CTP NV H1-2025 業績

2025 年上半年租賃活動強勁,新簽訂租約面積增加 11% 平方米,同店租金增長 4.9%,每股淨資產 (EPRA NTA) 年增 13.5%,至 19.36 歐元

阿姆斯特丹,2025年8月7日 CTP NV (CTPNV.AS)(簡稱「CTP」、「集團」或「公司」)2025年上半年錄得3.672億歐元總租金收入,年成長14.41億歐元,年比租金成長4.91億歐元,主要受指數化以及重新談判和到期租約的複歸影響。上半年租賃市場維持強勁,新簽訂租約年增111億歐元。新簽訂租約的平均月租金年增51億歐元。[1].

截至 2025 年 6 月 30 日,年租金收入增加至 7.57 億歐元,入住率維持在 93%,租金收取率為 99.7%。

上半年,CTP交付了22.4萬平方米的物業,成本收益率(“YoC”)為10.3%,竣工時出租面積為100%,使集團的現有物業組合總可出租面積達到1350萬平方米。受ERV成長2.5%的推動,同店重估價達4.0%,平均復歸收益率壓縮11個基點。總資產價值(「GAV」)成長7.2%,達到171億歐元,較去年同期成長15.9%。上半年每股EPRA淨資產收益率(NTA)成長7.1%,達到19.36歐元,較去年同期成長13.5%,也得益於開發專案進展。

公司特定調整後 EPRA 收益年增 12.2%,達到 1.993 億歐元。 CTP 的公司特定調整後 EPRA 每股盈餘為 0.42 歐元,成長 6.2%。公司特定調整後 EPRA 每股盈餘的年增率受到 2024 年下半年股權增發導致的股份數量增加的負面影響。由於我們下半年的後期交付和淨開發收入,集團預計將實現 2025 年 0.86 至 0.88 歐元的預期收益,與 2024 年相比增長 8 至 10%。

截至 2025 年 6 月 30 日,在建工程總面積為 200 萬平方米,預估年增率為 10.3%,全部出租後潛在租金收入為 1.6 億歐元。

集團土地儲備達2610萬平方米,其中自有及表內土地儲備2220萬平方米。這些土地儲備為CTP未來巨大的成長潛力提供了保障,其中90%位於現有商業園區週邊(現有園區58%,新建園區31%,潛在總可出租面積超過10萬平方公尺)。結合其行業領先的年增長率,CTP預計未來幾年將繼續實現兩位數的淨資產價值(NTA)成長。

我們尤其受益於近岸外包趨勢,這體現在我們與亞洲製造業租戶的成長上,在過去 18 個月中,亞洲製造業租戶占我們整體租賃活動的約 20%,而我們整體投資組合中的這一比例超過 10%。

年化租金收入增加至7.57億歐元。我們200萬平方公尺的在建總可出租面積和2,610萬平方公尺的土地儲備已鎖定下一階段的成長,這意味著我們能夠在未來幾年繼續實現兩位數的淨租金收入成長。我們有信心實現雄心勃勃的目標,在2027年實現10億歐元的年化租金收入。

主要亮点

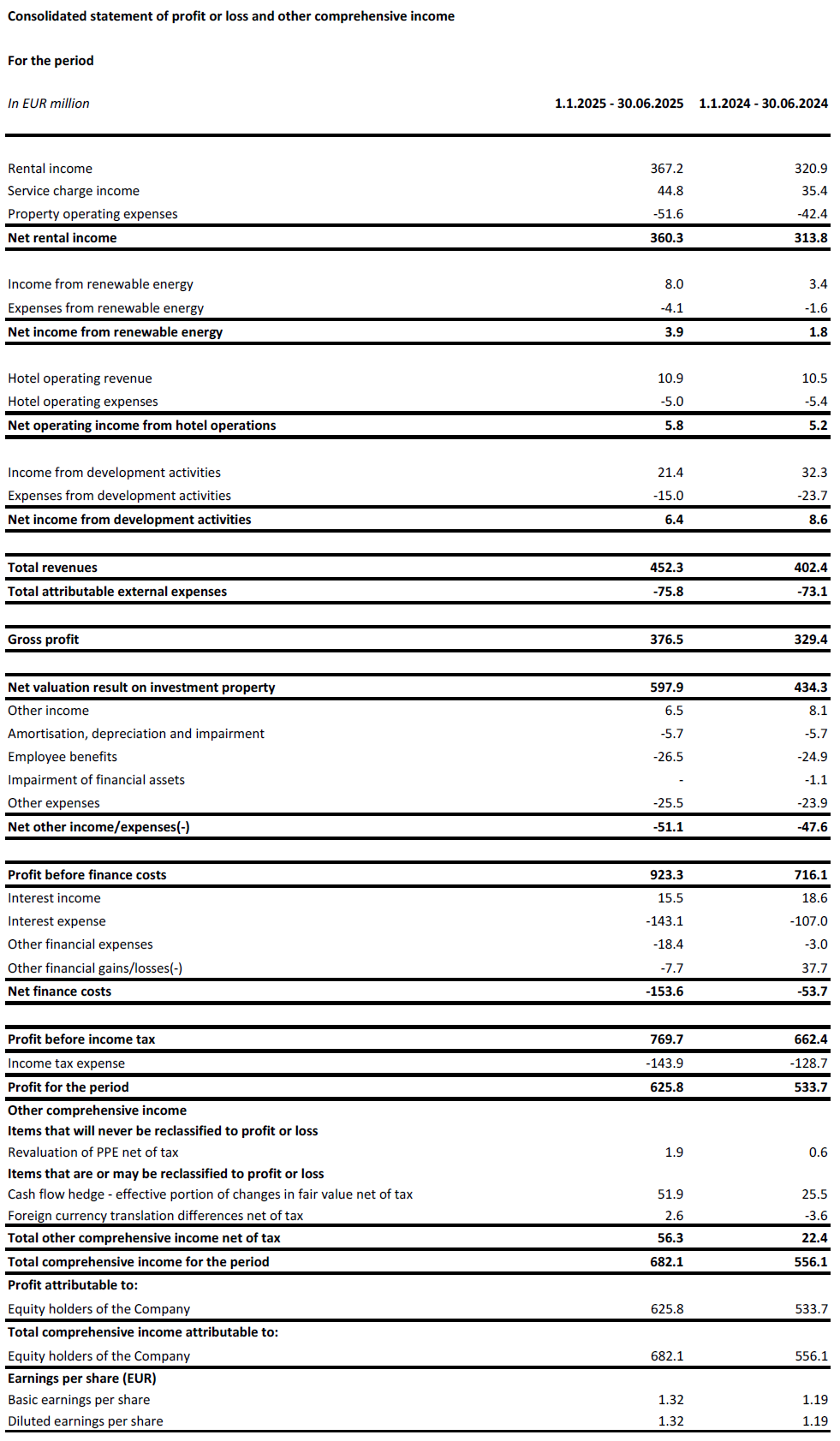

| 单位:百万欧元 | 2025年上半年 | 2024 年 H1 | %變化 |

| 總租金收入 | 367.2 | 320.9 | +14.4% |

| 净租金收入 | 360.3 | 313.8 | +14.8% |

| 投资性房地产净估值结果 | 597.9 | 434.3 | +37.7% |

| 本期利润 | 625.8 | 533.7 | +17.2% |

| 公司特定调整后 EPRA 盈利 | 199.3 | 177.6 | +12.2% |

| 欧元 | 2025年上半年 | 2024 年 H1 | %變化 |

| 公司特定调整后 EPRA EPS | 0.42 | 0.40 | +6.2% |

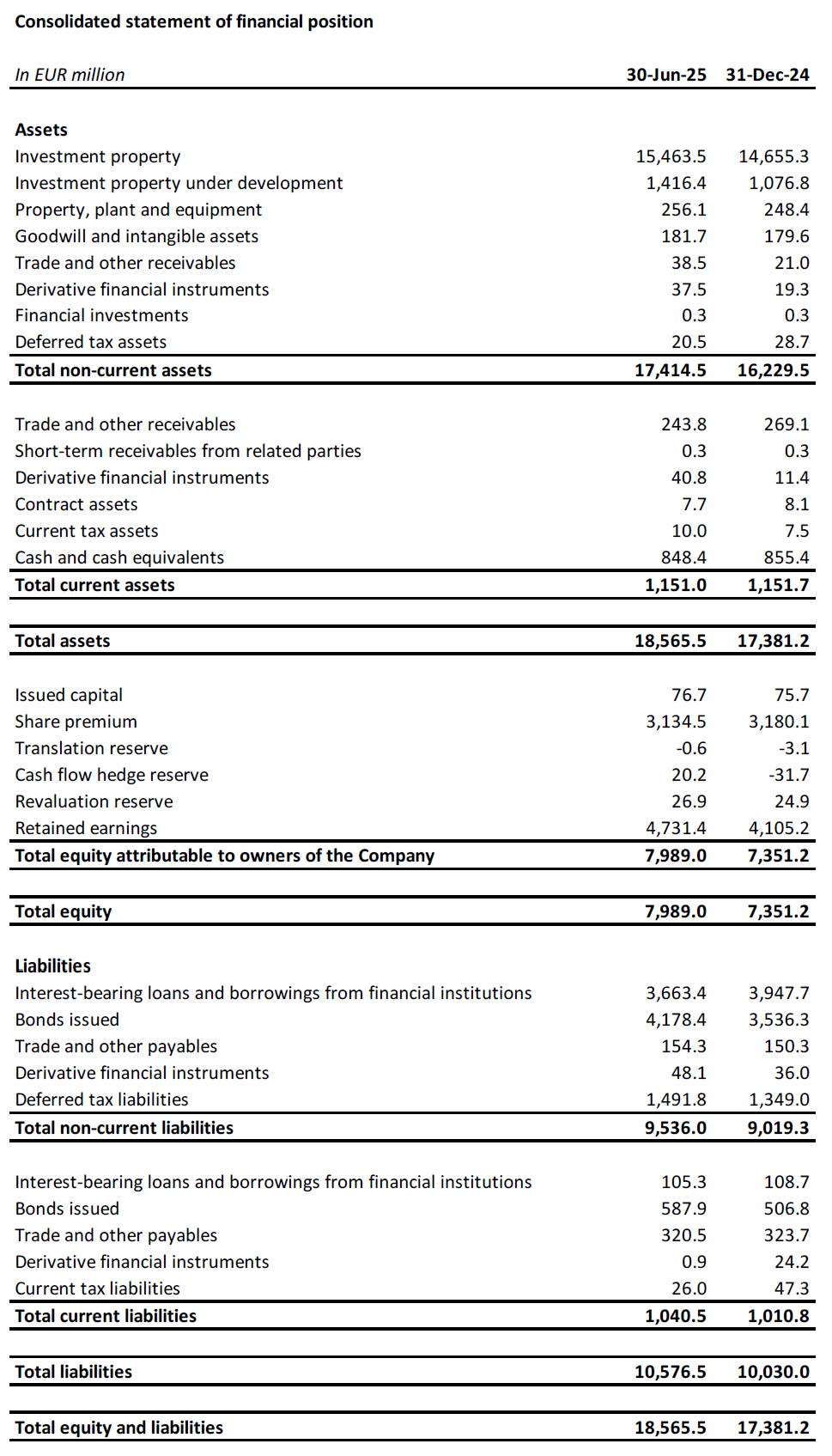

| 单位:百万欧元 | 2025年6月30日 | 2024 年 12 月 31 日 | %變化 |

| 投资性房地产("IP) | 15,463.5 | 14,655.3 | +5.5% |

| 开发中投资物业(IPuD) | 1,416.4 | 1,076.8 | +31.5% |

| 2025年6月30日 | 2024 年 12 月 31 日 | %變化 | |

| 每股 EPRA NTA | €19.36 | €18.08 | +7.1% |

| 在建项目的预期年收益率 | 10.3% | 10.3% | |

| LTV | 44.9% | 45.3% |

持續強勁的租戶需求推動租金成長

2025年上半年,CTP簽訂了1,015,000平方米的租賃合同,與2024年同期相比增加了11%,平均每平方米月租金為5.98歐元(2024年上半年:5.59歐元)。調整國家之間的差異後,租金平均上漲了5%。

| 按平方米计算的已签订租约 | Q1 | Q2 | 年度 | Q3 | 第四季 | 風雲 |

| 2023 | 297,000 | 552,000 | 849,000 | 585,000 | 542,000 | 1,976,000 |

| 2024 | 336,000 | 582,000 | 919,000 | 577,000 | 618,000 | 2,113,000 |

| 2025 | 416,000 | 599,000 | 1,015,000 | |||

| 年成長 | +24% | +3% | +11% |

| 每平方米签订的平均月租租赁合同(欧元) | Q1 | Q2 | 年度 | Q3 | 第四季 | 風雲 |

| 2023 | 5.31 | 5.56 | 5.47 | 5.77 | 5.81 | 5.69 |

| 2024 | 5.65 | 5.55 | 5.59 | 5.69 | 5.79 | 5.68 |

| 2025 | 6.17 | 5.91 | 5.98 |

簽訂的租約中約有三分之二是與現有租戶簽訂的,這符合 CTP 與現有公園現有租戶共同成長的商業模式。

透過常設投資組合和收購產生現金流

截至2025年6月30日,CTP在捷克共和國、羅馬尼亞、匈牙利和斯洛伐克的平均市場份額達到28.2%,並繼續保持這些市場最大的工業和物流房地產資產所有者和開發商地位。該集團在塞爾維亞和保加利亞也是市場領導者。

CTP 擁有超過 1,500 名客戶,擁有廣泛且多元化的國際租戶基礎,其中包括信用評級良好的藍籌公司。 CTP 的租戶涵蓋各行各業,包括製造業、高科技/IT、汽車、電子商務、零售、批發和第三方物流。租戶基礎高度多元化,沒有一家租戶的年租金收入占公司總租金的 2.5% 以上,從而帶來了穩定的收入來源。 CTP 的前 50 名租戶僅佔其租金收入的 36.0%,絕大多數客戶在多個 CTP 園區租用空間。

該公司的入住率達到93%(2024財年:93%)。集團的客戶留存率保持強勁,達到85%(2024財年:87%),彰顯了CTP利用長期客戶關係的能力。投資組合的WAULT為6.2年(2024財年:6.4年),符合公司6年以上目標。

2025 年上半年租金收取水準為 99.7%(2024 財年:99.8%),租戶的支付狀況並未惡化。

2025年上半年,租金收入達3.672億歐元,絕對值年增14.41兆歐元,主要得益於交付量及年增速。年比來看,租金收入成長4.91兆歐元,這得益於指數化以及重新談判和到期租約的複歸。

集團已採取措施限制服務費流失,導致淨租金收入與租金收入比率從2024年上半年的97.8%改善至2025年上半年的98.1%。因此,淨租金收入較去年同期成長14.8%。

CTP 投資組合產生的租金收入中,越來越多的收入受益於通膨保護。自 2019 年底以來,集團所有新的租賃協議均包含與 CPI 掛鉤的指數化條款,該條款將年度租金增長計算為以下兩者中的較高者:

- 每年固定增加 1.5%-2.5% ;或

- 消费者价格指数[2].

截至 2025 年 6 月 30 日,集團投資組合產生的 72% 收入包含此雙重指數化條款,集團預計這一數字將進一步增加。

復歸潛力達到 14.9%。新租約持續簽署,高於預計租金價值 (「ERV」),顯示市場租金持續強勁成長並支持估值。

截至 2025 年 6 月 30 日,年化租金收入達到 7.57 億歐元,年增 11.5%,顯示 CTP 投資組合的強勁現金流成長。

H1 開發案交付時年化率為 10.3%,出租率為 100%

CTP 继续对其高利润管道进行严格投资。

2025年上半年,集團完工總可出租面積22.4萬平方公尺(2024年上半年:32.8萬平方公尺)。專案交付量為年均10.31萬平方米,出租量為100.1萬平方米,預計年合約租金收入為1210萬歐元。與往常一樣,2025年的交付時間將集中在第四季。

2022年的平均建築成本約為每平方公尺550歐元,而2023年和2024年則降至每平方公尺500歐元,並在2025年上半年保持穩定。這使得集團能夠繼續保持業界領先的年產能(YC)超過10%,這也得益於CTP獨特的園區模式以及內部的建設和採購專業知識。

截至 2025 年 6 月 30 日,集團在建建築面積為 200 萬平方米,潛在租金收入為 1.6 億歐元,預期年增幅為 10.3%。 CTP 長期以來一直透過在現有園區內以租戶為主導的開發案實現永續成長。集團在建案中有 79% 位於現有園區,9% 位於新園區,這些新園區有潛力開發到超過 100,000 平方米的 GLA。計畫 2025 年交付 53% 預租項目,高於 2024 財政年度的 35%。現有園區的預租量為 47%,而新園區的預租量為 80%,顯示工程風險較低。 CTP預計交貨時預租量將達到80%-90%,與歷史表現一致。由於CTP在大多數市場擔任總承包商,因此可以完全掌控交付流程和時間,這使得公司能夠根據租戶需求加快或放慢交貨速度,同時也能為租戶提供靈活的建築需求。

集團預計到2025年,將交付120萬至170萬平方公尺的辦公空間,具體數量取決於租戶需求。目前,集團已簽訂了10.6萬平方公尺的未來專案租賃協議,但尚未開工建設,這進一步表明租戶需求持續成長。

截至2025年6月30日,CTP的土地儲備達2610萬平方米(2024年12月31日:2640萬平方米),這使得公司預計在2020年實現2000萬平方米總可出租面積的目標。集團正致力於盤活現有土地儲備,同時在土地儲備補充方面保持嚴格的資本配置。其中,58%土地儲備位於CTP現有園區內,31%土地儲備位於或毗鄰新園區,這些園區的面積預計將增加至10萬平方公尺以上。 15%土地儲備以選擇權作抵押,其餘85%土地儲備為自有土地儲備,並相應反映在資產負債表中。

假設建築面積比為2平方公尺土地與1平方公尺總可出租面積(GLA)的比率,CTP可在其已抵押土地儲備上建造超過1300萬平方公尺的總可出租面積。 CTP的土地資產負債表價格約為每平方公尺60歐元,平均建築成本約為每平方公尺500歐元,總投資成本約為每平方公尺620歐元。集團現有投資組合價值約為每平方公尺1,040歐元,因此每平方公尺建築面積的重估潛力約為400歐元。

能源業務貨幣化

CTP 繼續實施其光伏系統推廣計劃。每MWp 的平均成本約為75 萬歐元,集團這些投資的目標成本為15%。

CTP 的光伏裝置容量為 138 MWp,其中 108 MWp 已全面投入營運。

2025 年上半年再生能源收入達到 800 萬歐元,年增 136%,主要得益於 2024 年全年安裝容量的增加。

随着越来越多的租户要求使用光伏系统,CTP 的可持续发展目标也随之实现,因为光伏系统可为租户提供 i) 更好的能源安全;ii) 更低的使用成本;iii) 符合更严格的法规;iv) 符合客户要求;v) 能够实现其自身的 ESG 目标。

估值結果受產品線和現有投資組合積極重估推動

投資性房地產(「IP」)估值從 2024 年 12 月 31 日的 147 億歐元增至 2025 年 6 月 30 日的 155 億歐元,這得益於已完成項目從開發中的投資性房地產(「IPuD」)轉移到 IP,以及現有投資組合的積極重估。

截至 2025 年 6 月 30 日,IPuD 為 14 億歐元,較 2024 年 12 月 31 日增加了 31.5%,這主要得益於資本支出、預租和施工進度增加導致的重估以及 2025 年上半年新建設項目的啟動。

截至 2025 年 6 月 30 日,GAV 增至 171 億歐元,較 2024 年 12 月 31 日成長 7.2%。

2025 年上半年的重估達 5.979 億歐元,主要得益於 IPuD 項目(+1.813 億歐元)、土地儲備(+4,310 萬歐元)和基礎資產(+3.736 億歐元)的正重估。

以同類基礎計算,CTP 的投資組合在 2025 年上半年的估值增加了 4.0%,這得益於 ERV 成長了 2.5%。

CTP 預計,在持續的租戶需求的推動下,ERV 將進一步實現正成長,而中東歐地區長期成長動力也將對這一需求產生積極影響。中東歐的租金水準仍然可承受;儘管它們的成長勢頭強勁,但其起點絕對水準卻遠低於西歐國家。實際上,許多中東歐市場的租金仍低於 2010 年的水準。

集團投資組合的保守估價報酬率為7.0%。 CTP在2025年上半年的殖利率進一步壓縮,平均整個投資組合的殖利率下降了11個基點,預計2025年下半年殖利率將進一步壓縮。受中東歐地區成長預期上升以及投資市場活躍度上升的推動,中東歐和西歐物流之間的收益率差異預計將隨著時間的推移而縮小。

每股 EPRA 淨資產收益率 (NTA) 從 2024 年 12 月 31 日的 18.08 歐元增至 2025 年 6 月 30 日的 19.36 歐元,年成長 13.5%,2025 年上半年成長 7.1%。成長主要源自於重估(+1.25 歐元)、公司特定調整後 EPRA 每股收益(+0.42 歐元),並被 5 月派發的 2024 年期末股息(-0.30 歐元)和其他項目(-0.09 歐元)所抵銷。

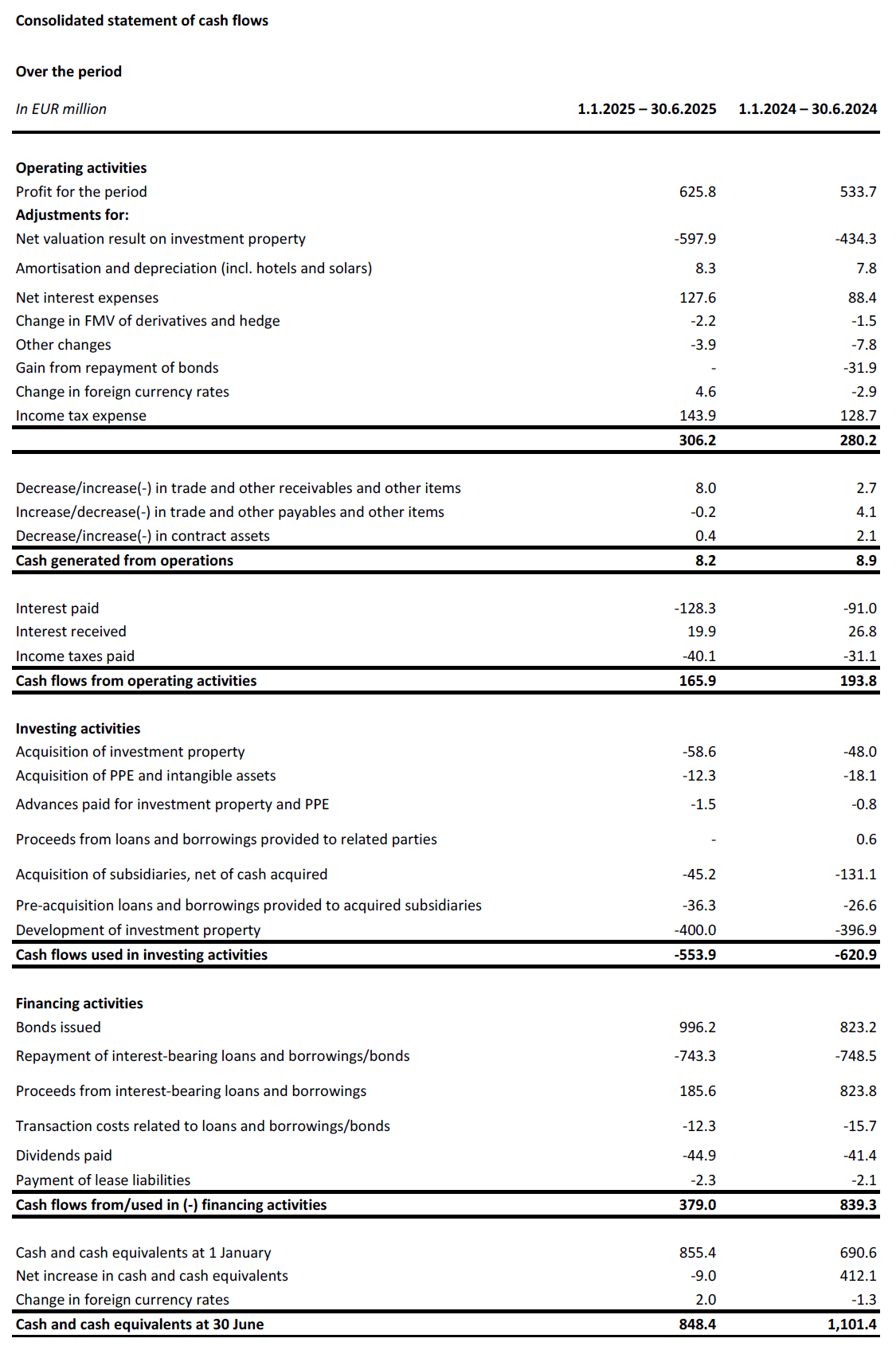

稳健的资产负债表和强劲的流动性

按照积极稳健的方针,集团拥有稳健的流动资金,以固定的债务成本和保守的还款方式,为实现增长目标提供资金支持。

2025 年上半年,集團獲得 17 億歐元資金用於其有機成長:

- 10 億歐元雙檔綠色債券,其中 5 億歐元為六年期檔,利率為 MS +145bps,票面利率為 3.625%;5 億歐元為十年期檔,利率為 MS +188bps,票面利率為 4.25%;

- 與亞洲銀行財團簽訂了 300 億日圓(相當於 1.85 億歐元)五年期無擔保貸款協議,利率為 TONAR +130bps,固定總成本為 4.1%;

- 與 13 家歐洲和亞洲銀行組成的銀團簽訂了一項 5 億歐元的五年期無擔保可持續性掛鉤貸款協議,固定總成本為 3.7%,截至 2025 年 6 月 30 日尚未提取。

2025年上半年,CTP繼續積極管理其銀行貸款組合。經協商,CTP已降低1.59億歐元擔保銀行貸款的保證金,並已預付2023年簽訂的4.41億歐元無擔保定期貸款,並將透過新的5億歐元無擔保貸款進行再融資。這兩項措施使CTP實現了大幅的利率節約,並降低了未來的總債務成本。

該集團的流動資金狀況為 21 億歐元,其中包括 8 億歐元的現金和現金等價物,以及 13 億歐元的未提取 RCF。

CTP 的平均債務成本為 3.2%(2024 財政年度:3.1%),由於新融資,與 2024 年底相比略有上升。 99.9% 的債務為固定利率或避險至到期。

本集團不將開發利息資本化,因此所有利息支出均計入損益表。平均債務期限為 5.1 年(2024 財政年度:5.0 年)。

集團已於2025年6月利用其可用現金償還了2.72億歐元債券。下一筆即將到期的債券是2025年10月到期的1.85億歐元債券,也將利用其可用現金儲備償還。

截至 2025 年 6 月 30 日,CTP 的 LTV 下降至 44.9%,主要原因是現有投資組合和正在開發的投資物業的正向重估。

由於集團的總投資組合收益率為 6.6%,其資產收益率較高,從而帶來了健康的現金流槓桿水平,這也反映在標準化淨債務與 EBITDA 之比為 9.2 倍(2024 財年:9.1 倍)中,集團的目標是將其保持在 10 倍。

截至 2025 年 6 月 30 日,該集團擁有 66% 無擔保債務和 34% 擔保債務,根據擔保債務測試和無抵押資產測試契約,擁有充足的空間。

隨著債券市場定價的合理化,目前的條件比銀行貸款市場的定價更具競爭力,這將使集團能夠更多地重新平衡無抵押貸款。

| 2025年6月30日 | 公约 | |

| 担保债务测试 | 15.7% | 40% |

| 未支配资产测试 | 194.9% | 125% |

| 利息保障比率 | 2.4倍 | 1.5x |

2024年第三季度,標普確認CTP的信用評等為BBB-,展望穩定。 2025年1月,日本評等機構JCR授予CTP A-信用評級,展望穩定。 2025年第二季度,穆迪將Baa3信用評等的展望從穩定上調至正面。

指導

租賃市場依然強勁,租戶需求強勁,新增供應減少,帶動租金持續成長。 CTP 已做好準備,從這些趨勢中獲益。集團的在建工程利潤豐厚,且以租戶為主導。 CTP 現有在建項目的年增長率仍保持行業領先水平,達到 10.3%。下一階段的成長將以建設和融資為主,截至 2025 年 6 月 30 日,在建項目面積為 200 萬平方米,目標是在 2025 年交付 120 萬至 170 萬平方米。

CTP 強大的資本結構、嚴謹的財務政策、強大的信貸市場准入、業界領先的土地儲備、內部建築專業知識和深厚的租戶關係使 CTP 能夠實現其目標。 CTP 預計,在開發完成、指數化和回歸的推動下,2027 年的租金收入將達到 10 億歐元,並預計在 2020 年前達到 2,000 萬平方公尺的 GLA 和 12 億歐元的租金收入。

集團設定了 2025 年公司特定調整後 EPRA EPS 0.86 歐元至 0.88 歐元的指導值。這是由我們強勁的潛在成長推動的,同比增長約為 4%,但由於 2024 年和 2025 年的(再)融資導致的平均債務成本上升,部分抵消了這一增長。

股息

CTP宣布派發每股普通股0.31歐元的中期股息,較2024年中期股息增加6.9%,相當於派發公司特定調整後每股收益(EPRA EPS)74%,與集團70% - 80%的股息政策派息率一致。預設為股票股息,但股東可選擇現金派息。

面向分析师和投资者的网络广播和电话会议

今天上午 9 点(格林尼治标准时间)和上午 10 点(欧洲中部时间),公司将通过网络直播和电话音频会议为分析师和投资者举行视频演示和问答会。

要观看网络直播,请提前在以下网址注册:

https://www.investis-live.com/ctp/6863c5976c0d660016f95b35/kalwt

如需通过电话参加演讲,请拨以下任一号码并输入与会者接入代码 893972.

荷蘭 +31 85 888 7233

英國 +44 20 3936 2999

美國 +1 646 664 1960

按 *1 可提问,按 *2 可撤回问题,按 *0 则可获得接线员帮助。

演讲结束后 24 小时内可在 CTP 网站上查阅录音: https://ctp.eu/investors/financial-results/

CTP 财务日历

| 行动 | 日期 |

| 資本市場日(德國伍珀塔爾) | 2025年9月24-25日 |

| 2025 年第 3 季結果 | 2025 年 11 月 6 日 |

| 2025財年業績 | 2026年2月26日 |

分析师和投资者咨询的详细联系方式:

Maarten Otte,投資人關係與資本市場主管

手机: +420 730 197 500+420 730 197 500

电子邮件: maarten.otte@ctp.eu

媒体垂询联系方式:

电子邮件: ctp@secnewgate.co.uk

关于 CTP

CTP是歐洲最大的上市物流和工業地產所有者、開發商和管理者(以可出租總面積計算),截至2025年6月30日,其在10個國家擁有1350萬平方米的可出租總面積。 CTP所有新建建築均獲得BREEAM「非常好」或更佳的認證,並獲得了Sustainalytics授予的可忽略不計風險的ESG評級,彰顯了其致力於永續發展的承諾。欲了解更多信息,請訪問CTP公司網站: www.ctp.eu

免责声明

本公告包含若干有关 CTP 财务状况、经营业绩和业务的前瞻性陈述。这些前瞻性表述可以通过使用前瞻性术语来识别,包括 "相信"、"估计"、"计划"、"项目"、"预计"、"期望"、"打算"、"目标"、"可能"、"旨在"、"可能"、"会"、"可能"、"可以"、"可以有"、"将 "或 "应该 "等术语,或在每种情况下,其反义词或其他变体或类似术语。前瞻性陈述可能而且经常与实际结果存在实质性差异。因此,不应对任何前瞻性声明施加不当影响。本新闻稿包含 2014 年 4 月 16 日欧盟第 596/2014 号法规(《市场滥用法规》)第 7(1)条所定义的内部信息。

[1] 針對鄉村風格進行了調整。

[2] 結合本地和 EU-27/歐元區 CPI,上限數量有限。

訂閱電子報

將工業房地產市場領導者的最新見解發送到您的收件匣。