CTP NV 2024 财年业绩

CTP 报告净租金收入创纪录达 11 亿欧元,同比增长 19.0%,公司特定调整后每股收益为 0.80 欧元,每股收益 NTA 增长 13.6% 至 18.08 欧元

阿姆斯特丹,2025 年 2 月 27 日 – CTP NV (CTPNV.AS),(“CTP”、“集团”或“公司”)全年录得 6.641 亿欧元总租金收入,同比增长 16.1%,同比租金增长 4.0%,主要受指数化和重新谈判及租约到期复归的影响。截至 2024 年 12 月 31 日,年化租金收入为 7.426 亿欧元,入住率为 93%。

2024 年,CTP 交付了 1,286,000 平方米,成本收益率(“YoC”)为 10.1%,竣工时出租量为 92%,使集团现有投资组合达到 1330 万平方米的 GLA,而总资产价值(“GAV”)增加了 17.2%,达到 160 亿欧元。每股 EPRA NTA 增加了 13.6%,达到 18.08 欧元。

公司特定调整后的 EPRA 收益同比增长 12.5% 至 3.64 亿欧元。CTP 的公司特定调整后 EPRA EPS 为 0.80 欧元,增长 9.9%,符合指导值。集团为 2025 年设定了 0.86 欧元至 0.88 欧元的公司特定调整后 EPRA EPS 指导值。

截至 2024 年 12 月 31 日,在建项目总面积为 180 万平方米,全部出租时潜在租金收入为 1.42 亿欧元,预计年增长率为 10.3%。

集团的土地储备增加至 2640 万平方米,其中自有和资产负债表内土地储备为 2170 万平方米。这些土地储备为 CTP 确保了巨大的未来增长潜力,主要集中在现有商业园区周围。结合其行业领先的 YoC,CTP 预计在未来几年将继续实现两位数的 NTA 增长。

2024 年,CTP 还在 IPO 后成功完成了首次加速簿记建档——超额认购数倍——筹集了 3 亿欧元的股本,为加速开发和收购提供了动力,例如杜塞尔多夫市中心 830,000 平方米的棕地再开发项目。

年化租金收入达 7.43 亿欧元,表明我们现有投资组合的现金流生成能力强劲,租金收款率为 99.8%。虽然下一阶段的增长已经确定,我们有 180 万平方米的 GLA 在建项目和超过 2640 万平方米的土地储备,但我们将继续实现两位数的 NTA 增长。除了当前项目预租外,我们还签署了另外 80,000 平方米的租约,用于未来项目,我们计划很快开始。

中东欧地区对工业和物流房地产的需求受到结构性需求驱动,例如第三方物流对供应链的专业化、电子商务的持续增长以及租户的近岸外包和友岸外包。由于中东欧地区是欧洲成本最低的地区,我们尤其受益于近岸外包趋势,这从亚洲制造业租户在欧洲为欧洲生产的增长中可以看出,他们在 2024 年占我们整体租赁活动的约 20%,而我们整体投资组合的份额为 10%。”

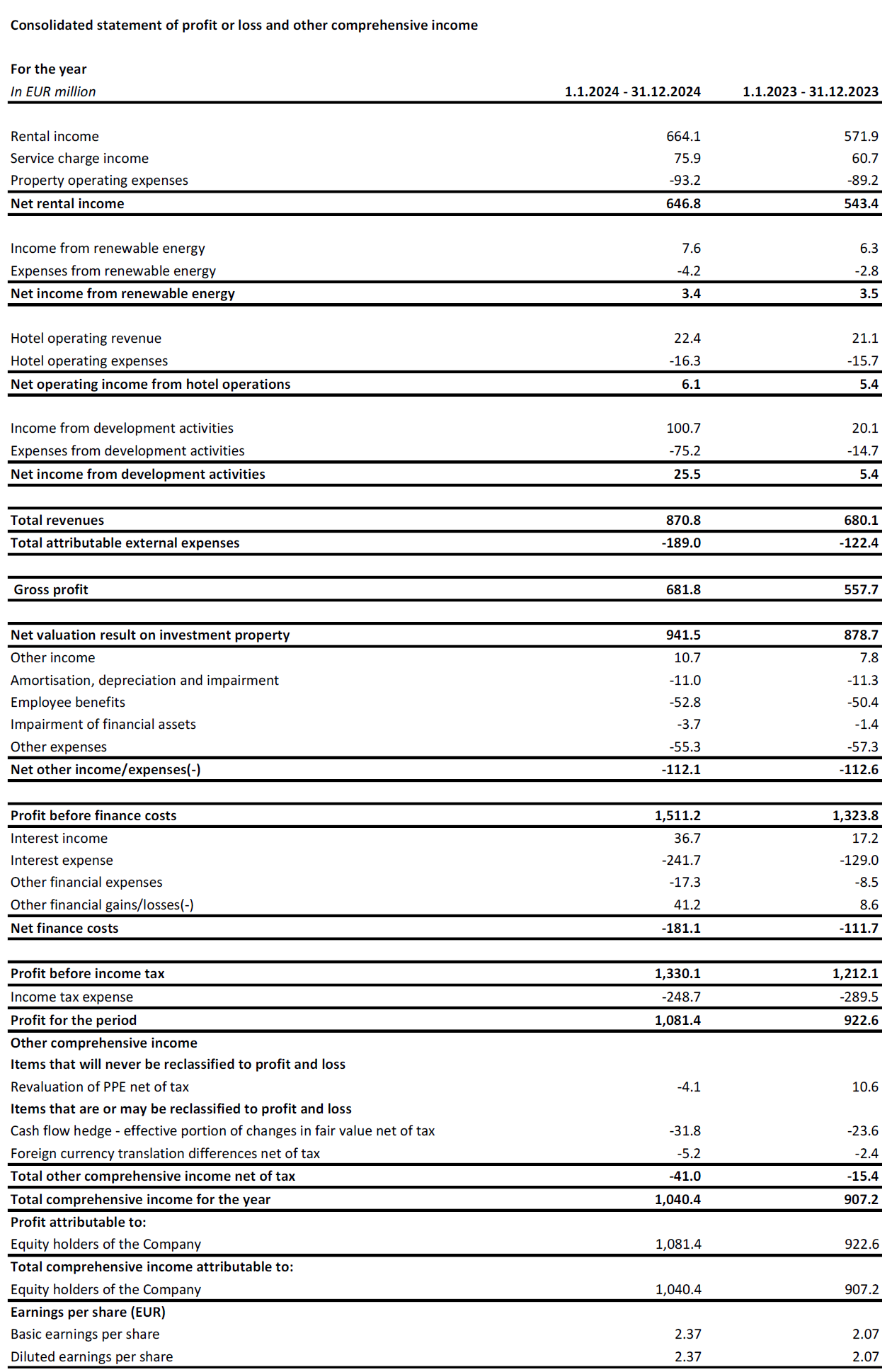

主要亮点[1]

| 单位:百万欧元 | 2024 | 2023 | % 变更 | 2024 年第四季度 | 2023 年第四季度 | % 变更 |

| 总租金收入 | 664.1 | 571.9 | +16.1% | 175.7 | 150.3 | +16.9% |

| 净租金收入 | 646.8 | 543.4 | +19.0% | 170.9 | 140.9 | +21.3% |

| 投资性房地产净估值结果 | 941.5 | 878.7 | +7.1% | 337.4 | 222.4 | +51.7% |

| 本期利润 | 1,081.4 | 922.6 | +17.2% | 344.3 | 189.9 | +81.3% |

| 公司特定调整后 EPRA 盈利 | 364.0 | 323.5 | +12.5% | 94.2 | 85.0 | +10.7% |

| 欧元 | 2024 | 2023 | % 变更 | 2024 年第四季度 | 2023 年第四季度 | % 变更 |

| 公司特定调整后 EPRA EPS | 0.80 | 0.73 | +9.9% | 0.20 | 0.19 | +4.8% |

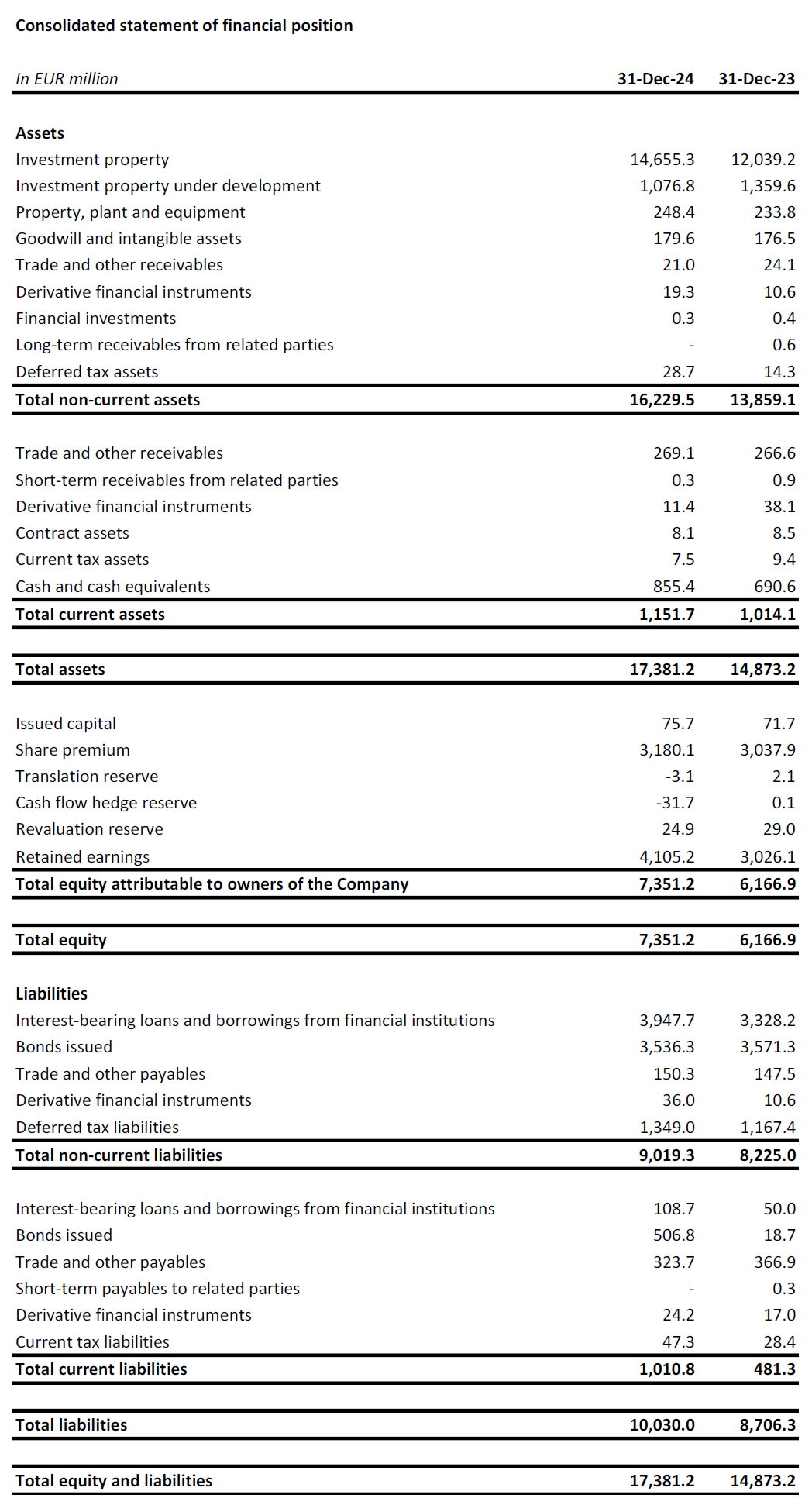

| 单位:百万欧元 | 2024 年 12 月 31 日 | 2023 年 12 月 31 日 | % 变更 | |||

| 投资性房地产("IP) | 14,655.3 | 12,039.2 | +21.7% | |||

| 开发中投资物业(IPuD) | 1,076.8 | 1,359.6 | -20.8% | |||

| 2024 年 12 月 31 日 | 2023 年 12 月 31 日 | % 变更 | ||||

| 每股 EPRA NTA | €18.08 | €15.92 | +13.6% | |||

| 在建项目的预期年收益率 | 10.3% | 10.3% | ||||

| LTV | 45.3% | 46.0% |

租户需求持续强劲推动租金增长

2024 年,CTP 签订了 2,113,000 平方米的租约,比 2023 年增加了 7%,合同年租金收入为 1.44 亿欧元,平均每平方米月租金为 5.68 欧元(2023 年:5.69 欧元)。调整国家组合之间的差异后,租金平均上涨了 3%。

| 按平方米计算的已签订租约 | Q1 | Q2 | Q3 | 第四季度 | 风云 |

| 2022 | 441,000 | 452,000 | 505,000 | 485,000 | 1,883,000 |

| 2023 | 297,000 | 552,000 | 585,000 | 542,000 | 1,976,000 |

| 2024 | 336,000 | 582,000 | 577,000 | 618,000 | 2,113,000 |

| 同比增长 | +13% | +5% | -1% | +14% | +7% |

| 每平方米签订的平均月租租赁合同(欧元) | Q1 | Q2 | Q3 | 第四季度 | 风云 |

| 2022 | 4.87 | 4.89 | 4.75 | 4.80 | 4.82 |

| 2023 | 5.31 | 5.56 | 5.77 | 5.81 | 5.69 |

| 2024 | 5.65 | 5.55 | 5.69 | 5.79 | 5.68 |

签订的租约中约有三分之二是与现有租户签订的,这符合 CTP 与现有公园现有租户共同成长的商业模式。

通过现有投资组合和收购产生现金流

截至 2024 年 12 月 31 日,CTP 在捷克共和国、罗马尼亚、匈牙利和斯洛伐克的平均市场份额增至 28.8%,并且仍然是这些市场中最大的工业和物流房地产资产所有者和开发商。该集团也是塞尔维亚和保加利亚的市场领导者。

CTP 拥有近 1,500 名客户,拥有广泛而多样化的国际租户基础,包括信用评级较高的蓝筹公司。CTP 的租户代表了广泛的行业,包括制造业、高科技/IT、汽车、电子商务、零售、批发和第三方物流。租户基础高度多样化,没有一个租户占公司年租金总额的 2.5% 以上,从而带来稳定的收入来源。CTP 的前 50 名租户仅占其租金总额的 35.2%,并且大部分租赁空间位于多个 CTPark 中。

公司的入住率达到 93%(2023 年:94%)。集团的客户保留率保持强劲,为 87%(2023 年:90%),并展示了 CTP 利用长期客户关系的能力。投资组合 WAULT 为 6.4 年(2023 年:6.5 年),符合公司 6 年以上的目标。

2024 年租金收取水平为 99.8%(2023 年:99.9%),租户的支付状况没有恶化。

租金收入为 6.641 亿欧元,绝对值同比增长 16.1%,主要得益于交付,以及 2024 年上半年在罗马尼亚收购 270,000 平方米 GLA,复归收益率超过 9%。按同类计算,租金收入增长 4.0%,主要得益于重新谈判和到期租约的指数化和复归。

集团已采取措施限制服务费流失,导致净租金收入与租金收入比率从 2023 年的 95.0% 改善至 2024 年的 97.4%。因此,净租金收入同比增长 19.0%。

在 CTP 投资组合产生的租金收入中,越来越多的部分受益于通胀保护。自 2019 年底起,集团的所有新租赁协议都包含双重指数化条款,即每年的租金涨幅按以下两项中的较高者计算:

- 每年固定增加 1.5%-2.5% ;或

- 消费者价格指数[2].

截至 2024 年 12 月 31 日,集团投资组合产生的 71% 收入包含此双重指数化条款,集团预计这一数字还将进一步增加。

复归潜力保持稳定,为 14.5%。新租约的签订量持续高于 ERV,表明市场租金持续强劲增长并支撑估值。

截至 2024 年 12 月 31 日,年化租金收入达到 7.426 亿欧元,同比增长 15.3%,显示 CTP 投资组合的现金流增长强劲。

2024 年开发项目交付,年建筑面积 10.1%,交付时出租率为 92%

CTP 继续对其高利润项目进行严格的投资。2024 年,集团完成了创纪录的 130 万平方米 GLA(2023 年:120 万平方米)。这些开发项目的 YoC 为 10.1%,出租量为 92%,将产生 8340 万欧元的合同年租金收入,当这些项目达到满员入住时,预计还将产生 730 万欧元的收入。

2024 年期间的一些主要交付包括:CTPark Warsaw West(波兰)169,000 平方米、CTPark Budapest Szigetszentmiklós(匈牙利)120,000 平方米、CTPark Ploiesti(罗马尼亚)87,000 平方米、CTPark Bucharest West(罗马尼亚)67,000 平方米、CTPark Warsaw South(波兰)57,000 平方米、CTPark Novi Sad East(塞尔维亚)52,000 平方米、CTPark Zabrze(波兰)48,000 平方米、CTPark Weiden(德国)44,000 平方米、CTPark Budapest Ecser(匈牙利)37,000 平方米、CTPark Žilina Airport(斯洛伐克)37,000 平方米。

2022 年的平均建筑成本约为每平方米 550 欧元,而 2023 年和 2024 年则达到每平方米 500 欧元。这使得该集团能够继续实现行业领先的 10% 以上的 YoC,这也得益于 CTP 独特的园区模式以及内部建筑和采购专业知识。

截至 2024 年 12 月 31 日,集团在建建筑面积为 180 万平方米,潜在租金收入为 1.42 亿欧元,预计 YoC 为 10.3%。CTP 长期以来一直通过现有园区的租户主导开发实现可持续增长。集团在建项目中有 80% 位于现有园区,而 7% 位于新园区,这些园区有可能开发为超过 100,000 平方米的 GLA。计划 2025 年交付 35% 预租。CTP 预计交付时将达到 80%-90% 预租,与历史表现一致。由于 CTP 在大多数市场中担任总承包商,因此它完全控制交付过程和时间,使公司能够根据租户需求加快或减慢速度,同时还为租户提供建筑要求方面的灵活性。

2025 年,集团预计将交付 120 万至 170 万平方米的办公空间,具体取决于租户需求。目前已签订的未来项目租约有 8 万平方米,但尚未开工,这进一步表明租户需求持续增长。

截至 2024 年 12 月 31 日,CTP 的土地储备为 2640 万平方米(2023 年 12 月 31 日:2340 万平方米),这使公司能够在 2020 年底实现 2000 万平方米 GLA 的目标。该集团专注于调动现有土地储备,同时在土地储备补充方面保持严格的资本配置。57% 的土地储备位于 CTP 现有的园区内,而 33% 位于或毗邻新园区,这些园区有可能增长到 100,000 平方米以上。18% 的土地储备由期权担保,而剩余的 82% 为自有土地,因此反映在资产负债表中。

假设建筑面积比率为 2 平方米土地与 1 平方米 GLA,CTP 可在其有担保的土地储备上建造超过 1300 万平方米的 GLA。CTP 的土地资产负债表价格约为每平方米 60 欧元,建筑成本平均约为每平方米 500 欧元,总投资成本约为每平方米 620 欧元。集团的现有投资组合(不包括较早的德国工业房地产投资信托基金投资组合)价值约为每平方米 1,030 欧元。

能源业务货币化

CTP 继续实施其光伏系统推广扩张计划。该集团的目标是这些投资的 YoC 为 15%,平均成本约为每兆瓦时 75 万欧元。

到 2024 年底,CTP 已安装光伏容量为 138 MWp,其中 66 MWp 已投入运营。

2024年可再生能源收入将达到760万欧元,同比增长22%。

随着越来越多的租户要求使用光伏系统,CTP 的可持续发展目标也随之实现,因为光伏系统可为租户提供 i) 更好的能源安全;ii) 更低的使用成本;iii) 符合更严格的法规;iv) 符合客户要求;v) 能够实现其自身的 ESG 目标。

估值结果受产品线和现有投资组合积极重估推动

投资性房地产(“IP”)的估值从 2023 年 12 月 31 日的 120 亿欧元增加到 2024 年 12 月 31 日的 147 亿欧元,主要原因是已完成的项目从开发中投资性房地产(“IPuD”)转移到 IP、增值收购和积极的重估。

截至 2024 年 12 月 31 日,IPuD 减少 20.8% 至 11 亿欧元,这主要是由于 2024 年第四季度大量交付以及 2025 年第一季度新建筑项目的启动。

截至 2024 年 12 月 31 日,GAV 增加至 160 亿欧元,与 2023 年 12 月 31 日相比增加 17.2%。

2024 年的重估价值达到 9.415 亿欧元,主要得益于 IPuD 项目(+3.804 亿欧元)、土地储备(+6120 万欧元)和排名资产(+4.999 亿欧元)的正重估。同类重估价值达到 5.9%,主要得益于同类 ERV 增长 4.9%。

该集团的投资组合具有保守的估值收益率,过去两年半中回归收益率扩大了 70 个基点,达到 7.1%。CTP 预计,中东欧地区工业和物流行业的收益率已达到峰值。随着西欧市场收益率波动较大,中东欧和西欧物流之间的收益率差异已回到长期平均水平。CTP 预计,随着中东欧地区增长预期的提高,收益率差异将随着时间的推移进一步缩小。

CTP 预计,在租户需求持续增长的背景下,ERV 将进一步增长,而中东欧地区的长期增长动力将对这一需求产生积极影响。中东欧的租金水平仍然可承受;尽管增长强劲,但其绝对水平远低于西欧国家。按实际价格计算,许多中东欧市场的租金仍低于 2010 年的水平。

EPRA NTA 每股从 2023 年 12 月 31 日的 15.92 欧元增至 2024 年 12 月 31 日的 18.08 欧元,增幅为 13.6%。增幅主要由重估 (+1.98 欧元) 和公司特定调整后的 EPRA EPS (+0.80 欧元) 推动,部分被派发的股息 (-0.57 欧元) 抵消。

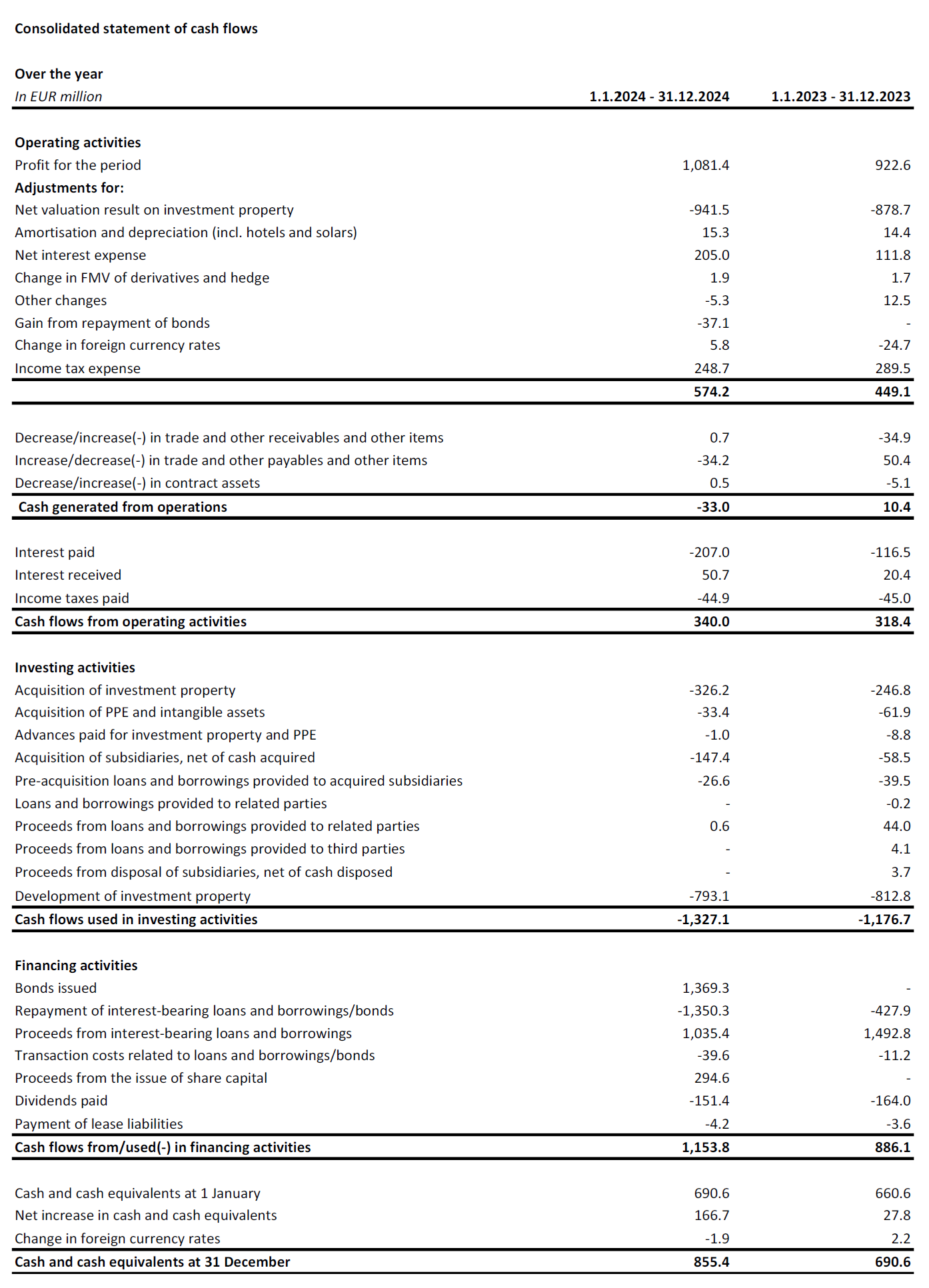

稳健的资产负债表和强劲的流动性

按照积极稳健的方针,集团拥有稳健的流动资金,以固定的债务成本和保守的还款方式,为实现增长目标提供资金支持。

本财年,集团筹集了 24 亿欧元:

- 与意大利和捷克银行财团签订的 1 亿欧元六年期担保贷款,固定总成本为 4.9%;

- 7.5 亿欧元六年期绿色债券,利率为 MS +220 个基点,票面利率为 4.75%;

- 与奥地利一家银行签订了一份 9000 万欧元的七年期担保贷款协议,固定总成本为 4.9%;

- 与斯洛伐克和奥地利银行财团签订了一份为期七年的 1.68 亿欧元担保贷款协议,固定总成本为 5.1%;

- 2 月份发行的六年期绿色债券中,7500 万欧元的发行利率为 MS +171 个基点;

- 与国际银行财团签订的 5 亿欧元五年期无担保贷款协议,固定总成本为 4.7%;

- 与意大利和捷克银行财团签订的为期七年的 1.5 亿欧元担保贷款协议,固定总成本为 4.35%;

- 5 亿欧元八年期绿色债券,利率为 MS +173 个基点,票面利率为 3.875%;以及

- 5000 万欧元五年期绿色债券,利率为 MS +125 个基点,票面利率为 3.427%。

今年,CTP 还完成了三笔债券招标,回购了 9.5 亿欧元的短期债券,实现了 3710 万欧元的资本收益,减少了 2025 年和 2026 年的债务到期日,并积极延长了其到期日。随着利差的下降,CTP 协商降低了 5.699 亿欧元的保证金,并偿还了另外 3.788 亿欧元的有担保银行贷款。

该集团的流动资金状况为 22 亿欧元,包括 9 亿欧元的现金和现金等价物,以及未提取的 RCF,其规模从 5.5 亿欧元增加到 13 亿欧元。

CTP 的平均债务成本为 3.09%(2023 年 12 月 31 日:1.95%),其中 99.9% 债务在到期前固定或对冲。集团不会将开发利息资本化,因此所有利息支出均计入损益表。平均债务期限为 5.0 年(2023 年 12 月 31 日:5.3 年)。

集团第一笔即将到期的重要贷款为 2.72 亿欧元[3] 该债券将于 2025 年 6 月到期,将从可用现金储备中偿还。

由于 2024 年 9 月的股权增资和年底的重新估值,截至 2024 年 12 月 31 日,CTP 的 LTV 为 45.3%,低于 2023 年 12 月 31 日的 46.0%。

得益于集团总投资组合收益率为 6.6%,集团资产收益率较高,从而带来健康的现金流杠杆水平,这也反映在标准化净债务与 EBITDA 之比为 9.1 倍(2023 年 12 月 31 日:9.2 倍)中,集团的目标是将其保持在 10 倍以下。

截至 2024 年 12 月 31 日,该集团拥有 64% 无担保债务和 36% 担保债务,并且根据担保债务测试和无抵押资产测试契约拥有充足的空间。

随着债券市场定价合理化,目前条件比银行贷款市场的定价更具竞争力,这将使集团能够重新平衡无担保贷款。

| 2024 年 12 月 31 日 | 公约 | |

| 担保债务测试 | 16.9% | 40% |

| 未支配资产测试 | 193.2% | 125% |

| 利息保障比率 | 2.6倍 | 1.5x |

2024 年第三季度,穆迪和标准普尔分别确认 CTP 的 Baa3 和 BBB- 信用评级,展望稳定。2025 年 1 月,日本评级机构 JCR 授予 CTP A- 信用评级,展望稳定。

指导

租赁动态保持强劲,租户需求强劲,新供应减少,导致租金持续增长。CTP 处于有利地位,可从这些趋势中受益。该集团的项目利润丰厚,且由租户主导。由于建筑成本下降和租金增长,CTP 项目 YoC 增加至 10.3%。下一阶段的增长是建设和融资,截至 2024 年 12 月 31 日,在建面积为 180 万平方米,目标是在 2025 年交付 120 万至 170 万平方米。

CTP 稳健的资本结构、严格的财务政策、强大的信贷市场准入、行业领先的土地储备、内部建筑专业知识和深厚的租户关系使 CTP 能够实现其目标。在开发竣工、指数化和复归的推动下,CTP 预计到 2027 年租金收入将达到 10 亿欧元,并有望在本世纪末达到 2000 万平方米的 GLA 和 12 亿欧元的租金收入。

集团设定了 2025 年公司特定调整后 EPRA EPS 0.86 欧元 - 0.88 欧元的指导值。这是由我们强劲的潜在增长推动的,同比增长率约为 4%,但由于 2024 年和 2025 年的(再)融资导致的平均债务成本上升,部分抵消了这一影响。

股息

CTP 提议 2024 年末期股息为每股普通股 0.30 欧元,经年度股东大会批准后,将于 2025 年 5 月 15 日支付。这将使 2024 年股息总额达到每股普通股 0.59 欧元,相当于公司特定调整后的 EPRA EPS 支出 74% - 符合集团支付 70%-80% 的股息政策 - 与 2023 年相比增长 12.4%。

默认股息为以股代息,但股东可以选择以现金支付股息。

面向分析师和投资者的网络广播和电话会议

今天 12:00(格林威治标准时间)和 13:00(欧洲中部时间),公司将通过现场网络直播和音频电话会议为分析师和投资者举办视频演示和问答环节。

要观看网络直播,请提前在以下网址注册:

https://www.investis-live.com/ctp/678e4096cddd8c000f42d182/mabgk

如需通过电话参加演讲,请拨以下任一号码并输入与会者接入代码 527498.

德国 +49 32 22109 8334

法国 +33 9 70 73 39 58

荷兰 +31 85 888 7233

英国 +44 20 3936 2999

美国 +1 646 233 4753

按 *1 可提问,按 *2 可撤回问题,按 *0 则可获得接线员帮助。

演讲结束后 24 小时内可在 CTP 网站上查阅录音: https://www.ctp.eu/investors/financial-reports/

CTP 财务日历

| 行动 | 日期 |

| 年度大会 | 2025 年 4 月 22 日 |

| 2025 年第一季度业绩 | 2025 年 5 月 8 日 |

| 2025 年上半年业绩 | 2025 年 8 月 7 日 |

| 资本市场日(德国伍珀塔尔) | 2025 年 9 月 24-25 日 |

| 2025 年第三季度业绩 | 2025 年 11 月 6 日 |

分析师和投资者咨询的详细联系方式:

投资者关系主管 Maarten Otte

手机: +420 730 197 500+420 730 197 500

电子邮件: maarten.otte@ctp.eu

媒体垂询联系方式:

Patryk Statkiewicz,集团营销与公关负责人

手机: +31 (0) 629 596 119+31 (0) 629 596 119

电子邮件: patryk.statkiewicz@ctp.eu

关于 CTP

按总可出租面积计算,CTP 是欧洲最大的上市物流和工业房地产所有者、开发商和管理者,截至 2024 年 12 月 31 日,在 10 个国家/地区拥有 1330 万平方米的 GLA。CTP 将所有新建建筑认证为 BREEAM 非常好或更好,并获得 Sustainalytics 的可忽略风险 ESG 评级,彰显了其致力于成为可持续发展企业的承诺。如需了解更多信息,请访问 CTP 的公司网站: www.ctp.eu

免责声明

法定审计师的审计程序正在进行中。

本公告包含若干有关 CTP 财务状况、经营业绩和业务的前瞻性陈述。这些前瞻性表述可以通过使用前瞻性术语来识别,包括 "相信"、"估计"、"计划"、"项目"、"预计"、"期望"、"打算"、"目标"、"可能"、"旨在"、"可能"、"会"、"可能"、"可以"、"可以有"、"将 "或 "应该 "等术语,或在每种情况下,其反义词或其他变体或类似术语。前瞻性陈述可能而且经常与实际结果存在实质性差异。因此,不应对任何前瞻性声明施加不当影响。本新闻稿包含 2014 年 4 月 16 日欧盟第 596/2014 号法规(《市场滥用法规》)第 7(1)条所定义的内部信息。

[1] 未经审计

[2] 结合当地和欧盟 27 国/欧元区 CPI,上限数量有限。

[3] 2024年6月28日要约收购结算后未偿还金额。

订阅我们的通讯

将工业房地产市场领导者的最新见解发送到您的收件箱。