Rezultate CTP NV S1-2025

STRONG LEASING ACTIVITY IN H1-2025 WITH 11% MORE SQM OF LEASES SIGNED, LIKE-FOR-LIKE RENTAL GROWTH OF 4.9%, AND EPRA NTA PER SHARE UP 13.5% YOY TO €19.36

AMSTERDAM, 7 August 2025 – CTP N.V. (CTPNV.AS), (“CTP”, the “Group” or the “Company”) recorded in H1-2025 Gross Rental Income of €367.2 million, up 14.4% y-o-y, and like-for-like y-o-y rental growth of 4.9%, mainly driven by indexation and reversion on renegotiations and expiring leases. Leasing remained strong in the first half of the year with 11% more leases signed y-o-y. The average monthly rent on the new leases signed increased by 5% y-o-y[1].

As at 30 June 2025, the annualised rental income increased to €757 million, while occupancy remained at 93% and the rent collection rate was 99.7%.

In the first half of the year, CTP delivered 224,000 sqm at a Yield on Cost (“YoC”) of 10.3% with 100% let at completion, bringing the Group’s standing portfolio to 13.5 million sqm of GLA. The like-for-like revaluation came to 4.0%, driven by ERV growth of 2.5%, with an average 11bps reversionary yield compression, while the Gross Asset Value (“GAV”) increased by 7.2% to €17.1 billion, and 15.9% y-o-y. EPRA NTA per share increased by 7.1% in H1 to €19.36 and 13.5% y-o-y, supported also by progress in the development pipeline.

Company specific adjusted EPRA earnings increased by 12.2% y-o-y to €199.3 million. CTP’s Company-specific adjusted EPRA EPS amounted to €0.42, an increase of 6.2%. The y-o-y increase in Company-specific adjusted EPRA EPS was negatively affected by the increased number of shares resulting from the equity raise in H2-2024. Thanks to our backloaded deliveries and net development income to the second half of the year, the Group is on track to reach the guidance of €0.86 – €0.88 for 2025, which represents 8 – 10% growth compared to 2024.

As at 30 June 2025, projects under construction totalled 2.0 million sqm with an expected YoC of 10.3%, and a potential rental income of €160 million when fully leased.

The Group’s landbank amounted to 26.1 million sqm, of which 22.2 million sqm is owned and on-balance sheet. This landbank secures substantial future growth potential for CTP, with 90% located around the existing business parks (58% in existing parks, 31% in new parks with a potential of over 100,000 GLA). Combined with its industry-leading YoC, CTP expects to continue to generate double-digit NTA growth in the years to come.

We are benefiting particularly from the nearshoring trend, shown by our growth with Asian manufacturing tenants, who made up around 20% of our overall leasing activity in the last 18 months, compared to an over 10% share of our overall portfolio.

The annualised rental income increased to €757 million. Our next phase of growth is already locked in through our 2.0 million sqm of GLA under construction and landbank of 26.1 million sqm, meaning we can continue generating double-digit NTA growth over the coming years. We are confident that we can achieve our ambitious goals and reach 1 billion annualized rental income in 2027.”

Puncte cheie

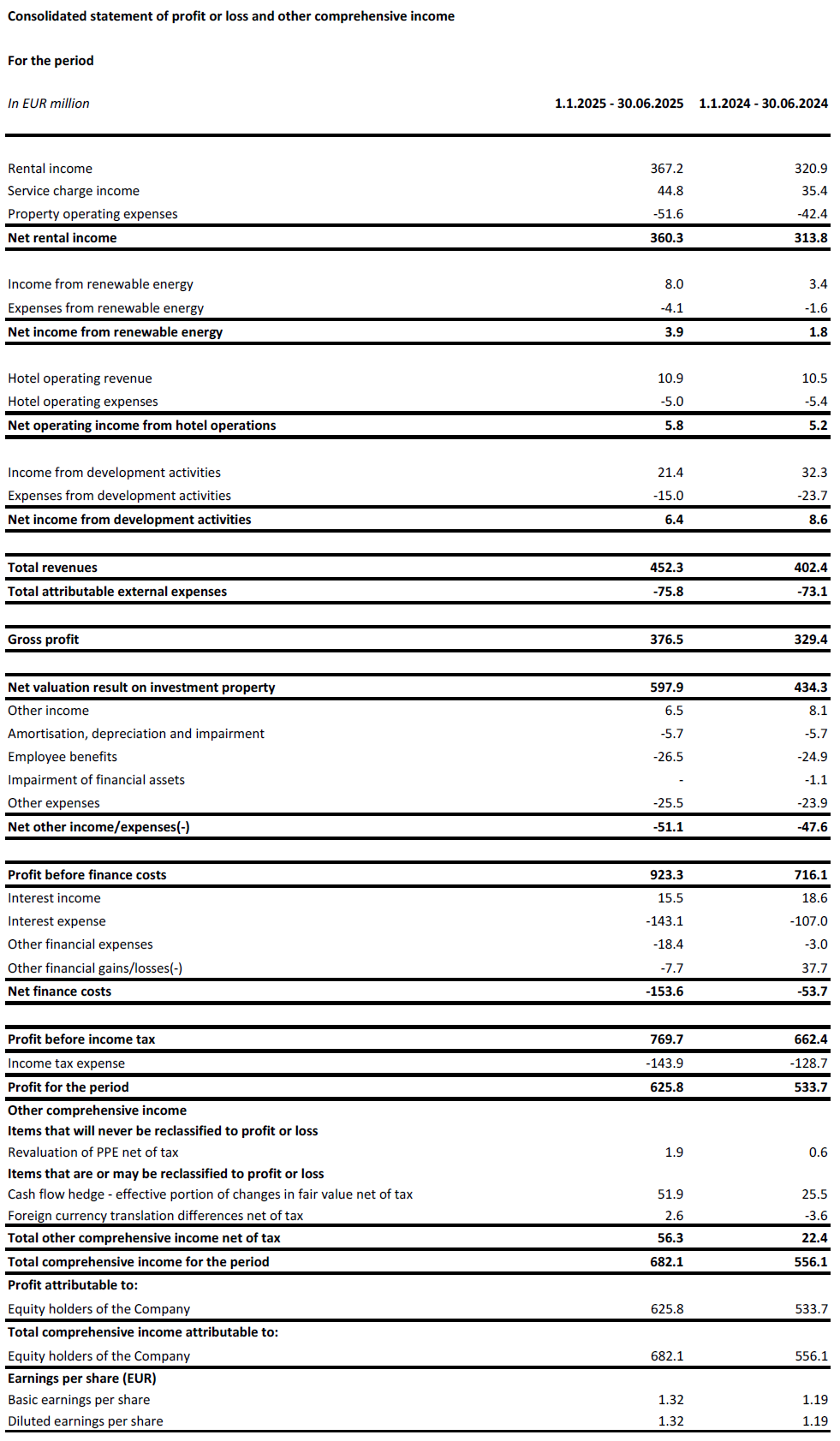

| În milioane de euro | S1-2025 | H1-2024 | % schimbare |

| Venit brut din chirie | 367.2 | 320.9 | +14.4% |

| Venituri nete din chirii | 360.3 | 313.8 | +14.8% |

| Rezultatul net al evaluării investițiilor imobiliare | 597.9 | 434.3 | +37.7% |

| Profitul perioadei | 625.8 | 533.7 | +17.2% |

| Câștiguri EPRA ajustate specifice societății | 199.3 | 177.6 | +12.2% |

| În euro | S1-2025 | H1-2024 | % schimbare |

| EPRA EPS ajustat EPRA specific societății | 0.42 | 0.40 | +6.2% |

| În milioane de euro | 30 June 2025 | 31 decembrie 2024 | % schimbare |

| Investiții imobiliare ("PI") | 15,463.5 | 14,655.3 | +5.5% |

| Investiții imobiliare în curs de dezvoltare ("IPuD") | 1,416.4 | 1,076.8 | +31.5% |

| 30 June 2025 | 31 decembrie 2024 | % schimbare | |

| EPRA NTA pe acțiune | €19.36 | €18.08 | +7.1% |

| YoC preconizat pentru proiectele în construcție | 10.3% | 10.3% | |

| LTV | 44.9% | 45.3% |

Cererea continuă și puternică a chiriașilor conduce la creșterea chiriilor

In H1-2025, CTP signed leases for 1,015,000 sqm, an increase of 11% compared to the same period in 2024, with an average monthly rent per sqm of €5.98 (H1-2024: €5.59). Adjusting for the differences among the country mix, rents increased on average by 5%.

| Contracte de închiriere semnate pe mp | Q1 | Q2 | YTD | Q3 | Î4 | FY |

| 2023 | 297,000 | 552,000 | 849,000 | 585,000 | 542,000 | 1,976,000 |

| 2024 | 336,000 | 582,000 | 919,000 | 577,000 | 618,000 | 2,113,000 |

| 2025 | 416,000 | 599,000 | 1,015,000 | |||

| Creștere anuală | +24% | +3% | +11% |

| Chirie medie lunară a contractelor de închiriere semnate pe mp (€) | Q1 | Q2 | YTD | Q3 | Î4 | FY |

| 2023 | 5.31 | 5.56 | 5.47 | 5.77 | 5.81 | 5.69 |

| 2024 | 5.65 | 5.55 | 5.59 | 5.69 | 5.79 | 5.68 |

| 2025 | 6.17 | 5.91 | 5.98 |

Aproximativ două treimi din contractele de închiriere semnate au fost cu chiriași existenți, în conformitate cu modelul de afaceri al CTP de creștere cu chiriașii existenți în parcurile existente.

Generarea fluxului de numerar prin portofoliu permanent și achiziții

CTP’s average market share in the Czech Republic, Romania, Hungary, and Slovakia came to 28.2% as at 30 June 2025 and it remains the largest owner and developer of industrial and logistics real estate assets in those markets. The Group is also the market leader in Serbia and Bulgaria.

With more than 1,500 clients, CTP has a wide and diversified international tenant base, consisting of blue-chip companies with strong credit ratings. CTP’s tenants represent a broad range of industries, including manufacturing, high-tech/IT, automotive, e-commerce, retail, wholesale, and 3PLs. The tenant base is highly diversified, with no single tenant accounting for more than 2.5% of the Company’s annual rent roll, which leads to a stable income stream. CTP’s top 50 tenants only account for 36.0% of its rent roll and the vast majority of clients rent space in multiple CTParks.

The Company’s occupancy came to 93% (FY-2024: 93%). The Group’s client retention rate remains strong at 85% (FY-2024: 87%) and demonstrates CTP’s ability to leverage long-standing client relationships. The portfolio WAULT stood at 6.2 years (FY-2024: 6.4 years), in line with the Company’s target of >6 years.

Rent collection level stood at 99.7% in H1-2025 (FY-2024: 99.8%), with no deterioration in the payment profile of tenants.

Rental income in H1-2025 amounted to €367.2 million, up 14.4% y-o-y on an absolute basis, mainly driven by deliveries and like-for-like growth. On a like-for-like basis, rental income grew 4.9%, thanks to indexation and reversion on renegotiations and expiring leases.

The Group has put measures in place to limit service charge leakage, which resulted in the improvement of the Net Rental Income to Rental Income ratio from 97.8% in H1-2024 to 98.1% in H1-2025. Consequently, the Net Rental Income increased 14.8% y-o-y.

O proporție tot mai mare din veniturile din chirii generate de portofoliul de investiții al CTP beneficiază de protecție împotriva inflației. De la sfârșitul anului 2019, toate contractele de leasing noi ale Grupului includ o clauză de indexare bazată pe IPC, care calculează creșterile anuale ale chiriei ca fiind cea mai mare dintre:

- o creștere fixă de 1,5%-2,5% pe an; sau

- indicele prețurilor de consum[2].

As at 30 June 2025, 72% of income generated by the Group’s portfolio includes this double indexation clause, and the Group expects this to increase further.

The reversionary potential came to 14.9%. New leases have been signed continuously above the Estimated Rental Value („ERV”), ilustrând o creștere puternică și continuă a chiriilor pe piață și susținând evaluările.

The annualised rental income came to €757 million as at 30 June 2025, an increase of 11.5% y-o-y, showcasing the strong cash flow growth of CTP’s investment portfolio.

H1 developments delivered with a 10.3% YoC and 100% let at delivery

CTP și-a continuat investițiile disciplinate în portofoliul său foarte profitabil.

In H1-2025, the Group completed 224,000 sqm of GLA (H1-2024: 328,000 sqm). The developments were delivered at a YoC of 10.3%, 100% let and will generate contracted annual rental income of €12.1 million. As usual, the deliveries in 2025 are skewed to the fourth quarter.

While average construction costs in 2022 were around €550 per sqm, in 2023 and 2024 they came to €500 per sqm and remained stable in H1-2025. This allows the Group to continue to deliver its industry-leading YoC above 10%, which is also supported by CTP’s unique park model and in-house construction and procurement expertise.

As at 30 June 2025, the Group had 2.0 million sqm of buildings under construction with a potential rental income of €160 million and an expected YoC of 10.3%. CTP has a long track record of delivering sustainable growth through its tenant-led development in its existing parks. 79% of the Group’s projects under construction are in existing parks, while 9% are in new parks which have the potential to be developed to more than 100,000 sqm of GLA. Planned 2025 deliveries are 53% pre-let, up from 35% as at FY-2024. Pre-let in existing parks stood at 47%, while the new parks pre-let was at 80%, showcasing the low risk embedded in the pipeline. CTP expects to reach 80%-90% pre-letting at delivery, in line with historical performance. As CTP acts as general contractor in most markets, it is fully in control of the process and timing of deliveries, allowing the Company to speed-up or slow-down depending on tenant demand, while also offering tenants flexibility in terms of their building requirements.

In 2025 the Group is expecting to deliver between 1.2 – 1.7 million sqm, depending on tenant demand. The 106,000 sqm of leases that are already signed for future projects — construction of which hasn’t started yet — are a further illustration of continued occupier demand.

CTP’s landbank amounted to 26.1 million sqm as at 30 June 2025 (31 December 2024: 26.4 million sqm), which allows the Company to reach its target of 20 million sqm GLA by the end of the decade. The Group is focusing on mobilising the existing landbank, while maintaining disciplined capital allocation in landbank replenishment. 58% of the landbank is located within CTP’s existing parks, while 31% is in, or is adjacent to, new parks which have the potential to grow to more than 100,000 sqm. 15% of the landbank was secured by options, while the remaining 85% was owned and accordingly reflected in the balance sheet.

Assuming a build-up ratio of 2 sqm of land to 1 sqm of GLA, CTP can build over 13 million sqm of GLA on its secured landbank. CTP’s land is held on balance sheet at around €60 per sqm and construction costs amount on average to approximately €500 per sqm, bringing total investment costs to approximately €620 per sqm. The Group’s standing portfolio is valued around €1,040 per sqm, resulting in a revaluation potential of around €400 per sqm built.

Monetizarea afacerii energetice

CTP își continuă planul de extindere pentru lansarea sistemelor fotovoltaice. Cu un cost mediu de ~750.000 EUR per MWp, Grupul vizează un YoC de 15% pentru aceste investiții.

CTP has an installed PV capacity of 138 MWp, of which 108 MWp is fully operational.

In H1-2025 the revenues from renewable energy came to €8.0 million, up 136% y-o-y mainly driven by the increase in capacity installed throughout 2024.

Ambiția de sustenabilitate a CTP merge mână în mână cu un număr tot mai mare de chiriași care solicită sisteme fotovoltaice, deoarece acestea le oferă i) o mai bună securitate energetică, ii) un cost de ocupare mai mic, iii) respectarea reglementărilor în creștere, iv) respectarea cerințelor clienților și v) posibilitatea de a-și îndeplini propriile ambiții ESG.

Rezultatele evaluării sunt determinate de pipeline și de reevaluarea pozitivă a portofoliului actual

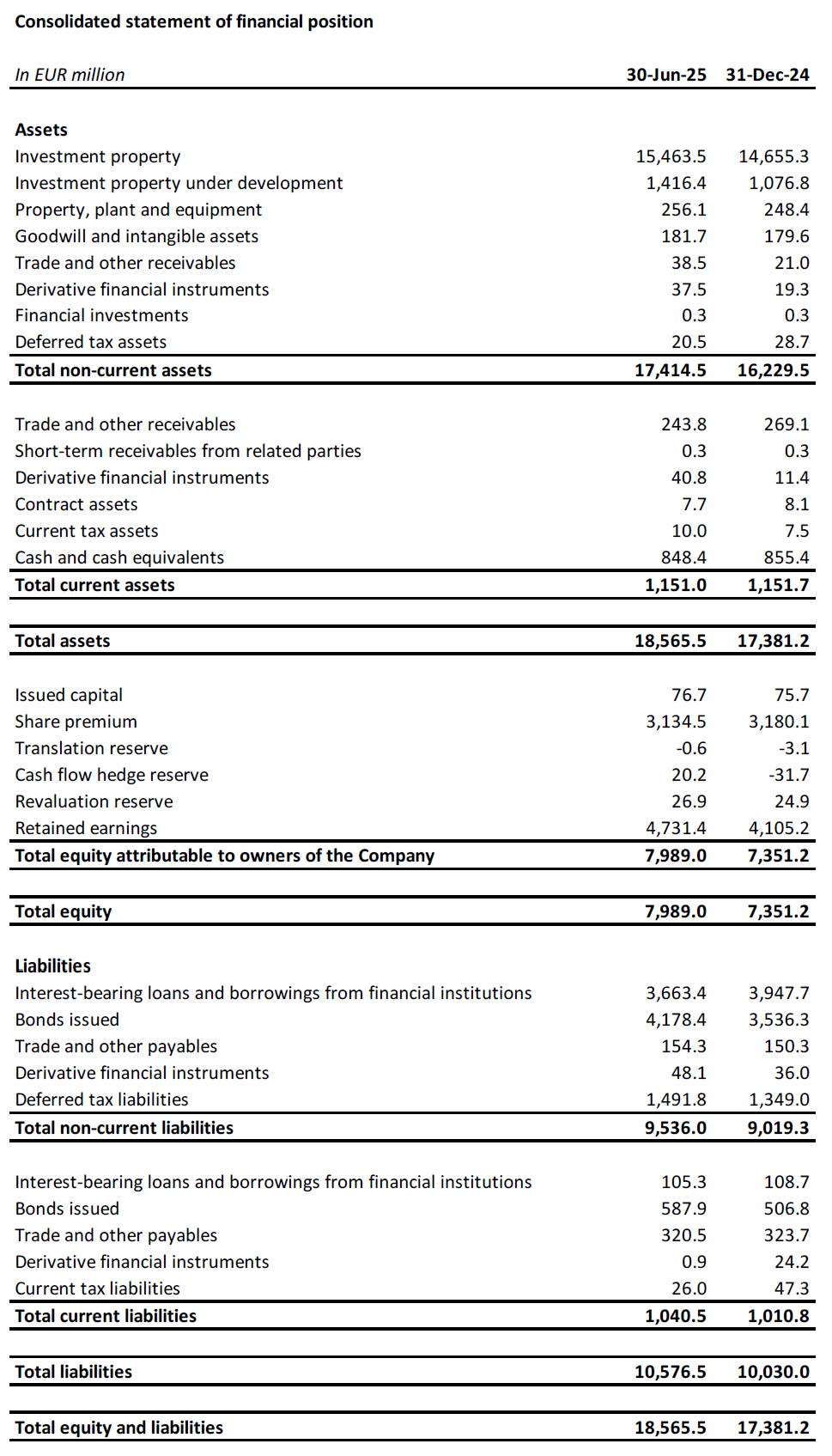

Investment Property (“IP”) valuation increased from €14.7 billion as at 31 December 2024 to €15.5 billion as at 30 June 2025, driven by the transfer of completed projects from Investment Property under Development (“IPuD”) to IP and positive revaluation of standing portfolio.

IPuD increased by 31.5% from 31 December 2024 to €1.4 billion as at 30 June 2025, driven by the CAPEX spent, the revaluation due to increase pre-letting and construction progress, and the start of new construction projects in H1-2025.

GAV increased to €17.1 billion as at 30 June 2025, up 7.2% compared to 31 December 2024.

The revaluation in H1-2025 came to €597.9 million, driven by the positive revaluation of IPuD projects (+€181.3 million), landbank (+€43.1 million), and the standings assets (+€373.6 million).

On a like-for-like basis, CTP’s portfolio saw a valuation increase of 4.0% during H1-2025, driven by an ERV growth of 2.5%.

CTP anticipează o creștere pozitivă suplimentară a ERV-ului pe fondul cererii continue din partea chiriașilor, care este influențată pozitiv de factorii de creștere seculară din regiunea CEE. Nivelurile chiriilor din CEE rămân accesibile, în ciuda creșterii puternice observate, deoarece acestea au pornit de la niveluri absolute semnificativ mai mici decât în țările din Europa de Vest. În termeni reali, chiriile din multe piețe CEE sunt încă sub nivelurile din 2010.

The Group’s portfolio has conservative valuation yields of 7.0%. CTP saw further yield compression during the first half of 2025 of 11bps on average across the portfolio and expects further yield compression over second part of 2025. The yield differential between CEE and Western European logistics is expected to decrease over time, driven by the higher growth expectations for the CEE region and increasing activity in the investment markets.

EPRA NTA per share increased from €18.08 as at 31 December 2024 to €19.36 as at 30 June 2025, representing an y-o-y increase of 13.5% and an increase of 7.1% in H1-2025. The increase is mainly driven by the revaluation (+€1.25), Company specific adjusted EPRA EPS (+€0.42) and offset by final 2024 dividend paid out in May (-€0.30) and other items (-€0.09).

Bilanț robust și poziție solidă de lichiditate

În conformitate cu abordarea sa proactivă și prudentă, Grupul beneficiază de o poziție solidă de lichiditate pentru a-și finanța ambițiile de creștere, cu un cost fix al datoriei și un profil de rambursare conservator.

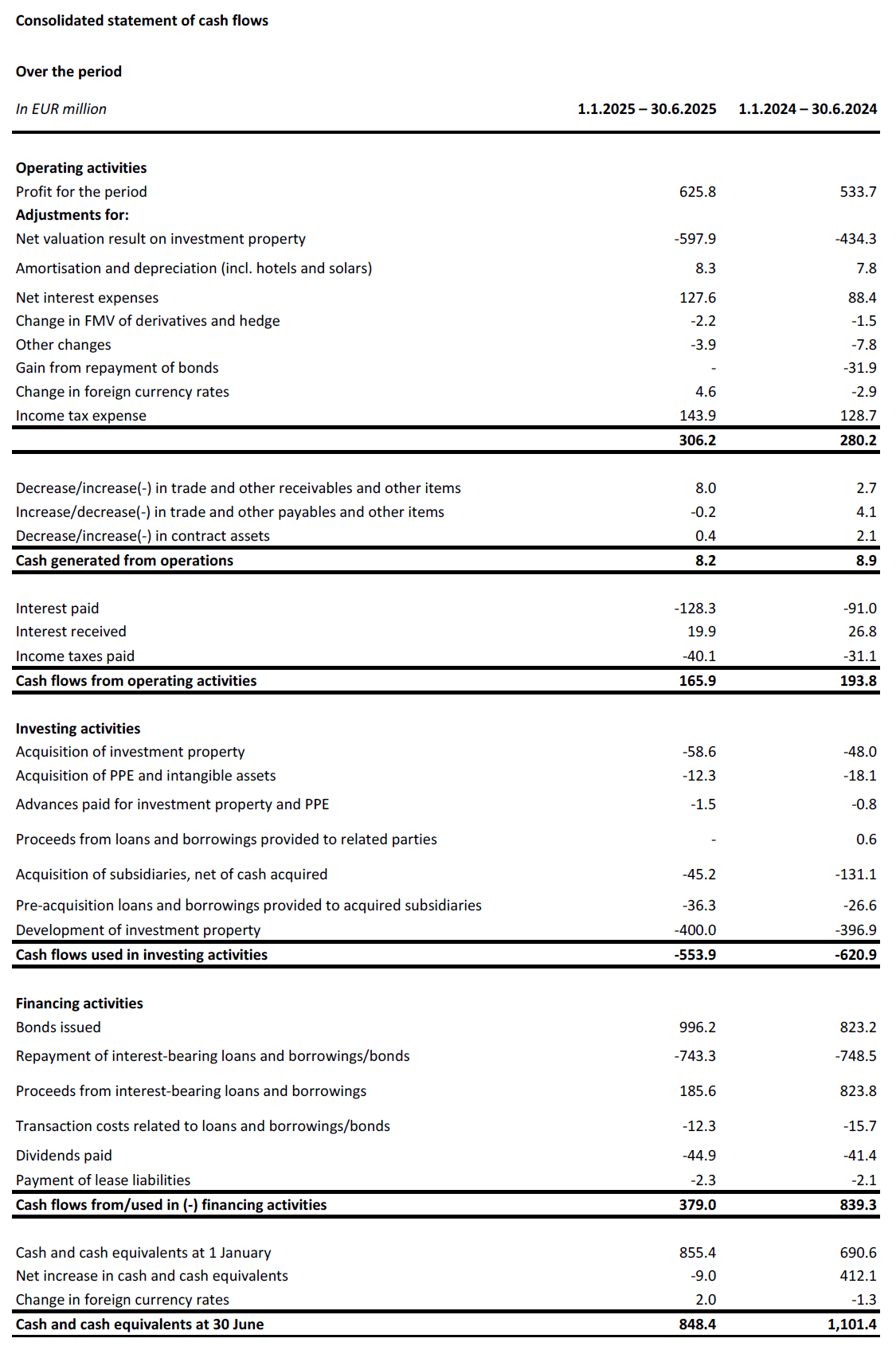

During H1-2025, the Group secured €1.7 billion to fund its organic growth:

- A €1.0 billion dual-tranche green bond with a €500 million six-year tranche at MS +145bps at a coupon of 3.625% and a €500 million ten-year tranche at MS +188bps at a coupon of 4.25%;

- A JPY30 billion (€185 million equivalent) five-year unsecured loan facility with a syndicate of Asian banks at TONAR +130bps and fixed all-in cost of 4.1%; and

- A €500 million five-year unsecured sustainability-linked loan facility with a syndicate of 13 European and Asian banks at fixed all-in cost of 3.7%, undrawn as of 30 June 2025.

CTP continued to actively manage its bank loan portfolio in H1-2025. Margin reduction on a further €159 million of secured bank loans was negotiated and €441 million of unsecured term loan signed in 2023 was prepaid and will be refinanced by the new €500 million unsecured loan. Both allowed CTP to achieve material interest rate savings and reduce the overall cost of debt going forward.

The Group’s liquidity position stood at €2.1 billion, comprised of €0.8 billion of cash and cash equivalents, and an undrawn RCF of €1.3 billion.

CTP’s average cost of debt stood at 3.2% (FY-2024: 3.1%), slightly up compared to year-end 2024, due to new funding. 99.9% of the debt is fixed rate or hedged until maturity.

Grupul nu capitalizează dobânzile aferente dezvoltărilor, prin urmare, toate cheltuielile cu dobânzile sunt incluse în contul de profit și pierdere. Maturitatea medie a datoriei a fost de 5,1 ani (anul fiscal 2024: 5,0 ani).

The Group repaid €272 million bond in June 2025 from its available cash. Next upcoming maturity is a €185 million bond due in October 2025, which will also be repaid from available cash reserves.

CTP’s LTV decreased to 44.9% as at 30 June 2025 mainly due to the positive revaluation of standing portfolio and investment properties under development.

The Group’s higher yielding assets, thanks to their gross portfolio yield of 6.6%, lead to a healthy level of cash flow leverage that is also reflected in the normalized Net Debt to EBITDA of 9.2x (FY-2024: 9.1x), which the Group targets to keep below 10x.

The Group had 66% unsecured debt and 34% secured debt as at 30 June 2025, with ample headroom under its Secured Debt Test and Unencumbered Asset Test covenants.

Pe măsură ce prețurile de pe piața obligațiunilor s-au raționalizat, condițiile sunt acum mai competitive decât prețurile de pe piața de creditare bancară, ceea ce va permite Grupului să se reechilibreze mai mult față de creditarea negarantată.

| 30 June 2025 | Pact | |

| Testul privind datoriile garantate | 15.7% | 40% |

| Testul activelor libere de sarcini | 194.9% | 125% |

| Rata de acoperire a dobânzii | 2,4x | 1.5x |

In Q3-2024, S&P confirmed CTP’s BBB- credit rating with a stable outlook. In January 2025, CTP was assigned an A- credit rating with a stable outlook by the Japanese rating agency JCR. In Q2-2025, Moody’s upgraded outlook from stable to positive on Baa3 credit rating.

Îndrumare

Leasing dynamics remain strong, with robust occupier demand, and decreasing new supply leading to continued rental growth. CTP is well positioned to benefit from these trends. The Group’s pipeline is highly profitable, and tenant led. The YoC for CTP’s current pipeline remained at industry leading 10.3%. The next stage of growth is built in and financed, with 2.0 million sqm under construction as at 30 June 2025, with a target to deliver between 1.2 – 1.7 million sqm in 2025.

Structura robustă de capital a CTP, politica financiară disciplinată, accesul solid la piața creditelor, banca funciară lider în industrie, expertiza internă în construcții și relațiile solide cu chiriașii permit CTP să își îndeplinească obiectivele. CTP se așteaptă să atingă venituri din chirii de 1,0 miliard de euro în 2027, impulsionate de finalizările dezvoltărilor, indexare și reversare a proprietăților, și este pe cale să atingă 20 de milioane de metri pătrați de suprafață închiriabilă și 1,2 miliarde de euro venituri din chirii înainte de sfârșitul deceniului.

The Group set a guidance of €0.86 – €0.88 Company-specific adjusted EPRA EPS for 2025. This is driven by our strong underlying growth, with around 4% like-for-like growth, partly offset by a higher average cost of debt due to the (re)-financing in 2024 and 2025.

Dividende

CTP announces an interim dividend of €0.31 per ordinary share, an increase of 6.9% compared to interim dividend 2024, and which represents a pay-out of 74% of the Company specific adjusted EPRA EPS, in line with the Group’s 70% – 80% dividend policy pay-out ratio. The default is a scrip dividend, but shareholders can opt for payment of the dividend in cash.

WEBCAST ȘI CONFERINȚĂ TELEFONICĂ PENTRU ANALIȘTI ȘI INVESTITORI

Astăzi, la ora 9.00 (GMT) și 10.00 (CET), compania va găzdui o prezentare video și o sesiune de întrebări și răspunsuri pentru analiști și investitori, prin intermediul unei transmisiuni în direct pe internet și al unei conferințe telefonice audio.

Pentru a viziona transmisiunea în direct pe internet, vă rugăm să vă înregistrați în avans la:

https://www.investis-live.com/ctp/6863c5976c0d660016f95b35/kalwt

Pentru a participa la prezentare prin telefon, vă rugăm să formați unul dintre următoarele numere și să introduceți codul de acces al participantului 893972.

Țările de Jos +31 85 888 7233

Regatul Unit +44 20 3936 2999

United States +1 646 664 1960

Apăsați *1 pentru a pune o întrebare, *2 pentru a vă retrage întrebarea sau *0 pentru asistență din partea operatorului.

O înregistrare va fi disponibilă pe site-ul CTP în termen de 24 de ore de la prezentare: https://ctp.eu/investors/financial-results/

CALENDARUL FINANCIAR AL CTP

| Acțiune | Data |

| Zilele pieței de capital (Wuppertal, Germania) | 24-25 septembrie 2025 |

| Rezultate Q3-2025 | 6 noiembrie 2025 |

| Rezultatele anului fiscal 2025 | 26 februarie 2026 |

DETALII DE CONTACT PENTRU SOLICITĂRI DE INFORMAȚII DIN PARTEA ANALIȘTILOR ȘI A INVESTITORILOR:

Maarten Otte, Șeful Relațiilor cu Investitorii și Piețelor de Capital

Mobil: +420 730 197 500

Email: maarten.otte@ctp.eu

DETALII DE CONTACT PENTRU SOLICITĂRI DE INFORMAȚII DIN PARTEA PRESEI:

Email: ctp@secnewgate.co.uk

Despre CTP

CTP este cel mai mare proprietar, dezvoltator și administrator de proprietăți imobiliare logistice și industriale listate la bursă din Europa, după suprafața brută închiriabilă, deținând 13,5 milioane mp de GLA în 10 țări la 30 iunie 2025. CTP certifică toate clădirile noi conform BREEAM Foarte bine sau mai bine și a obținut un rating ESG de risc neglijabil din partea Sustainalytics, subliniind angajamentul său de a fi o afacere sustenabilă. Pentru mai multe informații, vizitați site-ul web corporativ al CTP: www.ctp.eu

Disclaimer

Acest anunț conține anumite declarații cu caracter prospectiv cu privire la situația financiară, rezultatele operațiunilor și activitatea CTP. Aceste declarații anticipative pot fi identificate prin utilizarea terminologiei anticipative, inclusiv a termenilor "crede", "estimează", "planifică", "proiectează", "anticipează", "se așteaptă", "intenționează", "țintește", "poate", "urmărește", "probabil", "ar putea", "ar putea", "ar putea avea", "va avea" sau "ar trebui" sau, în fiecare caz, forma negativă a acestora sau alte variante sau terminologie comparabilă. Declarațiile prospective pot să difere și deseori diferă în mod semnificativ de rezultatele reale. Prin urmare, nu trebuie să se acorde o influență nejustificată niciunei declarații prospective. Acest comunicat de presă conține informații privilegiate, astfel cum sunt definite la articolul 7 alineatul (1) din Regulamentul (UE) 596/2014 din 16 aprilie 2014 (Regulamentul privind abuzul de piață).

[1] Ajustat pentru un mix de țări.

[2] Cu o combinație de IPC local și UE-27/zona euro, doar un număr limitat de plafoane.

Înscrieți-vă la newsletter-ul nostru

Primește cele mai recente informații de la liderul pieței imobiliare industriale direct în căsuța ta poștală.