CTP NV 2025年第三季度业绩

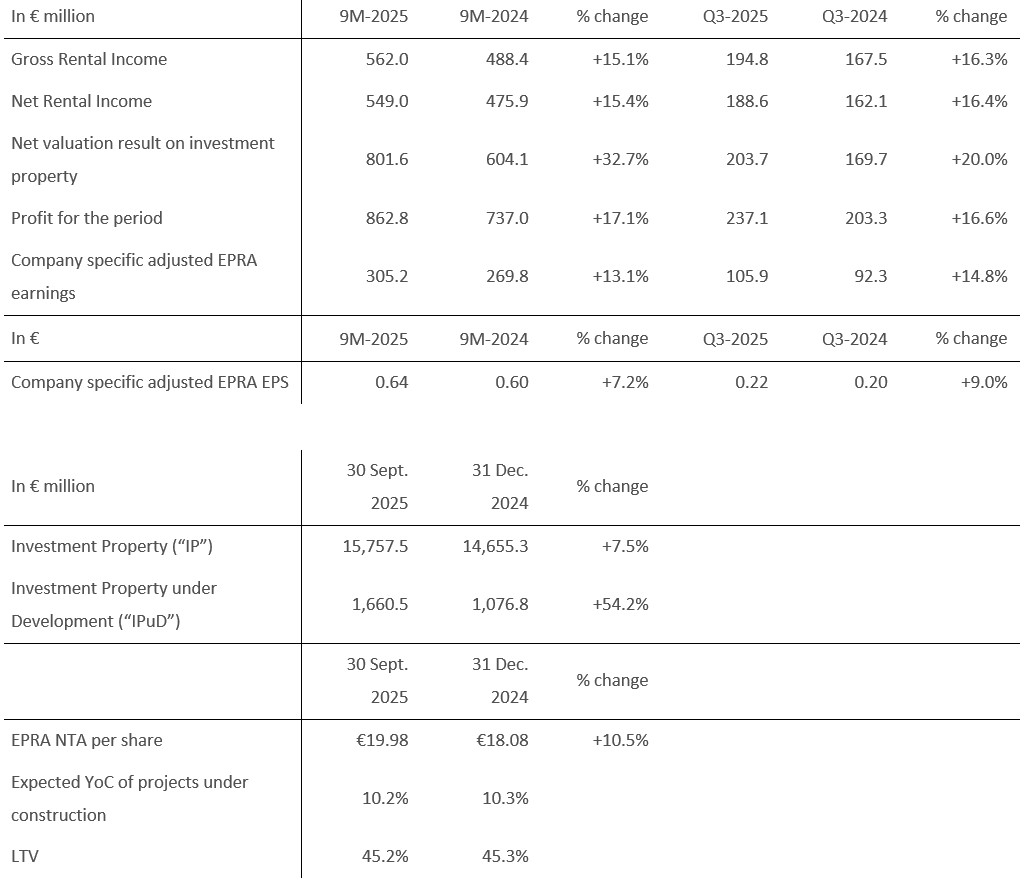

净租金收入同比增长 15.41 万亿美元,同店租金增长 4.51 万亿美元,每股净资产同比增长 14.01 万亿美元至 19.98 欧元。

阿姆斯特丹,2025年11月6日 CTP NV(CTPNV.AS)(简称“CTP”、“集团”或“公司”)在今年前九个月的总租金收入同比增长15.11万亿欧元,达到5.62亿欧元,同店租金收入同比增长4.51万亿欧元,主要得益于指数化调整以及重新谈判和到期租约带来的租金回升。截至2025年9月30日,年化租金收入增至7.78亿欧元,入住率维持在931万亿欧元,租金收取率为99.81万亿欧元。.

截至2025年前9个月,CTP交付了55.3万平方米的物业,成本收益率(YoC)为10.31万亿欧元,竣工时已出租100万亿欧元,使集团现有物业组合的总可出租面积(GLA)达到1380万平方米。总资产价值(GAV)增长10.61万亿欧元,达到177亿欧元,同比增长16.01万亿欧元。截至2025年前9个月,每股净资产值(NTA)增长10.51万亿欧元,达到19.98欧元,同比增长14.01万亿欧元。.

公司特定调整后EPRA收益同比增长13.11万亿欧元,达到3.052亿欧元。CTP公司特定调整后EPRA每股收益为0.64欧元,增长7.21万亿欧元。由于交付量和净开发收入集中在下半年,集团仍有望实现2025年每股收益0.86欧元至0.88欧元的预期目标,较2024年增长81万亿欧元至101万亿欧元。.

截至2025年9月30日,在建项目总建筑面积达200万平方米,预计年营业额达10.21万亿英镑,全部出租后潜在租金收入可达1.65亿欧元。这些项目的大部分将于2025年交付,CTP预计今年仍将交付130万至160万平方米。.

集团拥有2570万平方米的土地储备,其中2200万平方米为自有土地并已列入资产负债表。该土地储备为CTP的未来增长提供了巨大的保障,其中90%位于现有商业园区周边(57%位于现有园区,33%位于新建园区,潜在总建筑面积超过10万平方米)。凭借其行业领先的YoC(新建筑面积),CTP预计未来几年将继续保持两位数的净资产增长率。.

标普9月份将CTP的信用评级从BBB-上调至BBB,展望稳定,这凸显了CTP平台的实力。此前,穆迪已将CTP在2025年第二季度的评级展望从稳定上调至正面。.

我们拥有2570万平方米的土地储备,蕴含超过50亿欧元的潜在开发利润,为持续创造价值提供了巨大的增长空间。我们独特的一体化模式,集运营商、开发商和增长平台于一体,使我们能够灵活把握现有市场和潜在新市场的机遇。.

近岸外包等结构性趋势正在加速发展,我们投资组合中亚洲制造业租户的持续增长便印证了这一点。在中东欧地区,我们持续看到国内消费的强劲增长,而在德国,我们则受益于经济的现代化进程。凭借我们的规模、优质的投资组合和在建项目,CTP 已做好充分准备,把握这些趋势带来的机遇,并实现到 2030 年总建筑面积达到 3000 万平方米的目标。”

主要亮点

租户需求持续强劲推动租金增长

2025年前9个月,CTP签署的租赁面积达157.7万平方米,较2024年同期增长6%,平均每月每平方米租金为5.86欧元(2024年前9个月:5.63欧元)。经国家/地区组合差异调整后,平均租金增长了6%。.

| 按平方米计算的已签订租约 | Q1 | Q2 | Q3 | 年度 | 第四季度 | 风云 |

| 2023 | 297,000 | 552,000 | 585,000 | 1,435,000 | 542,000 | 1,976,000 |

| 2024 | 336,000 | 582,000 | 577,000 | 1,495,000 | 618,000 | 2,113,000 |

| 2025 | 416,000 | 599,000 | 562,000 | 1,577,000 |

| 每平方米签订的平均月租租赁合同(欧元) | Q1 | Q2 | Q3 | 年度 | 第四季度 | 风云 |

| 2023 | 5.31 | 5.56 | 5.77 | 5.60 | 5.81 | 5.69 |

| 2024 | 5.65 | 5.55 | 5.69 | 5.63 | 5.79 | 5.68 |

| 2025 | 6.17 | 5.91 | 5.64 | 5.86 |

总共签署的 73% 租赁合同都是与现有租户签订的,这符合 CTP 与现有园区现有租户共同发展的商业模式。.

通过现有投资组合和收购产生现金流

截至2025年9月30日,CTP在捷克、罗马尼亚、匈牙利和斯洛伐克的平均市场份额达到28.31万亿美元,仍然是这些市场中最大的工业和物流地产所有者和开发商。该集团在塞尔维亚和保加利亚也处于市场领先地位。.

CTP拥有超过1500家客户,其租户群体广泛且多元化,涵盖众多信用评级高的蓝筹企业。CTP的租户来自各行各业,包括制造业、高科技/IT、汽车、电子商务、零售、批发和第三方物流(3PL)。租户构成高度多元化,没有任何单一租户的年租金收入超过公司总租金收入的2.51万亿美元,从而确保了稳定的收入来源。CTP前50大租户的租金收入仅占总租金收入的32.71万亿美元,而且绝大多数客户在多个CTP园区租赁办公空间。.

公司入住率维持在93%(2024财年:93%)。集团客户留存率保持强劲,为82%(2024财年:87%),展现了CTP有效利用长期客户关系的能力。投资组合加权平均持有期为6.1年(2024财年:6.4年),符合公司设定的6年以上目标。.

2025 年前 9 个月的租金收取水平为 99.8%(2024 财年:99.8%),租户的支付情况没有恶化。.

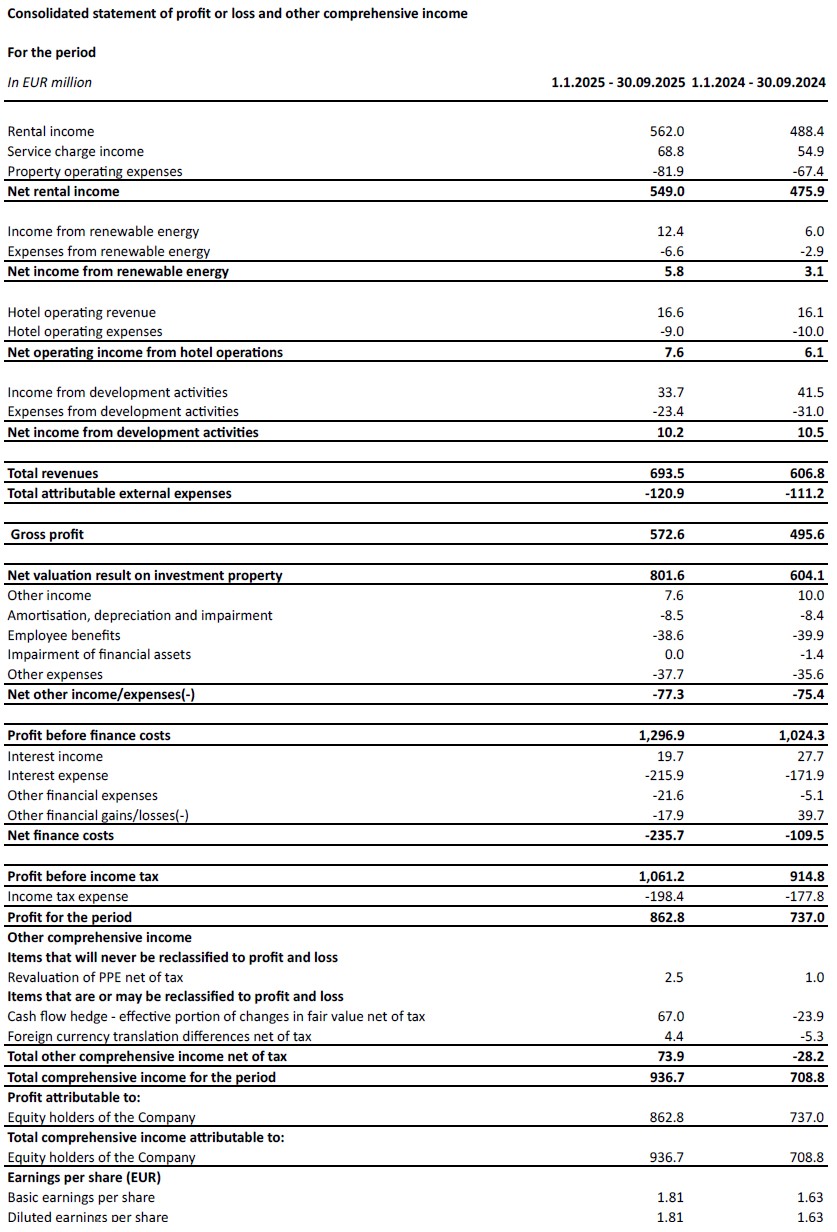

2025年前9个月的租金收入达5.62亿欧元,同比增长15.11万亿欧元,主要得益于交付量和同类业务增长。按同类业务计算,租金收入增长4.51万亿欧元,这主要得益于指数化调整以及重新谈判和到期租赁合同的收益返还。.

集团已采取措施限制服务费流失,使得净租金收入与租金收入之比从 2024 年前 9 个月的 97.41 万亿日元提高到 2025 年前 9 个月的 97.71 万亿日元。因此,净租金收入同比增长 15.41 万亿日元。.

中保基金投资组合产生的租金收入中,越来越多的部分受益于通胀保护。自2019年底以来,集团的新租赁协议均包含与消费者物价指数(CPI)挂钩的指数化条款,该条款将年度租金增长计算为以下两者中的较高者:

- 每年固定增加 1.5%-2.5% ;或

- 消费者价格指数[1].

截至 2025 年 9 月 30 日,集团投资组合产生的 72% 收入包含此双重指数化条款,集团预计这一数字将进一步增长。.

潜在收益达到13.71万亿至5万亿美元。新签订的租赁合同价格持续高于预估租金价值(“ERV”),表明市场租金持续强劲增长,并为估值提供了支撑。.

截至 2025 年 9 月 30 日,年化租金收入达到 7.78 亿欧元,同比增长 10.81 万亿欧元,充分展现了 CTP 投资组合强劲的现金流增长。.

2025年前9个月的开发项目交付量为10.3%年产能,交付时租赁量为100%。

CTP 继续对高利润管道进行严格投资。

2025年前9个月,集团竣工总建筑面积达55.3万平方米(2024年前9个月:54.5万平方米)。这些项目按年交付,总建筑面积为10.31万吨,其中1001万吨已出租,预计每年可产生3550万欧元的合同租金收入。与往年一样,2025年的交付主要集中在第四季度。.

2022年平均建筑成本约为每平方米550欧元,2023年和2024年降至每平方米500欧元,并在2025年前9个月保持稳定。这使得集团能够继续实现其行业领先的年产量(YoC),超过10%,这也得益于CTP独特的园区模式以及内部的建筑和采购专业知识。.

截至2025年9月30日,集团在建建筑面积达200万平方米,潜在租金收入达1.65亿欧元,预计年租金收入(YoC)为10.21万亿吨。CTP集团长期以来一直致力于通过现有园区的租户主导型开发实现可持续增长。集团在建项目中,781万亿吨位于现有园区,另有101万亿吨位于新建园区,这些新建园区的开发潜力超过10万平方米总建筑面积(GLA)。2025年计划交付的预租面积为631万亿吨,高于2024财年的351万亿吨。现有园区的预租面积为581万亿吨,新建园区的预租面积为761万亿吨,充分体现了项目储备的低风险性。 CTP预计交付时将达到80%-90%的预租量,与以往业绩一致。由于CTP在大多数市场都担任总承包商,因此能够完全掌控交付流程和时间,从而可以根据租户需求加快或减慢交付速度,同时也能为租户提供灵活的建筑需求选择。.

集团预计到2025年将交付130万至160万平方米的物业,具体数量取决于租户需求。目前已签署的15.1万平方米未来项目租赁协议(这些项目尚未开工建设)进一步印证了租户持续旺盛的需求。.

截至2025年9月30日(2024年12月31日:2640万平方米),CTP的土地储备达2570万平方米,这将极大地助力其实现到2030年总建筑面积达到3000万平方米的目标。集团正致力于调动现有土地储备,同时在土地储备补充方面保持稳健的资本配置。其中,57%的土地储备位于CTP现有园区内,另有33%位于或毗邻未来可能扩展至10万平方米以上的新园区。15%的土地储备已通过期权担保,其余85%则为集团自有土地,并已相应计入资产负债表。.

假设土地与建筑面积的比例为2平方米比1平方米,CTP可在其已获担保的土地储备上建造约1300万平方米的建筑面积。CTP的土地资产负债表价格约为每平方米60欧元,平均建筑成本约为每平方米500欧元,因此总投资成本约为每平方米620欧元。集团现有物业组合的价值约为每平方米1040欧元,这意味着建成后每平方米的重估潜力约为400欧元。.

能源业务货币化

CTP 继续实施其光伏系统推广扩张计划。该集团的目标是这些投资的 YoC 为 15%,平均成本约为每兆瓦时 75 万欧元。

CTP 的光伏装机容量为 149 MWp,其中 123.5 MWp 已全面投入运行。.

2025 年前 9 个月,可再生能源收入达到 1240 万欧元,同比增长 108%,主要得益于 2024 年全年新增装机容量的增加。.

CTP 的可持续发展目标与越来越多的租户要求使用光伏系统提供绿色能源的目标不谋而合,因为光伏系统可以为他们提供:i) 提高能源安全;ii) 降低占用成本;iii) 符合日益严格的监管要求;iv) 满足客户的要求;以及 v) 实现自身 ESG 目标的能力。.

估值结果受产品线和现有投资组合积极重估推动

截至 2024 年 12 月 31 日,投资性房地产(“IP”)估值为 147 亿欧元,截至 2025 年 9 月 30 日增至 158 亿欧元,主要原因是已完成的项目从在建投资性房地产(“IPuD”)转移到投资性房地产,以及现有投资组合的积极重估。.

截至 2025 年 9 月 30 日,IPuD 从 2024 年 12 月 31 日增加了 54.21 万亿欧元,达到 17 亿欧元,这主要得益于资本支出、预租增加和建设进度加快带来的重估,以及 2025 年前 9 个月新建设项目的启动。.

截至 2025 年 9 月 30 日,GAV 增至 177 亿欧元,比 2024 年 12 月 31 日增加了 10.61 万亿欧元。.

第一季度和第三季度的业绩中,仅对IPuD项目进行了重估。2025年前9个月的重估额为8.016亿欧元,主要得益于IPuD项目(+3.852亿欧元)、土地储备(+4330万欧元)和现有资产(+3.73亿欧元)的正向重估。.

CTP预计,在租户需求持续增长的推动下,ERV将进一步实现正增长,而中东欧地区的长期增长动力也对租户需求产生了积极影响。尽管中东欧地区的租金水平增长强劲,但由于其初始绝对水平远低于西欧国家,因此租金水平仍然相对可负担。实际上,许多中东欧市场的租金仍低于2010年的水平。.

集团投资组合的估值收益率较为保守,为7.0%。随着中东欧地区增长预期的提高以及投资市场活动的日益活跃,中东欧和西欧物流行业的收益率差距预计将随时间推移而缩小。.

截至2025年9月30日,EPRA每股净资产值从2024年12月31日的18.08欧元增至19.98欧元,较2025年前9个月增长10.51万亿美元,较上年同期增长14.01万亿美元。增长主要由重估收益(+1.67欧元)和公司特定调整后EPRA每股收益(+0.64欧元)推动,部分被5月份派发的2024年末期股息(-0.30欧元)和其他项目(-0.11欧元)所抵消。.

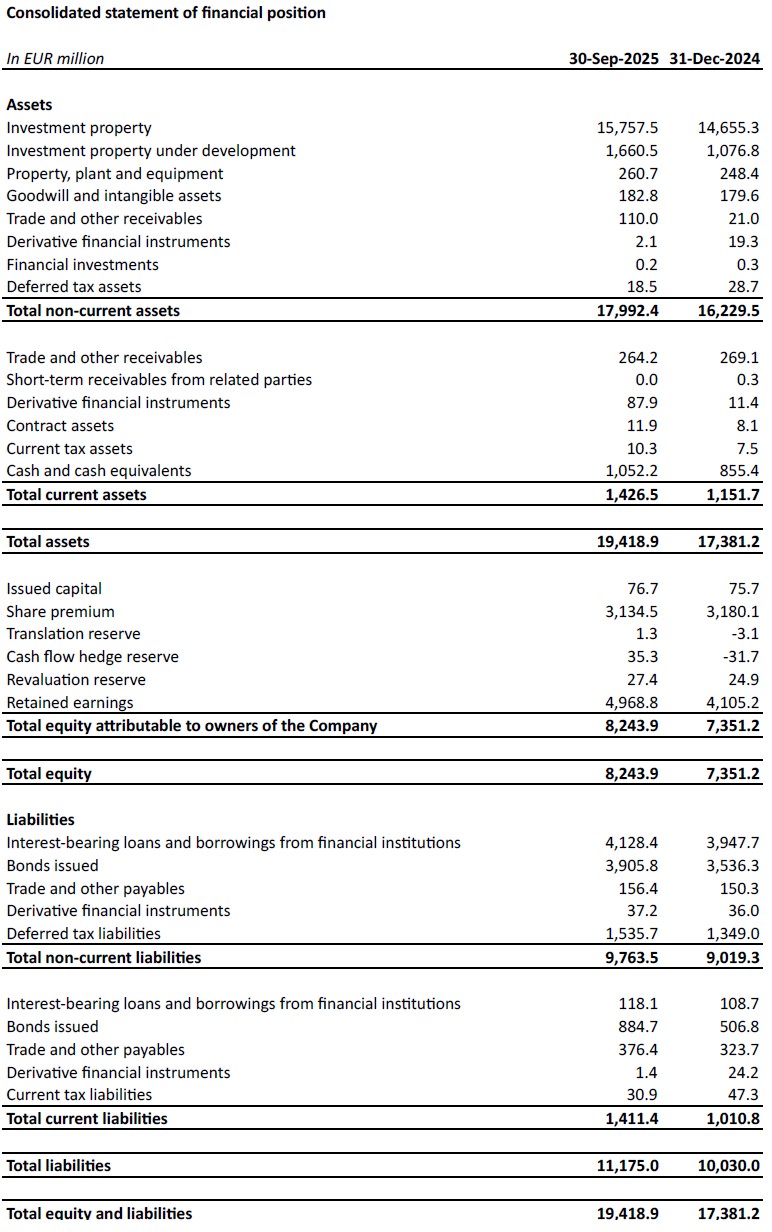

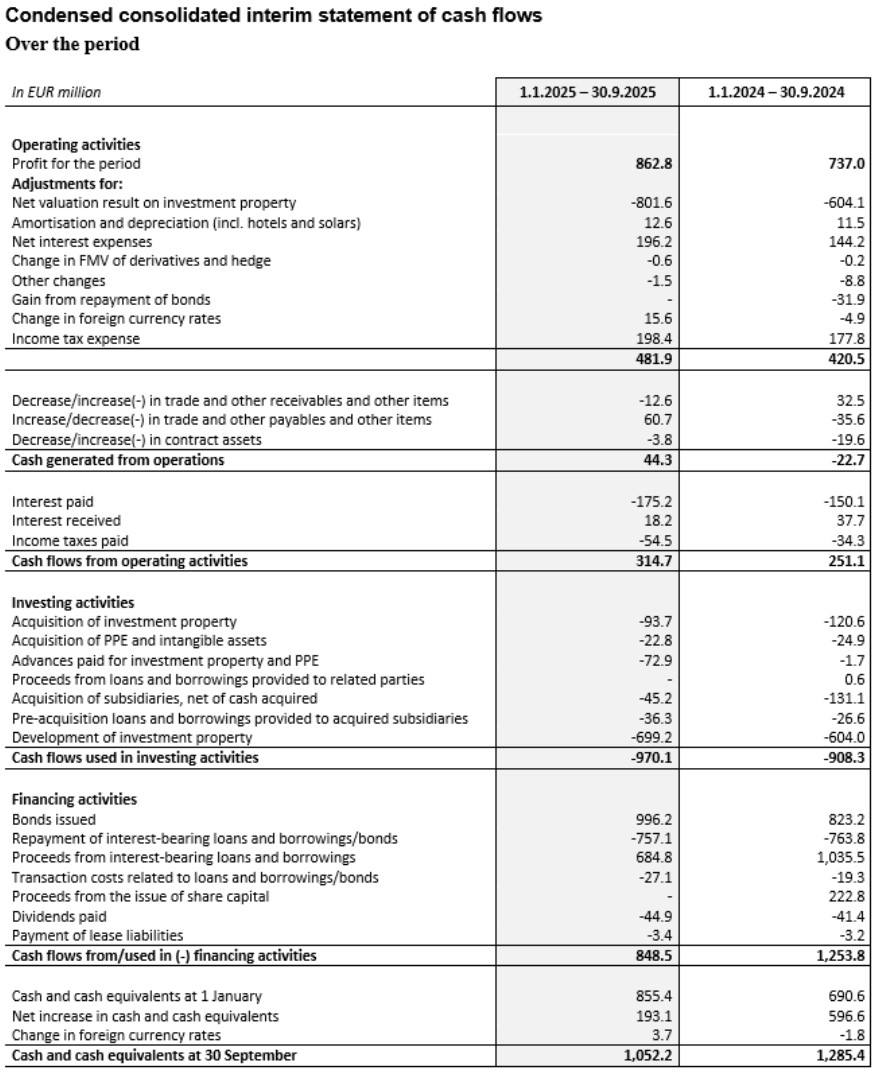

稳健的资产负债表和强劲的流动性

按照积极稳健的方针,集团拥有稳健的流动资金,以固定的债务成本和保守的还款方式,为实现增长目标提供资金支持。

在2025年前9个月期间,该集团获得了17亿欧元的资金,用于支持其内生增长:

- 10 亿欧元双档绿色债券,其中 5 亿欧元为六年期档,利率为 MS +145bps,票面利率为 3.625%;5 亿欧元为十年期档,利率为 MS +188bps,票面利率为 4.25%;

- 与亚洲银行财团签订了 300 亿日元(相当于 1.85 亿欧元)五年期无担保贷款协议,利率为 TONAR +130bps,固定总成本为 4.1%;

- 一笔 5 亿欧元的五年期无担保可持续发展挂钩贷款,由 13 家欧洲和亚洲银行组成的银团提供,固定总成本为 3.7%。.

此外,2025 年 10 月 13 日,CTP 发行了 6 亿欧元的 6.5 年期绿色债券,利率为 MS +118 个基点,票面利率为 3.625%。.

在2025年前9个月,CTP继续积极管理其银行贷款组合。公司就另外1.93亿欧元的担保银行贷款协商降低了保证金,并提前偿还了2023年签署的4.41亿欧元无担保定期贷款,该笔贷款已通过新增的5亿欧元无担保贷款进行再融资。这两项举措均使CTP大幅降低了利息支出,从而降低了其未来的整体债务成本。.

集团的流动资金为 24 亿欧元,其中包括 11 亿欧元的现金及现金等价物,以及 13 亿欧元的未提取循环信贷额度。.

CTP 的平均债务成本为 3.2%(2024 财年:3.1%),由于新融资,与 2024 年底相比略有上升。99.9% 的债务为固定利率或对冲至到期。

集团不将开发项目的利息资本化,因此所有利息支出均计入损益表。平均债务期限为4.8年(2024财年:5.0年)。.

集团于2025年6月动用可用现金储备偿还了一笔2.72亿欧元的债券。另有一笔1.85亿欧元的债券将于2025年10月到期,也已动用现金储备偿还。.

截至 2025 年 9 月 30 日,CTP 的贷款价值比 (LTV) 达到 45.2%,这主要得益于在建投资性房地产的强劲重估。.

由于集团资产收益率较高,总投资组合收益率达到 6.61 TP5T,集团实现了健康的现金流杠杆水平,这也体现在经调整后的净债务与 EBITDA 比率为 9.2 倍(2024 财年:9.1 倍),集团的目标是将其保持在 10 倍以下。.

截至 2025 年 9 月 30 日,集团债务包括 68% 无担保债务和 32% 担保债务,在担保债务测试和无抵押资产测试契约下,集团仍有充足的缓冲空间。.

随着债券市场定价合理化,目前条件比银行贷款市场的定价更具竞争力,这将使集团能够重新平衡无担保贷款。

| 2025年9月30日 | 公约 | |

| 担保债务测试 | 14.9% | 40% |

| 未支配资产测试 | 190.6% | 125% |

| 利息保障比率 | 2.5倍 | 1.5x |

2025年第三季度,标普将CTP的信用评级从BBB-上调至BBB,展望稳定。2025年1月,日本评级机构JCR授予CTP A-信用评级,展望稳定。2025年第二季度,穆迪将CTP的Baa3信用评级展望从稳定上调至正面。.

指导

租赁市场依然强劲,租户需求旺盛,新增供应减少,推动租金持续上涨。CTP 已做好充分准备,将受益于这些趋势。集团在建项目盈利能力强,且以租户需求为主导。CTP 目前在建项目的年化收益率 (YoC) 仍保持在行业领先水平,高达 10.21 万亿至 5 万亿美元。下一阶段的增长已完成规划和融资,截至 2025 年 9 月 30 日,在建项目面积达 200 万平方米,预计 2025 年交付 130 万至 160 万平方米,2026 年再交付 140 万至 170 万平方米。.

CTP凭借其稳健的资本结构、严谨的财务政策、强大的信贷市场渠道、行业领先的土地储备、内部建筑专业技术以及深厚的租户关系,能够实现其既定目标。CTP预计到2027年,其租金收入将达到10亿欧元,这主要得益于项目竣工、指数化调整和租金回升。此外,CTP也有望实现到2030年总建筑面积达到3000万平方米的目标。.

集团确认其2025年经调整后的公司特定每股收益(EPRA EPS)预期为0.86欧元至0.88欧元。由于原计划在罗马尼亚的收购未能实现,预计实际每股收益将更接近预期区间的下限。EPRA EPS的增长主要得益于强劲的基础业务增长,预计同店租金增长将达到约41万亿至5万亿美元,但部分增长将被2024年和2025年(再)融资导致的平均债务成本上升所抵消。集团预计2026年EPRA EPS将恢复两位数增长。.

CTP的股息政策是派发公司特定调整后EPRA每股收益的701TP5万亿至801TP5万亿卢比。默认派息方式为股票股息,但股东可以选择现金股息。.

面向分析师和投资者的网络广播和电话会议

今天上午 9 点(格林尼治标准时间)和上午 10 点(欧洲中部时间),公司将通过网络直播和电话音频会议为分析师和投资者举行视频演示和问答会。

要观看网络直播,请提前在以下网址注册:

https://www.investis-live.com/ctp/68dce560eefece00147ba94d/vbqpg

如需通过电话参加演讲,请拨以下任一号码并输入与会者接入代码 128602.

德国 +49 32 22109 8334

法国 +33 9 70 73 39 58

荷兰 +31 85 888 7233

英国 +44 20 3936 2999

美国 +1 646 664 1960

按 *1 可提问,按 *2 可撤回问题,按 *0 则可获得接线员帮助。

演讲结束后 24 小时内可在 CTP 网站上查阅录音: https://ctp.eu/investors/financial-results/

CTP 财务日历

| 行动 | 日期 |

| 2025财年业绩 | 2026年2月26日 |

| 2026年第一季度业绩 | 2026年4月30日 |

| 年度大会 | 2026年5月20日 |

| 2026年上半年结果 | 2026年7月30日 |

| 资本市场日 | 2026年9月 |

| 2026年第三季度业绩 | 2026年10月29日 |

分析师和投资者咨询的联系方式:

Maarten Otte,投资者关系和资本市场主管

手机:+420 730 197 500

邮箱: [email protected]

Pavel Švihálek,资金和投资者关系经理

手机:+420 724 928 828

电子邮件: [email protected]

媒体垂询联系方式:

电子邮件: [email protected]

关于 CTP

CTP是欧洲最大的上市物流和工业地产所有者、开发商和管理者,按总可出租面积计算,截至2025年9月30日,其在10个国家拥有1380万平方米的总可出租面积。CTP所有新建建筑均获得BREEAM“优秀”或更高等级认证,并获得Sustainalytics颁发的“风险可忽略不计”的ESG评级,彰显了其致力于可持续发展的承诺。更多信息,请访问CTP公司网站: www.ctp.eu

免责声明

本公告包含若干有关 CTP 财务状况、经营业绩和业务的前瞻性陈述。这些前瞻性表述可以通过使用前瞻性术语来识别,包括 "相信"、"估计"、"计划"、"项目"、"预计"、"期望"、"打算"、"目标"、"可能"、"旨在"、"可能"、"会"、"可能"、"可以"、"可以有"、"将 "或 "应该 "等术语,或在每种情况下,其反义词或其他变体或类似术语。前瞻性陈述可能而且经常与实际结果存在实质性差异。因此,不应对任何前瞻性声明施加不当影响。本新闻稿包含 2014 年 4 月 16 日欧盟第 596/2014 号法规(《市场滥用法规》)第 7(1)条所定义的内部信息。

[1] 结合当地和欧盟 27 国/欧元区 CPI,上限数量有限。

订阅我们的通讯

将工业房地产市场领导者的最新见解发送到您的收件箱。