pre budúce projekty, ktorých výstavba sa ešte nezačala, je ďalšou ilustráciou pokračujúceho dopytu zo strany nájomcov.

Pozemná banka CTP mala k 30. septembru 2024 rozlohu 27,1 milióna m2 (31. december 2023: 23,4 milióna m2), čo umožňuje Spoločnosti dosiahnuť svoj cieľ 20 miliónov m2 GLA do konca dekády. Skupina sa zameriava na mobilizáciu existujúcej pozemkovej banky pri zachovaní disciplinovanej alokácie kapitálu pri dopĺňaní pozemkov. 60% pozemnej banky sa nachádza v existujúcich parkoch CTP, zatiaľ čo 30% je v nových parkoch alebo s nimi susedí, ktoré majú potenciál narásť na viac ako 100 000 m2. 23% pozemkovej banky bolo zabezpečených opciami, zatiaľ čo zvyšných 77% bolo vo vlastníctve a zodpovedajúcim spôsobom sa premietlo do súvahy.

Za predpokladu pomeru zastavanosti 2 m2 pozemku k 1 m2 GLA môže CTP postaviť viac ako 13 miliónov m2 GLA na svojom zabezpečenom pozemku. Pozemky CTP sú v súvahe približne 50 EUR za m2 a stavebné náklady dosahujú v priemere približne 500 EUR za m2, čím celkové investičné náklady dosahujú približne 600 EUR na m2. Stále portfólio skupiny, s výnimkou staršieho bývalého portfólia Deutsche Industrie REIT, má hodnotu okolo 1 000 EUR za m2.

Monetizácia energetického biznisu

CTP pokračuje v pláne expanzie v oblasti zavádzania fotovoltaických systémov. S priemernými nákladmi ~ 750 000 EUR na MWp sa Skupina pri týchto investíciách zameriava na YoC 151 TP3T.

Počas prvých 9 mesiacov Skupina nainštalovala na strechu ďalších 19 MWp, ktoré sa v súčasnosti pripájajú do siete. Celkový inštalovaný výkon je teraz 119 MWp.

V 9M-2024 dosiahli výnosy z obnoviteľnej energie 6,0 milióna eur, čo je medziročný nárast o 101 TP3T.

Ambície spoločnosti CTP v oblasti udržateľnosti idú ruka v ruke so stále väčším počtom nájomcov, ktorí požadujú fotovoltaické systémy, pretože im poskytujú i) lepšiu energetickú bezpečnosť, ii) nižšie náklady na užívanie, iii) súlad so zvýšenou reguláciou, iv) súlad s požiadavkami ich klientov a v) možnosť naplniť ich vlastné ambície v oblasti ESG.

Výsledky oceňovania poháňané potrubím a portfóliom s pozitívnym precenením

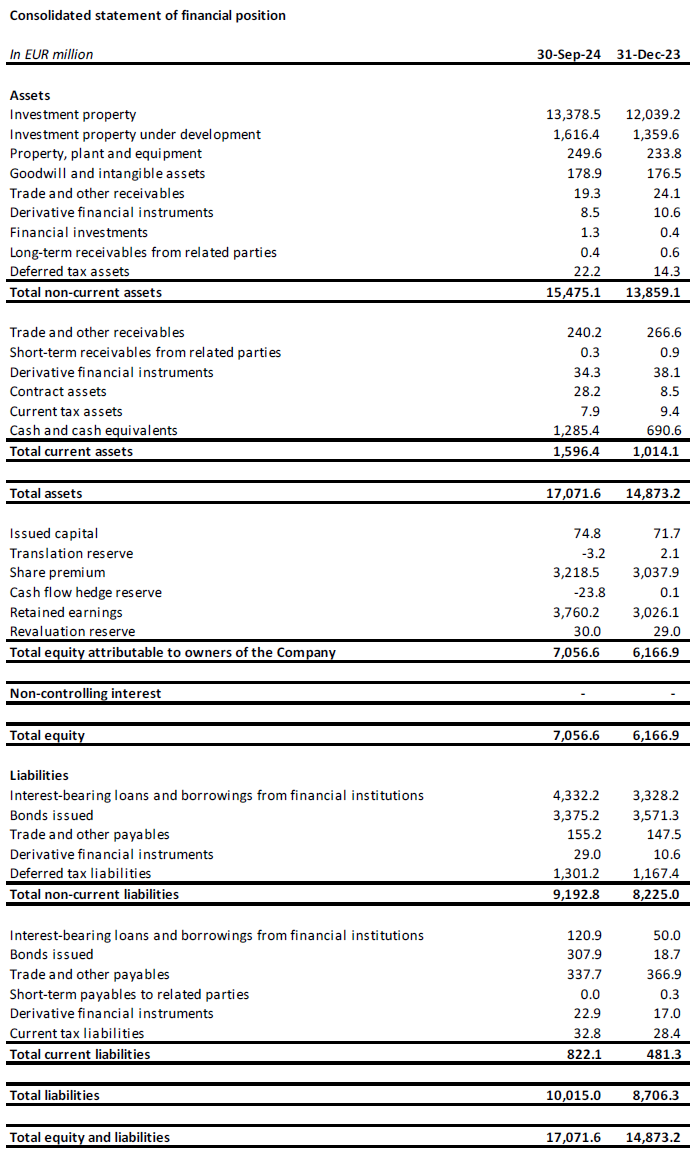

Ocenenie investičných nehnuteľností (ďalej len „IP“) sa zvýšilo z 12,0 miliardy EUR k 31. decembru 2023 na 13,4 miliardy EUR k 30. septembru 2024, čo bolo spôsobené najmä prevodom dokončených projektov z Investície do nehnuteľností vo výstavbe (ďalej len „IPuD“) do IP, aktívny akvizície a kladné precenenia.

IPuD sa k 30. septembru 2024 zvýšil o 18,91 TP3T na 1,6 miliardy EUR, čo je spôsobené pokrokom vo vývoji, pričom väčšina projektov má byť ako obvykle dodaná v štvrtom štvrťroku.

GAV sa k 30. septembru 2024 zvýšila na 15,2 miliardy EUR, čo predstavuje nárast o 11,81 TP3T v porovnaní s 31. decembrom 2023.

Pre výsledky za 1. a 3. štvrťrok sa preceňujú iba projekty IPuD. Precenenie za Q3-2024 bolo 167,4 milióna EUR, čo predstavuje precenenie za prvých 9 mesiacov na 604,1 milióna EUR, čo je spôsobené kladným precenením projektov IPuD (+ 351,2 milióna EUR), pozemkovej banky (+ 26,1 milióna EUR) a výsledkov aktív (+226,9 mil. €).

Portfólio Skupiny má konzervatívne oceňovacie výnosy, pričom reverzný výnos sa za posledné dva roky rozšíril o 80 bázických bodov, čím sa dostal na 7,21 TP3T. CTP očakáva, že výnosy dosiahli vrchol v sektore Industrial & Logistics v regióne CEE. S väčšími pohybmi výnosov na západoeurópskych trhoch sa výnosový rozdiel medzi CEE a západoeurópskou logistikou vracia k dlhodobému priemeru. CTP očakáva, že rozdiel vo výnosoch sa bude ďalej znižovať v dôsledku vyšších očakávaní rastu v regióne strednej a východnej Európy.

CTP očakáva ďalší pozitívny rast ERV na pozadí pokračujúceho dopytu nájomcov, ktorý je pozitívne ovplyvnený sekulárnymi faktormi rastu v regióne strednej a východnej Európy. Úroveň prenájmu v strednej a východnej Európe zostáva cenovo dostupná; a napriek zaznamenanému silnému rastu začali z výrazne nižších absolútnych úrovní ako v krajinách západnej Európy. V reálnom vyjadrení je nájomné na mnohých trhoch strednej a východnej Európy stále nižšie ako v roku 2010.

EPRA NTA na akciu sa zvýšila z 15,92 EUR k 31. decembru 2023 na 17,52 EUR k 30. septembru 2024, čo predstavuje nárast o 10,11 TP3T. Nárast je spôsobený najmä precenením (+1,29 EUR), špecifickým upraveným EPRA EPS (+0,60 EUR), čiastočne kompenzovaným vyplatenou dividendou (-0,28 EUR).

Pevná súvaha a silná likvidita

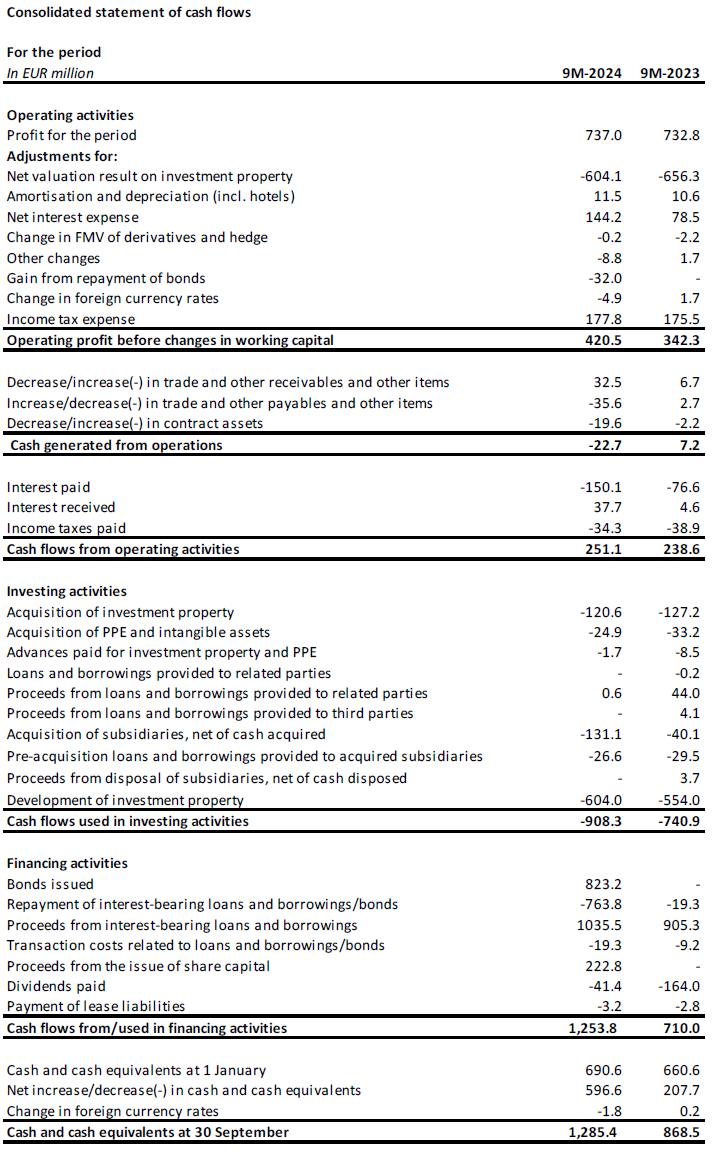

V súlade so svojím proaktívnym a obozretným prístupom skupina profituje z pevnej likvidnej pozície na financovanie svojich rastových ambícií, s fixnými nákladmi na dlh a konzervatívnym profilom splácania.

Počas prvých 9 mesiacov roka skupina získala 1,8 miliardy EUR:

- Šesťročný zabezpečený úverový rámec vo výške 100 miliónov EUR so syndikátom talianskych a českých bánk pri fixnej celkovej cene 4,91 TP3T;

- 750 miliónov eur šesťročný zelený dlhopis v MS +220 bps pri kupóne 4,75%;

- 7-ročný zabezpečený úverový rámec vo výške 90 miliónov EUR s rakúskou bankou s fixnými celkovými nákladmi 4,91 TP3T;

- 168 miliónov eur sedemročný zabezpečený úverový rámec so syndikátom slovenských a rakúskych bánk s fixnou celkovou cenou 5,11 TP3T;

- 75 miliónov eur zo šesťročného zeleného dlhopisu vydaného vo februári 2024 v ČŠ +171 bps;

- 500 miliónov EUR päťročný nezabezpečený úverový rámec so syndikátom medzinárodných bánk s fixnou celkovou cenou 4,71 TP3T; a

- Sedemročný zabezpečený úverový rámec vo výške 150 miliónov EUR navýšený syndikátom talianskych a českých bánk pri fixnej celkovej cene 4 351 TP3T.

V priebehu roka CTP dokončila aj dve ponuky tendra na dlhopisy, pričom odkúpila späť 750 miliónov eur krátkodobých dlhopisov, čím dosiahla kapitálový zisk vo výške 31,9 milióna eur, znížila splatnosti dlhov v rokoch 2025 a 2026 a proaktívne rozšírila svoj profil splatnosti.

Likviditná pozícia skupiny predstavovala 1,8 miliardy eur, z toho 1,3 miliardy eur v hotovosti a peňažných ekvivalentoch a nevyčerpaných 550 miliónov eur.

Priemerná cena dlhu CTP bola 2,731 TP3T (31. december 2023: 1,951 TP3T), pričom 99,71 TP3T dlhu bolo fixovaných alebo zaistených do splatnosti. Skupina nekapitalizuje úroky z vývoja, preto sú všetky úrokové náklady zahrnuté do výkazu ziskov a strát. Priemerná splatnosť dlhu bola 5,0 roka (31. december 2023: 5,3 roka).

Prvá významná nadchádzajúca splatnosť Skupiny je 272 miliónov EUR[2] dlhopis splatný v júni 2025, ktorý bude splatený z dostupných hotovostných rezerv.

LTV spoločnosti CTP dosiahla k 30. septembru 2024 hodnotu 44,91 TP3T, čo je pokles zo 46,21 TP3T k 30. júnu 2024 vďaka ABB[3]. CTP očakáva, že LTV bude klesať, keďže precenenia vývoja skupiny sú plne zaúčtované.

Aktíva skupiny s vyšším výnosom, vďaka ich hrubému výnosu portfólia 6,51 TP3T, vedú k zdravej úrovni pákového efektu peňažných tokov, ktorý sa odráža aj v normalizovanom čistom dlhu voči EBITDA vo výške 9,0-násobok (31. december 2023: 9,2-násobok), ktorý Zoskupte ciele tak, aby sa držali pod 10x.

Skupina mala k 30. septembru 2024 59% nezabezpečený dlh a 41% zabezpečený dlh, s dostatočným priestorom v rámci jej zmlúv o teste zabezpečeného dlhu a testu nezaťaženého majetku.

S racionalizáciou oceňovania na trhu s dlhopismi sú teraz podmienky konkurencieschopnejšie ako ceny na trhu bankových úverov, čo umožní Skupine prehodnotiť rovnováhu smerom k nezabezpečeným úverom.

| 30. septembra 2024 | Covenant | |

| Test zabezpečeného dlhu | 19.5% | 40% |

| Test nezaťažených aktív | 190.6% | 125% |

| Pomer úrokového krytia | 2,75x | 1.5x |

V Q3-2024 Moody's a S&P potvrdili úverový rating CTP Baa3 a BBB- so stabilným výhľadom.

Potvrdená dividenda a usmernenie

Dynamika lízingu zostáva silná, s veľkým dopytom zo strany nájomcov a klesajúcou novou ponukou, čo vedie k pokračujúcemu rastu nájomného. CTP má dobrú pozíciu na to, aby ťažila z týchto trendov. Plynovod skupiny je vysoko ziskový a vedie ho nájomca. YoC pre plynovod CTP sa zvýšil na 10,41 TP3T vďaka klesajúcim stavebným nákladom a rastu nájomného. Ďalšia fáza rastu je postavená a financovaná, s 1,9 milióna m2 vo výstavbe k 30. septembru 2024, s cieľom dodať 1,2 – 1,3 milióna m2 v roku 2024.

Robustná kapitálová štruktúra CTP, disciplinovaná finančná politika, silný prístup na úverový trh, popredná pozemková banka, odbornosť v oblasti vnútropodnikovej výstavby a hlboké vzťahy s nájomcami umožňujú CTP plniť svoje ciele. CTP očakáva, že v roku 2027 dosiahne príjmy z prenájmu vo výške 1,0 miliardy EUR, poháňané dokončením vývoja, indexáciou a reverziou, a je na dobrej ceste dosiahnuť do konca desaťročia 20 miliónov m2 GLA a 1,2 miliardy EUR príjmov z prenájmu.

Skupina potvrdzuje svoje usmernenia EPRA EPS na rok 2024, ktoré sú špecifické pre spoločnosť upravenú v hodnote 0,80 – 0,82 EUR, ktoré sa v dôsledku nárastu akcií po ABB v septembri očakávajú smerom k dolnej hranici.

Dividendová politika CTP je vyplácať 70% - 80% upraveného zisku na akciu EPRA špecifického pre spoločnosť. Štandardne sa vypláca dividenda v hotovosti, ale akcionári sa môžu rozhodnúť pre výplatu dividendy v hotovosti.

WEBCAST A KONFERENČNÝ HOVOR PRE ANALYTIKOV A INVESTOROV

Dnes o 9:00 (GMT) a 10:00 (CET) bude spoločnosť organizovať videoprezentáciu a zasadnutie s otázkami a odpoveďami pre analytikov a investorov prostredníctvom živého webového vysielania a audiokonferenčného hovoru.

Ak si chcete pozrieť živé webové vysielanie, zaregistrujte sa vopred na adrese:

https://www.investis-live.com/ctp/6707916fb2cedb000e393936/laper

Ak sa chcete k prezentácii pripojiť telefonicky, vytočte jedno z nasledujúcich čísel a zadajte prístupový kód účastníka 427163.

Nemecko +49 32 22109 8334

Francúzsko +33 9 70 73 39 58

Holandsko +31 85 888 7233

Spojené kráľovstvo +44 20 3936 2999

Spojené štáty americké +1 646 787 9445

Stlačením tlačidla *1 položíte otázku, stlačením tlačidla *2 otázku stiahnete alebo stlačením tlačidla *0 získate pomoc operátora.

Záznam bude k dispozícii na webovej stránke CTP do 24 hodín po prezentácii: https://www.ctp.eu/investors/financial-reports/

FINANČNÝ KALENDÁR CTP

| Akcia | Dátum |

| Výsledky FY-2024 | 27. februára 2025 |

| Výročné valné zhromaždenie | 22. apríla 2025 |

| Výsledky za 1. štvrťrok 2025 | 8. mája 2025 |

| Výsledky H1-2025 | 7. augusta 2025 |

| Dni kapitálového trhu | 24. – 25. septembra 2025 |

| Výsledky 3. štvrťroka 2025 | 6. novembra 2025 |

KONTAKTNÉ ÚDAJE PRE OTÁZKY ANALYTIKOV A INVESTOROV:

Maarten Otte, vedúci oddelenia pre vzťahy s investormi

Mobilný telefón: +420 730 197 500

E-mail: [email protected]

KONTAKTNÉ ÚDAJE PRE OTÁZKY MÉDIÍ:

Patryk Statkiewicz, vedúci oddelenia marketingu a PR skupiny

Mobilný telefón: +31 (0) 629 596 119

E-mail: [email protected]

O spoločnosti CTP

CTP je najväčším európskym kótovaným vlastníkom, developerom a správcom logistických a priemyselných nehnuteľností podľa hrubej prenajímateľnej plochy, pričom k 30. septembru 2024 vlastní 12,6 milióna m2 GLA v 10 krajinách. CTP certifikuje všetky nové budovy podľa BREEAM Veľmi dobré alebo lepšie a zarobené hodnotenie ESG so zanedbateľným rizikom od Sustainalytics, čo podčiarkuje jej záväzok byť udržateľným podnikaním. Pre viac informácií navštívte firemnú webovú stránku CTP: www.ctp.eu

Zrieknutie sa zodpovednosti

Toto oznámenie obsahuje určité výhľadové vyhlásenia týkajúce sa finančnej situácie, výsledkov činnosti a podnikania spoločnosti CTP. Tieto výhľadové vyhlásenia môžu byť identifikované použitím výhľadovej terminológie, vrátane výrazov "verí", "odhaduje", "plánuje", "projektuje", "očakáva", "predpokladá", "zamýšľa", "ciele", "môže", "ciele", "pravdepodobne", "by", "mohol", "môže mať", "bude" alebo "mal by" alebo v každom prípade ich negatívnych alebo iných variácií alebo porovnateľnej terminológie. Výhľadové vyhlásenia sa môžu podstatne líšiť a často sa aj líšia od skutočných výsledkov. V dôsledku toho by sa na žiadne výhľadové vyhlásenie nemal pripisovať neprimeraný vplyv. Táto tlačová správa obsahuje dôverné informácie v zmysle článku 7 ods. 1 nariadenia (EÚ) č. 596/2014 zo 16. apríla 2014 (nariadenie o zneužívaní trhu).

[1] Pri kombinácii miestneho CPI a CPI EÚ-27 / eurozóny len obmedzený počet stropov.

[2] Zostávajúca suma po vysporiadaní ponuky dňa 28.6.2024.

[3] K 30. septembru 2024 bolo vyrovnaných iba 227 miliónov EUR voľne plávajúcich akcií, 73 miliónov EUR akcií upísaných generálnym riaditeľom a zakladateľom bolo vyrovnaných v prvý októbrový týždeň po výplate dividend.

Prihláste sa na odber nášho newslettera

Získajte najnovšie informácie od lídra na trhu s priemyselnými nehnuteľnosťami priamo do svojej e-mailovej schránky.